Legal Documents

Property Taxes

Arizona Form 290 Request for Penalty Abatement

Arizona Form 290 is a request for penalty abatement for taxpayers. This form allows taxpayers to request the abatement of penalties due to reasonable cause. It is essential for individuals and businesses seeking to appeal tax penalties imposed by the Arizona Department of Revenue.

Business Formation

New Remittance Address Notification Template

This file contains a template for notifying clients about a new remittance address. It provides essential details on how to update payment information. Use this template to ensure timely payments and avoid processing delays.

Property Taxes

Maryland 2023 Nonresident Tax Forms Instructions

This document provides essential forms and instructions for nonresident individuals filing personal income taxes in Maryland. It details taxable income, filing requirements, and addresses specific modifications made for 2023. Utilize this guide to understand how to correctly complete your nonresident tax forms.

Business Formation

Board Resolution for Opening Bank Account

This document is a board resolution for opening a bank account in the name of a company. It outlines the authorized signatories and their powers related to the account. Ideal for companies needing to formalize their banking arrangements.

Property Taxes

Arizona Form 285-I Individual Income Tax Disclosure

The Arizona Form 285-I is a crucial document for taxpayers needing to authorize an appointee for handling their tax matters. This form allows the release of confidential tax information for specified years. Proper completion ensures compliance with Arizona's tax regulations.

Compliance

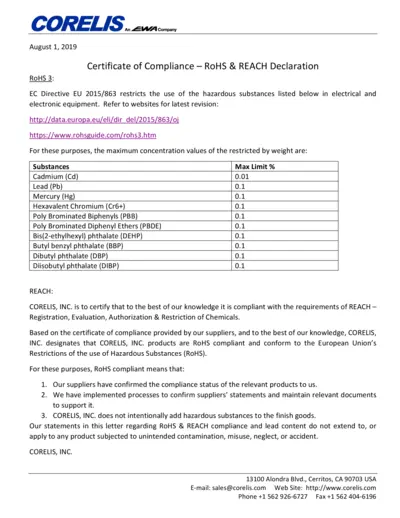

Certificate of Compliance RoHS REACH Declaration

This file contains the compliance information related to RoHS and REACH regulations. It outlines the hazardous substances restricted for use in electronic equipment and confirms compliance by CORELIS, INC. Essential for manufacturers and suppliers in the electronics industry.

Property Taxes

IRS Form 8846 Instructions for Employer Credit

This document provides detailed instructions for IRS Form 8846, which is used by certain employers to claim a credit for social security and Medicare taxes paid on employee tips. It includes forms, guidelines, and necessary steps for proper submission. Ensure compliance with IRS regulations while filing.

Property Taxes

Schedule C Form 1040 Profit or Loss From Business

The Schedule C form is used by sole proprietors to report income or loss from their business. It is essential for calculating tax obligations and ensuring compliance with IRS regulations. Proper completion of this form can result in significant tax savings and accurate accounting.

Property Taxes

Foreign Person U.S. Source Income 2021 Form 1042-S

This file provides detailed instructions and forms for nonresident aliens and foreign entities to report U.S. income. It includes considerations for withholding taxes and filing requirements for nonresident individuals and corporations. Essential for those engaged in U.S. trades or businesses.

Property Taxes

D-2848 District of Columbia Power of Attorney Form

The D-2848 Power of Attorney form allows individuals to appoint representatives for tax matters. It's essential for taxpayers needing assistance in communicating with the tax office. This form must be completed and submitted for valid representation.

Business Formation

yono SBI Business User Manual and Onboarding Guide

This file serves as a comprehensive user manual for yono SBI Business. It provides detailed instructions for corporate onboarding and filling out necessary forms. Users will find helpful information and steps to successfully navigate the onboarding process.

Real Estate

Rajasthan Land Conversion Application Guide

This document provides a comprehensive guide on how to apply for land conversion under the Rajasthan Urban Areas Rule 2010. It outlines the necessary steps and processes involved in the online submission. Ideal for applicants looking to convert land from residential to commercial use.