Veterans Affairs Documents

Veterans Affairs

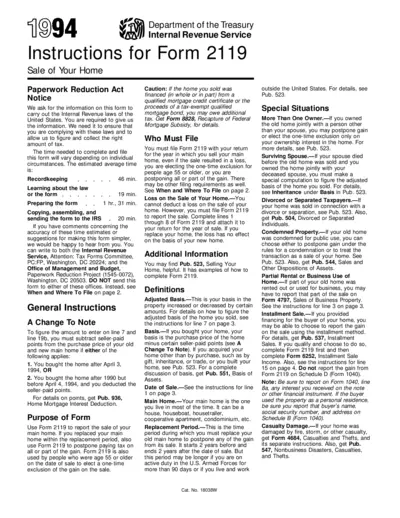

Instructions for Form 2119 - Sale of Your Home

The Instructions for Form 2119 provides essential guidance for reporting the sale of your main home and understanding tax implications. Users will find crucial information on eligibility for exclusions and detailed steps for completing the form accurately. This resource is invaluable for homeowners wanting to navigate tax responsibilities effectively.

Veterans Affairs

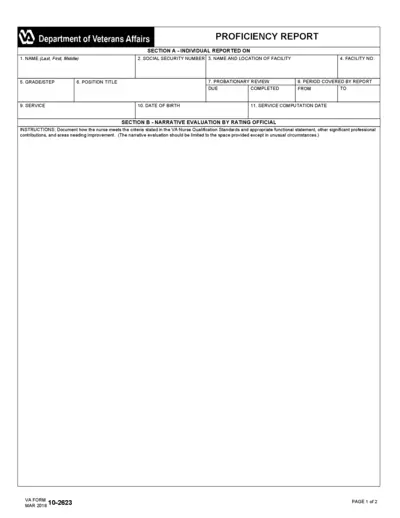

Veterans Affairs Proficiency Report Guidance

This document outlines the evaluation process for nursing professionals in the Department of Veterans Affairs. It includes individual reporting details, rating criteria, and sections for approval signatures. Ideal for nurses needing performance reviews and evaluations.

Veterans Affairs

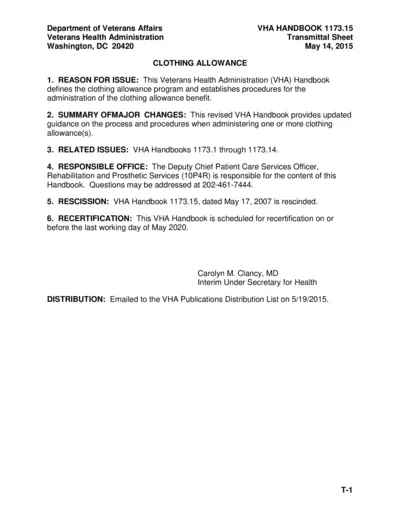

Clothing Allowance VHA Handbook 1173.15

This file provides details regarding the Clothing Allowance program for Veterans. It outlines eligibility criteria, application procedures, and entitlements. This handbook serves as an essential guide for Veterans seeking financial assistance for clothing damages due to medical necessities.

Veterans Affairs

VSA 54 Certification of Disability Application

This file is for veterans looking to certify their disability status. It assists in applying for registration fee exemptions and special license plates. Complete the form and submit it to the DMV for processing.

Veterans Affairs

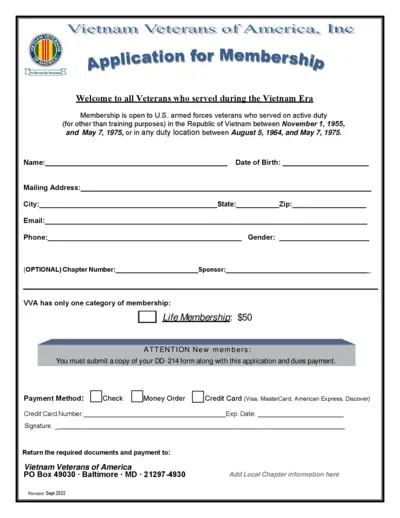

Vietnam Veterans Application for Membership

This form is for U.S. armed forces veterans seeking membership in the Vietnam Veterans of America organization. It outlines the necessary information and eligibility criteria for veterans who served during the Vietnam Era. Complete this application to join a community of fellow veterans and gain access to various benefits.

Veterans Affairs

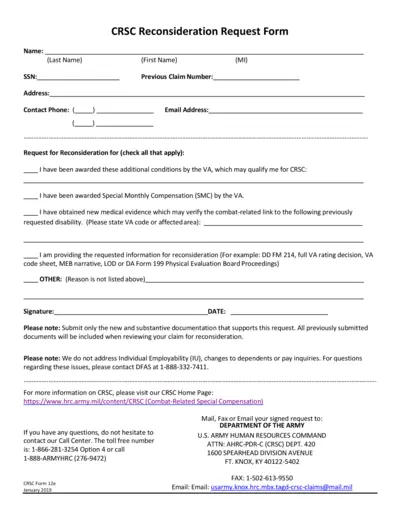

CRSC Reconsideration Request Form Instructions

This file contains the CRSC Reconsideration Request Form for veterans. It outlines the necessary information and documentation required for submission. Fill it out carefully to ensure proper processing of your request.

