Finance Documents

Loans

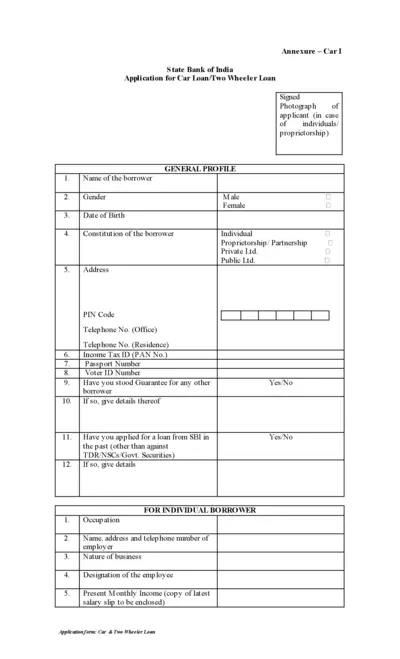

Car Loan Application Form - State Bank of India

This document is a Car Loan Application Form provided by the State Bank of India. It contains all necessary details and instructions for applying for a car or two-wheeler loan. Ensure to fill it accurately to streamline your loan approval process.

Annual Reports

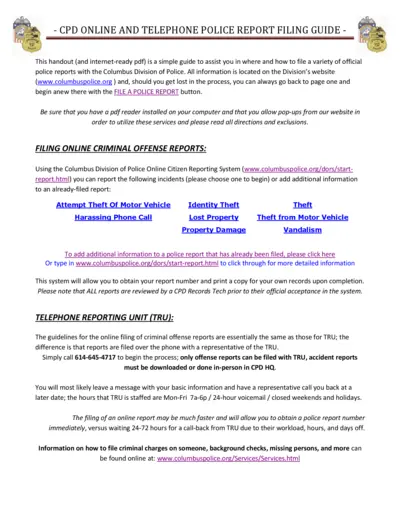

Columbus Police Report Filing Guide

This guide provides information on how to file police reports with the Columbus Division of Police. It includes both online and telephone methods to file various types of reports. Users will find essential details and instructions for an efficient reporting process.

Tax Forms

Nontitled Personal Property Use Tax Return - 8402B

This form provides instructions for filing the Nontitled Personal Property Use Tax Return. It details the information required regarding tax liabilities on nontitled personal property. It is essential for individuals and businesses in Chicago for compliance with local tax laws.

Tax Forms

Instructions for Form 2555 - Foreign Earned Income

This document provides essential instructions to complete Form 2555 for claiming foreign earned income exclusions. It outlines eligibility requirements, step-by-step procedures, and tax implications. Designed for U.S. citizens and resident aliens living abroad, it simplifies the filing process.

Tax Forms

Form 8839 Instructions for Adoption Credit 2023

Form 8839 is essential for claiming adoption credits. It guides taxpayers through the process of reporting qualified adoption expenses. Ensure you follow this guide to maximize your adoption tax benefits.

Tax Forms

IRS Form 1099-DA Instructions for Digital Assets

This file provides essential instructions for filling out IRS Form 1099-DA related to digital asset transactions. It outlines the necessary fields and requirements for reporting digital assets. Users can follow the guidelines to ensure accurate filing and compliance with IRS regulations.

Tax Forms

IRS Form 709: Gift Tax Return Instructions

Form 709 allows U.S. citizens and residents to report gifts and generation-skipping transfers. It details how to compute gift taxes for the given tax year. Essential for proper tax compliance.

Loans

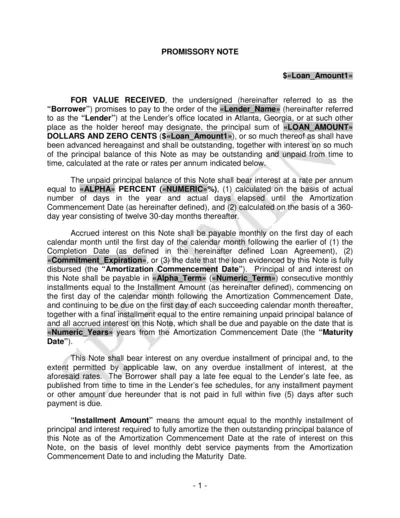

Loan Agreement Promissory Note Template

This file is a template for a promissory note used for loan agreements. It outlines repayment terms, interest rates, and borrower obligations. Ideal for lenders and borrowers to formalize loan agreements.

Banking

Chase Additional Banking Services and Fees

This document provides detailed information on Chase's additional banking services and fees for personal accounts. Users can access the latest fee schedule and understand the financial products available. It includes comprehensive sections on checking accounts, savings accounts, and other services offered by Chase.

Loans

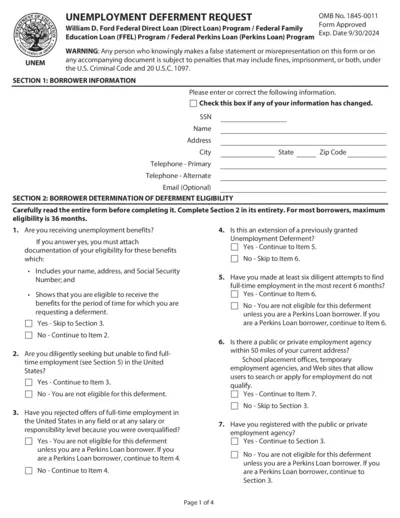

Unemployment Deferment Request Form Instructions

This document provides detailed information about the Unemployment Deferment Request Form. It includes guidelines on how to fill it out, who is eligible, and where to submit the form. Use this resource to ensure you understand the requirements and processes involved.

Tax Forms

Form D-4A Certificate of Nonresidence Application

This form is essential for individuals who do not reside in DC all year. It establishes that the individual should not be subject to DC income tax withholding. Complete the form accurately and submit it to your employer promptly.

Banking

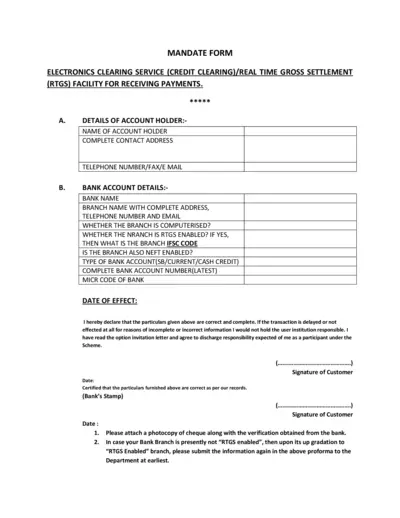

Mandate Form for Electronic Payment Services

This mandate form is essential for individuals and businesses seeking to initiate Electronic Clearing Services and RTGS payments. It collects important account and bank details necessary for processing financial transactions smoothly. Properly completed forms ensure effective payment processing without delays.