Legal Documents

Property Taxes

1099-S Certification Exemption Form Instructions

This form is used to certify the exemption for no information reporting on the sale or exchange of a principal residence. Sellers must complete this form to determine their reporting obligations. It is essential for avoiding unnecessary tax implications during a residence sale.

Business Formation

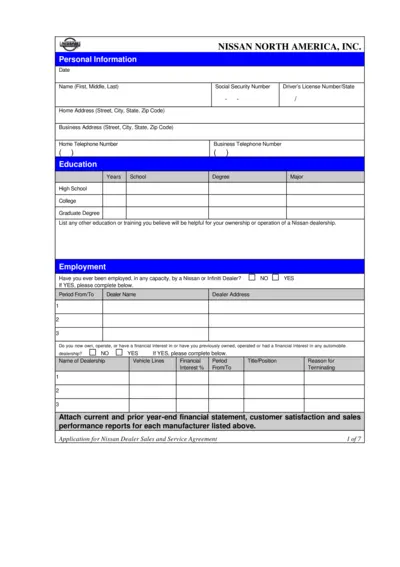

Nissan Dealer Application Form - Essential Guide

This file contains important information and instructions related to the Nissan Dealer Sales and Service Agreement application process. It is essential for potential Nissan dealership owners to understand the requirements thoroughly. Follow the guidelines to ensure your application is complete and accurately filled out.

Contracts

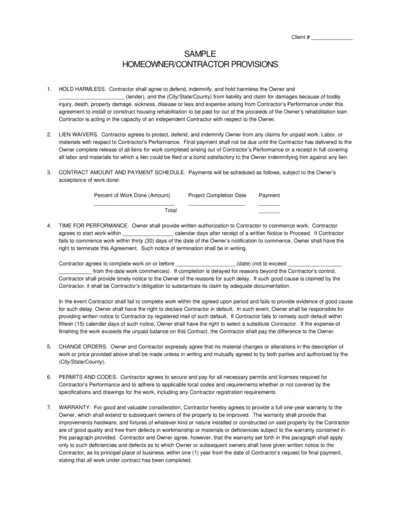

Contractor Agreement Provisions for Homeowners

This document outlines essential provisions for homeowners and contractors in a housing rehabilitation context. It includes clauses on liability, payments, and warranties. Perfect for both homeowners and contractors seeking to understand their rights and responsibilities.

Property Taxes

IRS 2019 1040 and 1040-SR Instructions for Taxpayers

This document provides detailed instructions for filling out IRS Forms 1040 and 1040-SR for the tax year 2019. It includes important updates and filing requirements. Ideal for taxpayers seeking clarity and guidance on their tax filings.

Real Estate

Real Estate Transfer Declaration of Value Form

This form is essential for declaring the value of real estate transactions. It guides buyers, sellers, and agents in accurately reporting sale details. Ensure all sections are filled correctly for legal and tax purposes.

Property Taxes

Louisiana Department of Revenue Refund Claim Form

The Louisiana Claim for Refund of Overpayment is a crucial document for taxpayers looking to request refunds for overpaid taxes. This form provides the necessary fields to ensure accurate submission and compliance with Louisiana Revised Statutes. Follow instructions carefully to ensure prompt processing of your refund request.

Business Formation

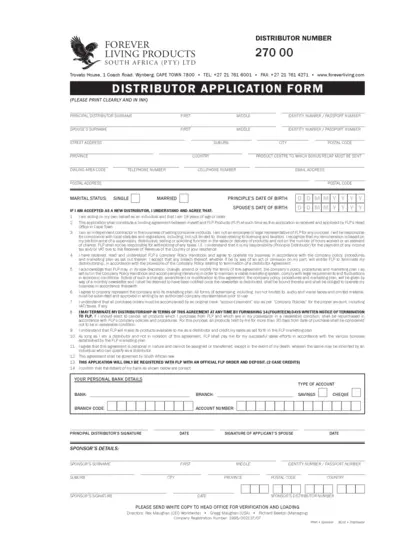

Distributor Application Form for Forever Living Products

This file contains the distributor application form required for joining Forever Living Products in South Africa. It includes necessary personal information and agreement clauses for distributors. Ensure to fill it out clearly before submission.

Real Estate

Equal Housing Opportunity Residential Real Estate Agreement

This file contains a legally binding agreement for buying and selling residential real estate. It provides detailed sections on aspects of the sale, including parties involved, property details, payment methods, and more. Ideal for both buyers and sellers in South Carolina.

Property Taxes

Instructions for Form 944 Employer's Annual Tax Return

This document provides detailed instructions for completing Form 944, the Employer's Annual Federal Tax Return. It is essential for employers to accurately report their federal tax obligations. Following these guidelines will allow for correct filing and compliance with tax regulations.

Property Taxes

Form 15103: IRS 1040 Return Delinquency Instructions

Form 15103 assists taxpayers with IRS Form 1040 Return Delinquency issues. This document provides guidance on necessary steps for compliance. Complete this form and follow the instructions for submission.

Property Taxes

Form 1040-ES Estimated Tax for Individuals 2014

This document provides instructions and guidelines for filling out Form 1040-ES for the year 2014. It explains the estimated tax payments for individuals, who must pay them, and the payment deadlines. Ensure you follow all the necessary steps to avoid penalties while filing your taxes.

Property Taxes

Minnesota Partnership Form M3 Instructions 2014

This document contains the instructions for completing the Minnesota Partnership Form M3 for the year 2014. It provides essential guidance on filing requirements, due dates, and specifics related to partnership income. Ideal for partnerships looking to navigate Minnesota tax filing requirements effectively.