Veterans Affairs Documents

Veterans Affairs

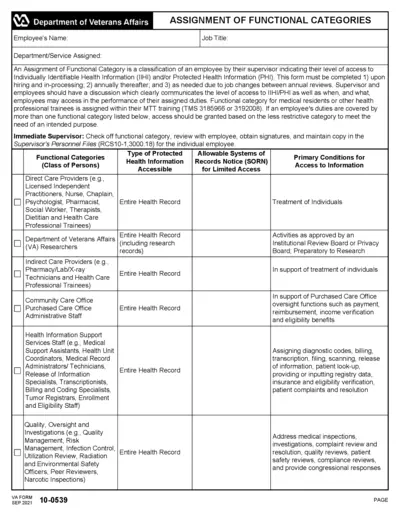

VA Assignment of Functional Categories Form

This form is used for the classification of employees based on their level of access to Individually Identifiable Health Information (IIHI) and Protected Health Information (PHI). It is applicable upon hiring, annually, or as needed due to job changes. The supervisor and employee discuss the level of access required for performing assigned duties.

Veterans Affairs

IRS Publication 4299: Privacy, Confidentiality, and Civil Rights Guide

This document is a comprehensive guide provided by the IRS on privacy, confidentiality, and civil rights. It includes key principles, security practices, and consent requirements. The guide is essential for IRS volunteers and their partner organizations.

Veterans Affairs

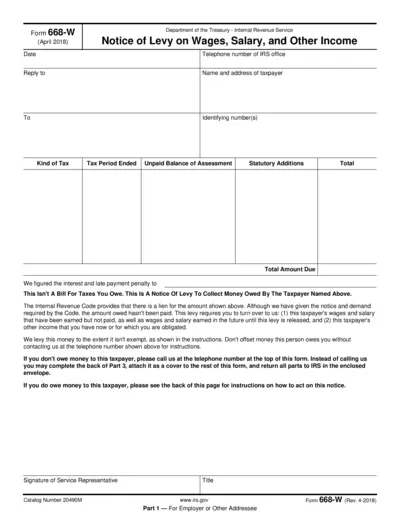

Form 668-W IRS Notice of Levy on Wages, Salary, and Other Income

Form 668-W is an IRS document for levying unpaid taxes from wages, salary, and other income. Recipients must comply and provide appropriate information. Follow instructions for exemptions and calculations.

Veterans Affairs

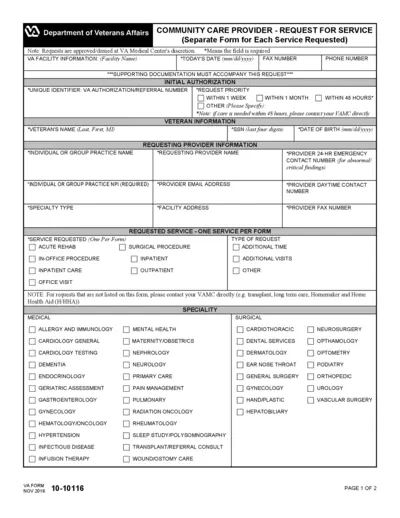

VA Community Care Provider Request for Service Form

This file is a request form for community care providers seeking service authorization from the VA Medical Center. It includes sections for facility information, veteran information, and requested services. Supporting documentation is required with the submission.

Veterans Affairs

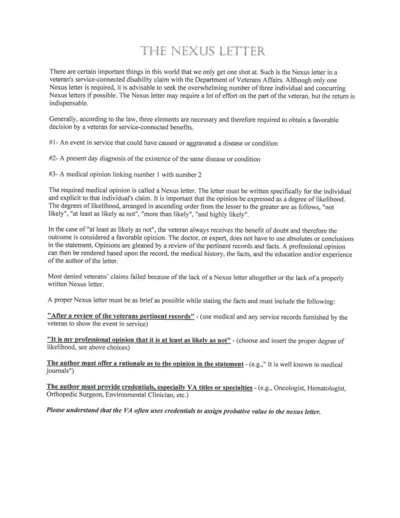

Nexus Letter Guide for Veterans' Disability Claims

This file provides instructions for veterans on how to create a Nexus letter for their service-connected disability claims. It explains the necessary elements and offers an example template. The Nexus letter is crucial for obtaining a favorable decision from the Department of Veterans Affairs.

Veterans Affairs

Veterans Affairs PCAFC Monthly Stipend Fact Sheet

This file provides comprehensive information about the Veterans Affairs Program of Comprehensive Assistance for Family Caregivers, including eligibility, stipend rates, and contact details.

