Finance Documents

Tax Forms

U.S. Individual Income Tax Return Form 1040 for 2014

The Form 1040 is the standard individual income tax return form used by U.S. taxpayers. It allows individuals to report their income, claim deductions, and determine their tax liability. Properly completing this form is essential for accurate income tax submissions.

Banking

HSBC Bank Account Opening Form Instructions

This HSBC Bank Account Opening Form provides essential details and instructions for customers wishing to open a bank account. Users will find necessary information about required documents, eligibility criteria, and account types. Follow the guidelines to ensure a smooth application process.

Banking

Wells Fargo Confirmation Letter for University of Utah

This file is a confirmation letter from Wells Fargo for the University of Utah regarding banking details. It includes important account information and contact details for further inquiries. Essential for understanding banking relationships and ensuring accurate financial documentation.

Tax Forms

Instructions for Form 4797 - Sales of Business Property

Form 4797 is essential for reporting sales and exchanges of business property, involuntary conversions, and recapture amounts. Proper completion of this form is required to report gains or losses on the sale of depreciable assets. This guide will help users understand the filing process and ensure compliance with IRS regulations.

Banking

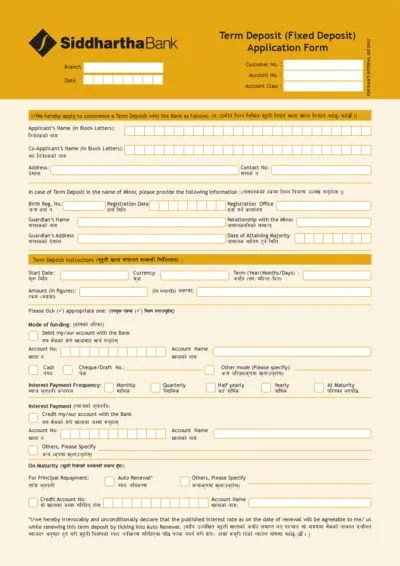

Siddhartha Bank Term Deposit Application Form

This file contains the application form for opening a term deposit account with Siddhartha Bank. It includes instructions and details required for filling out the form, as well as terms and conditions. Ideal for customers wishing to secure a fixed deposit with the bank.

Retirement Plans

Vanguard Retirement Plan Beneficiary Designation

This form allows you to designate beneficiaries for your retirement plan. Proper designation ensures that your assets are distributed according to your wishes. Follow the instructions carefully to complete the form accurately.

Banking

Canara Bank Re-KYC Process Instructions

This file provides detailed instructions on how to complete the Re-KYC process for Canara Bank. Users can submit requests via SMS or email. Ensure your Customer ID is readily available for a smooth experience.

Banking

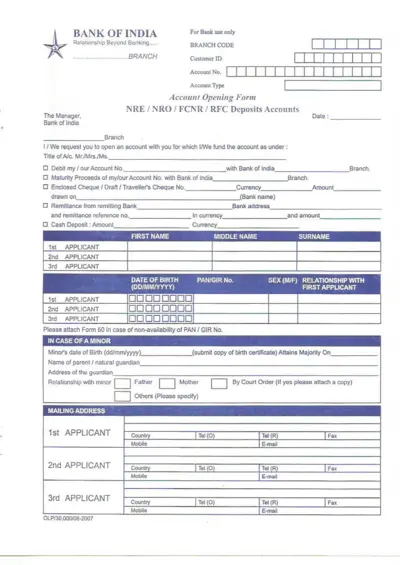

Bank of India Account Opening Form Instructions

This document provides detailed instructions for filling out the Bank of India Account Opening Form, suitable for NRE, NRO, or RFC accounts. Ensure all sections are completed accurately to facilitate a smooth application process. Use this file to prepare necessary information before visiting the bank.

Tax Forms

Instructions for Form IT-203-A Business Allocation Schedule

This file provides comprehensive instructions for filling out Form IT-203-A, the Business Allocation Schedule required for New York State income tax. It is essential for nonresidents and those conducting business in the Metropolitan Commuter Transportation District. This document guides users on how to accurately allocate business income and complete the necessary forms.

Tax Forms

2023 Instructions for Form 8814 IRS Parents Election

This document provides detailed instructions for parents electing to report their child's interest and dividends on their tax return. It outlines eligibility criteria, filling out the form, and tax implications. Use this form to simplify reporting your child's income and avoid additional tax filings.

Banking

Punjab National Bank Corporate Internet Banking Form

This document is a registration form for Corporate Internet Banking services at Punjab National Bank (International) Limited. It outlines the necessary information and requirements needed for setup. Proper completion will ensure access to online banking facilities for authorized company officials.

Tax Forms

California Exempt Organization Business Income Tax Return

This file is essential for California exempt organizations to report their income, deductions, and tax obligations for 2023. It includes detailed instructions and necessary fields to ensure compliance with state regulations. Use this file to accurately complete your tax return and avoid potential fines.