Legal Documents

Business Formation

Purchase Order Template Free Download

This purchase order template allows users to create and manage their orders efficiently. It includes sections for basic order details, seller and buyer information, and delivery instructions. Ideal for both personal and business use.

Business Formation

8D Worksheet Template for Problem-Solving

The 8D Worksheet Template is designed to guide teams in solving problems using Ford's Eight Disciplines approach. It provides a structured framework for identifying and addressing issues effectively. Use this template to ensure a systematic and thorough problem-solving process.

Property Taxes

Form 911 Instructions for Taxpayer Advocate Service

This document provides essential instructions for completing Form 911, used to seek assistance from the Taxpayer Advocate Service (TAS). It outlines the conditions for filing, necessary details, and next steps for taxpayers facing issues with the IRS. Learn more about your rights and how to navigate tax challenges effectively.

Real Estate

Application to Invalidate Property Registration

This file is an application form for property owners looking to invalidate property registration with the NYC Department of Housing Preservation and Development. It ensures that the last registered owner or managing agent is properly notified regarding housing maintenance issues. Completed forms must be submitted according to the guidelines specified.

Real Estate

Keller Williams Realty Referral Information Form

The Keller Williams Realty Referral Information Form is a crucial document for real estate transactions. It helps to streamline the referral process between agents and ensures that essential information regarding sellers and buyers is accurately captured. This form facilitates cooperation and efficiency in real estate referrals.

Business Formation

Business Action Plan Template for Effective Strategy

This Business Action Plan Template helps organizations outline strategic actions to achieve their goals. It provides a clear structure for assigning responsibilities and deadlines. Utilize this template to effectively plan and execute your business strategies.

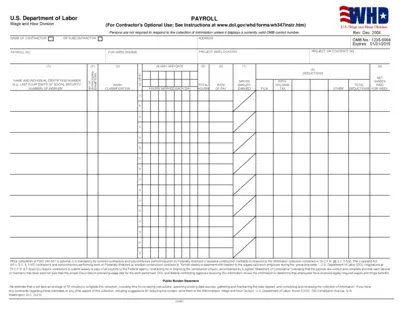

Labor Law

U.S. Department of Labor Payroll Form

This file is a payroll form used by contractors and subcontractors working on federally financed or assisted construction projects. It collects information about wages and hours worked by employees. It ensures compliance with federal wage laws.

Real Estate

Full Payment Certificate Application for Property Transfers

This file outlines the application process for obtaining a Full Payment Certificate in Chicago. It includes necessary information and requirements for property transfers. Ideal for buyers, sellers, and agents dealing with property transactions.

Property Taxes

2023 California Corporation Franchise Tax Return Instructions

This file contains detailed instructions for filing the 2023 California Corporation Franchise or Income Tax Return. It includes crucial information regarding new tax laws, requirements for form submissions, and specific schedules. Business owners and tax professionals will find this resource essential for accurate tax filing.

Business Formation

American Express Corporate Card Application

This file is an American Express Corporate Card application. It contains details on eligibility, necessary information for applicants, and consent requirements. Use this application to request a corporate card on behalf of your company.

Business Formation

General Motors License Application Form

This file is a comprehensive Licensee Application Form for General Motors. It contains detailed company and product information required for licensing purposes. Follow the instructions provided to complete and submit the form effectively.

Property Taxes

Detailed Instructions for Form 8949 Filing

This document provides comprehensive instructions on how to fill out Form 8949 for reporting capital gains and losses. It assists taxpayers in understanding the necessary details for accurate reporting to the IRS. Users can refer to this document for guidelines to avoid errors in their tax filings.