Legal Documents

Property Taxes

Schedule K-1 Form 1065 Instructions 2021

This file contains important instructions and information associated with Schedule K-1 (Form 1065) for the year 2021. It is essential for partnerships to report income, deductions, credits, and more. Users must complete this form accurately to ensure correct tax reporting.

Real Estate

Transfer Stamp Requirement Listing for Illinois

This document provides a comprehensive listing of transfer stamp requirements for various counties and municipalities in Illinois. It outlines fees, necessary inspections, and specific obligations for buyers and sellers during property transactions. Ideal for helping users navigate the process of obtaining transfer stamps efficiently.

Business Formation

California Business Entities Submission Cover Sheet

This file contains the California Business Entities Submission Cover Sheet required for filing various business documents. Users can find detailed submission instructions and relevant fees to streamline their process. It's a vital resource for businesses looking to maintain compliance with state regulations.

Business Formation

Kentucky Articles of Organization for LLC

This file provides the Articles of Organization necessary for establishing a Limited Liability Company (LLC) in Kentucky. It includes information regarding filing instructions, registered agents, and other essential details. Perfect for business owners looking to formalize their LLC in Kentucky.

Property Taxes

IRS Form 2848 Power of Attorney and Declaration

IRS Form 2848 is used to authorize a representative to act on your behalf before the IRS. This form provides detailed instructions for filling out and submitting. It ensures that your tax matters are handled efficiently and professionally.

Real Estate

Residential Lease Agreement Template for Tenants

This Residential Lease Agreement template provides essential terms for landlords and tenants. It outlines the rental agreement details, including property specifications and rental terms. Perfect for individuals entering a lease arrangement.

Child Support

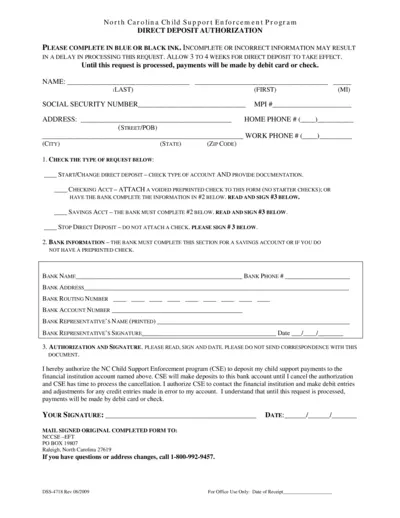

North Carolina Child Support Direct Deposit Authorization

This form is a Direct Deposit Authorization for child support payments in North Carolina. It enables recipients to receive their payments directly in their bank accounts. Complete the form accurately to ensure timely processing of direct deposits.

Property Taxes

Form 2220: Underpayment of Estimated Tax Instructions

Form 2220 is used by corporations to calculate underpayment penalties for estimated tax. Understanding this form helps corporations comply with IRS requirements. Ensure timely filing and accurate calculations to avoid unnecessary penalties.

Business Formation

Connecticut Sales and Use Tax Resale Certificate

This file provides regulations and instructions regarding resale certificates in Connecticut. It includes details on filling out and using the resale certificate. Essential for businesses engaged in the resale of tangible goods and taxable services.

Property Taxes

Consent to Disclose Tax Return Information

This file is the IRS Form 15080, allowing taxpayers to consent to the disclosure of their tax return information. It provides details about the consent process and the implications of sharing tax return data with volunteer sites. Users can understand how to fill out this form to engage in the VITA/TCE tax preparation services.

Real Estate

OREA Form 101 Agreement of Purchase and Sale Ontario

This Ontario Real Estate Association Form 101 is essential for buyers and sellers in condominium resale transactions. It outlines the terms of purchase and includes information on the property details and conditions. Use this comprehensive agreement to ensure a smooth sales process in Ontario's real estate market.

Property Taxes

New Jersey Estate Tax Form L-8 Instructions

This document provides the necessary instructions for completing New Jersey's Estate Tax Form L-8. It outlines the required information, eligibility criteria, and filing guidelines. Perfect for individuals needing to understand their estate tax obligations.