Veterans Affairs

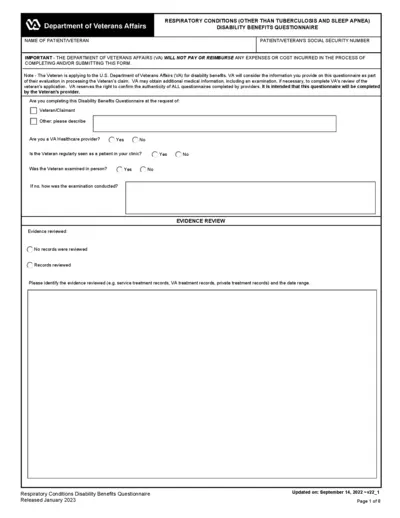

Veterans Affairs Respiratory Conditions Questionnaire

This PDF file contains a Disability Benefits Questionnaire specifically for respiratory conditions other than tuberculosis and sleep apnea. It is designed for veterans applying for disability benefits through the U.S. Department of Veterans Affairs. Complete the form to ensure accurate evaluation of the veteran's respiratory-related health issues.

Veterans Affairs

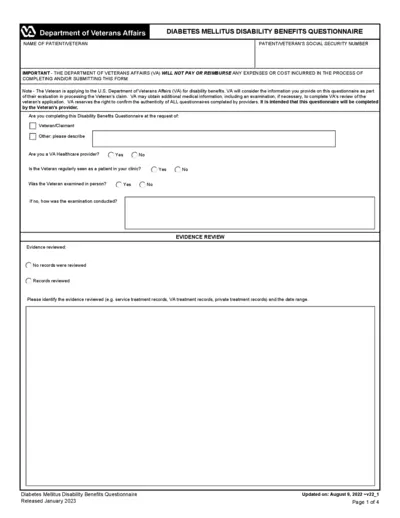

Diabetes Mellitus Disability Benefits Questionnaire

This questionnaire is required for veterans applying for disability benefits related to diabetes mellitus. It collects relevant medical history and diagnoses. Provide accurate information to ensure a proper evaluation of the claim.

Veterans Affairs

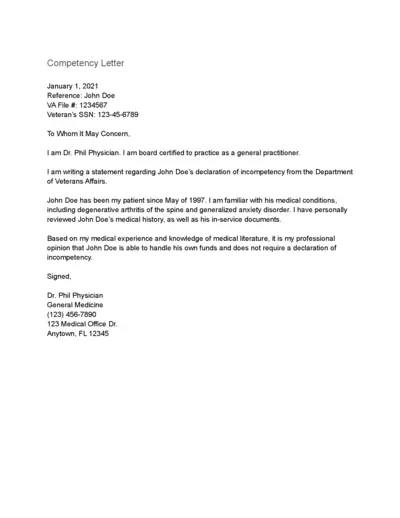

Competency Letter for Veterans Guidance Document

This file contains a competency letter useful for veterans' documentation. It outlines the necessary information regarding the competency declaration process. Ideal for patients and advocates seeking clarity on handling funds.

Veterans Affairs

IRS Form 5310 Application for Determination

IRS Form 5310 is an essential document for plan sponsors seeking determination for terminating their retirement plans. Users must complete the form accurately to ensure proper processing by the Internal Revenue Service. This file includes updated mailing addresses and instructions.

Veterans Affairs

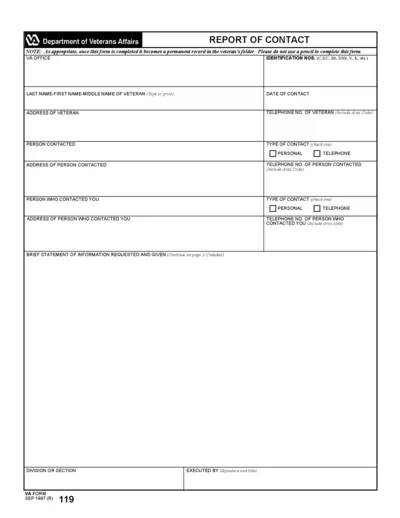

Department of Veterans Affairs Contact Report

The Department of Veterans Affairs Report of Contact form is essential for veterans to document communications. This form ensures that important details about contact with veterans' affairs are recorded accurately. Use this guide to understand how to fill out the form correctly.

Veterans Affairs

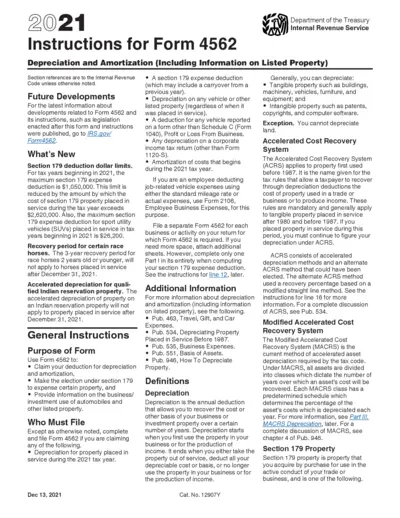

2021 IRS Form 4562 Instructions for Depreciation

This file contains essential instructions for completing IRS Form 4562, which is used for claiming depreciation and amortization. It offers guidelines for Section 179 eligibility and reporting. Understanding these instructions is vital for taxpayers to accurately report their expenses related to business assets.