Veterans Affairs

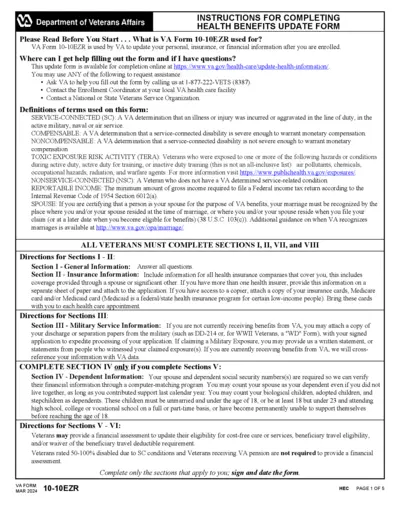

Health Benefits Update Form - VA Form 10-10EZR Instructions

VA Form 10-10EZR is used to update personal, insurance, or financial information after enrollment. Get help filling out the form online or by contacting VA. Follow the instructions carefully to complete and submit the form.

Veterans Affairs

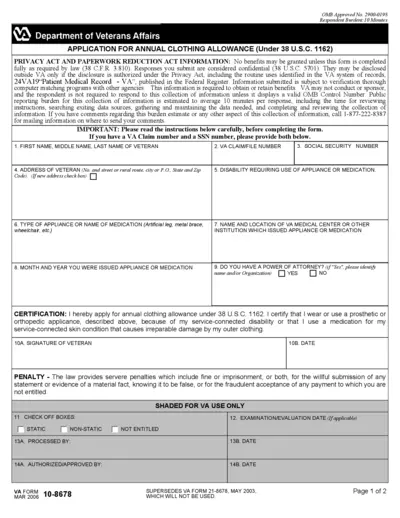

Application for Annual Clothing Allowance - VA Form 10-8678

This document provides the information and form needed for veterans to apply for the annual clothing allowance provided by the Department of Veterans Affairs. Eligible veterans with service-connected disabilities that cause wear and tear on clothing due to the use of prosthetic or orthopedic appliances, or irreparable damage due to prescribed medications for skin conditions, can use this form to claim their allowance. The form includes important instructions and details for completion.

Veterans Affairs

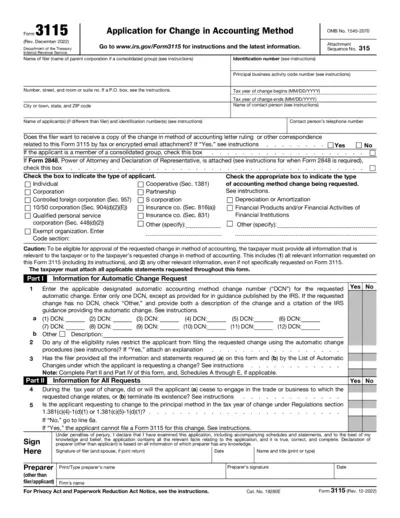

Form 3115 (Rev. December 2022): Change in Accounting Method

IRS Form 3115 is an application for a change in accounting method. This form is used by taxpayers to request a change in their accounting method and is submitted to the Internal Revenue Service (IRS). The latest information and instructions are available on the IRS website.

Veterans Affairs

Stakeholder Liaison Guidance on Submitting IRS Forms

This file provides essential instructions regarding the submission of IRS Forms 2848 and 8821. It outlines the process for third-party authorization and electronic signatures. This document is useful for tax professionals and individuals involved in tax-related filings.

Veterans Affairs

IRS Form 5471 Schedule J Instructions

This document provides instructions for filling out Schedule J of Form 5471. It includes guidelines on accumulated earnings and profits of controlled foreign corporations. Ensure accurate completion to comply with IRS requirements.

Veterans Affairs

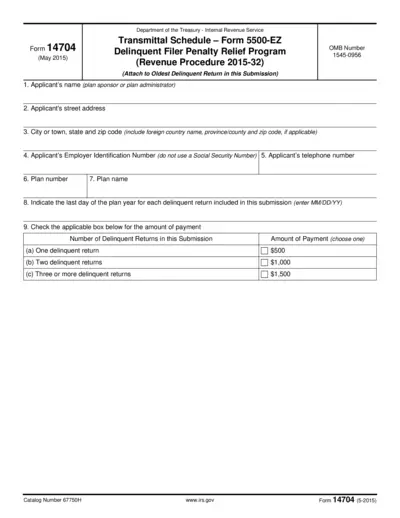

Form 14704 Transmittal Schedule for 5500-EZ

Form 14704 is used for the Delinquent Filer Penalty Relief Program. This form allows applicants to submit their delinquent returns. It is essential for ensuring compliance with IRS regulations.