Legal Documents

Property Taxes

Kentucky Individual Income Tax Filing Instructions

This document provides detailed instructions for filing the 2014 Kentucky Individual Income Tax forms. It outlines which forms to use based on residency status and provides essential filing information. Ensure compliance and maximize your refund with these guidelines.

Property Taxes

Connecticut Real Estate Conveyance Tax Return Guide

This publication provides essential information about the Connecticut Real Estate Conveyance Tax Return. It includes the necessary forms, updated processes, and detailed instructions for filling out the application. Ideal for homeowners and real estate professionals looking for compliance.

Contracts

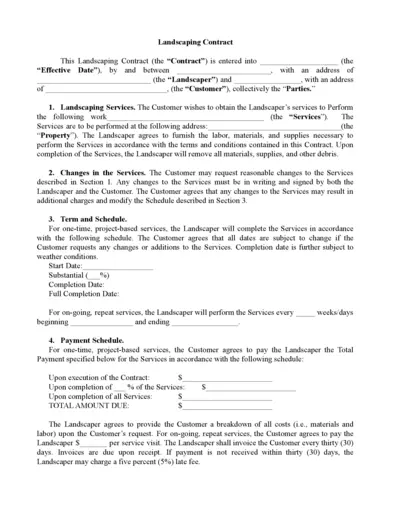

Professional Landscaping Contract Agreement

This Landscaping Contract outlines the agreement between the landscaper and the customer for lawn care services. It defines the scope of services, payment schedules, and responsibilities of both parties. This form is essential for anyone looking to formalize their landscaping projects.

Business Formation

Mary Kay Independent Beauty Consultant Order Form

This file contains the order form for Mary Kay Independent Beauty Consultants, featuring a variety of products. It includes a detailed list of items available, along with description and pricing information. The form also outlines important instructions for placing orders and managing your Mary Kay business efficiently.

Real Estate

Real Estate Sale Contract Agreement Template

This file is a comprehensive contract for the sale of real estate, outlining the terms and conditions agreed upon by the buyer and seller. It serves as a legally binding agreement that protects both parties and provides clear instructions for the purchase process. Essential for anyone involved in real estate transactions, this contract ensures understanding and compliance with local land use laws.

Property Taxes

Virginia Estimated Income Tax Payment Vouchers

Form 760ES allows Virginia residents to submit their estimated income tax payments electronically. This form is required for individuals expected to owe more than $150 in income tax. Obtain detailed instructions for filling out and submitting the form to meet your tax obligations.

Property Taxes

IRS Publication 559: Tax Guidance for Executors

IRS Publication 559 provides essential tax guidance for survivors, executors, and administrators dealing with the estate of deceased individuals. It outlines filing requirements, duties, and forms, facilitating the tax return process for estates. This publication is a vital resource for understanding the responsibilities and necessary actions to take following a decedent's passing.

Property Taxes

IRS e-file Signature Authorization Form 8878

Form 8878 allows taxpayers to authorize their ERO for electronic filing. It is essential for submitting IRS extension applications. Ensure to follow the guidelines while completing this form.

Business Formation

Epson Advantage Partner Program Application

This file contains instructions and details about the Epson Advantage Partner Program application process, including eligibility and requirements. It is designed for resellers interested in partnering with Epson to enhance their business solutions. Review the guidelines and complete the application to become an authorized Epson partner.

Business Formation

New York State Employer Registration for Unemployment Insurance

This file provides the necessary information for employers in New York State to register for unemployment insurance. It includes sections for employer information, liability details, and required addresses. This form is essential for ensuring compliance with New York State labor laws.

Property Taxes

IDAHO State Tax Commission Form 850 Instructions

This document provides detailed instructions on how to complete Form 850 for sales and use tax returns in Idaho. It includes essential information on due dates, filing procedures, and contact information. Ideal for business owners needing to navigate state tax compliance.

Business Formation

Fictitious Business Name Statement | San Diego County

This Fictitious Business Name Statement must be filled out for registering a business name in San Diego County. It outlines the necessary instructions and validations for the registrant. Businesses need to display their registered name publicly as required by law.