Finance Documents

Tax Forms

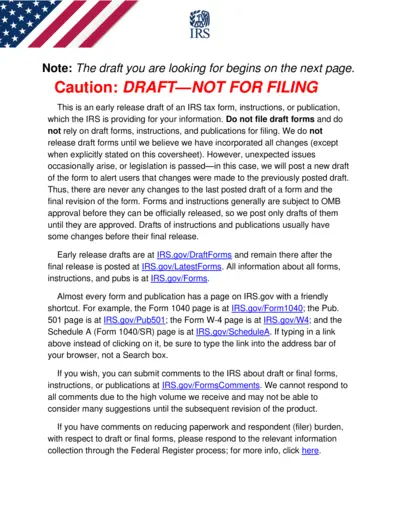

IRS Schedule 3 2021 Tax Form Instructions

This document includes detailed instructions for IRS Schedule 3 for tax year 2021. It provides essential information on claiming additional credits and payments. Ideal for individuals preparing their taxes or tax professionals assisting clients.

Tax Forms

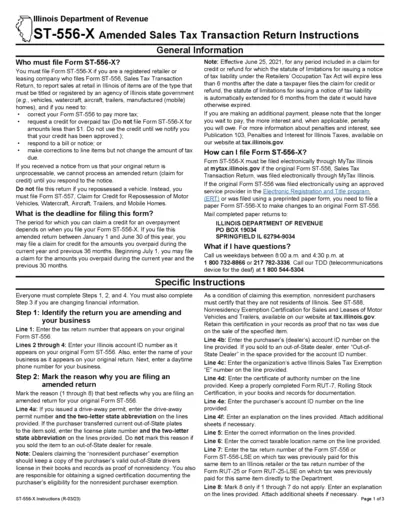

Illinois ST-556-X Amended Sales Tax Instructions

This file provides essential instructions for amending the Sales Tax Transaction Return (Form ST-556-X) in Illinois. Users can learn about filing requirements, deadlines, and submission procedures. It is a crucial resource for retailers and leasing companies dealing with sales tax.

Tax Forms

Illinois Department of Revenue IL-1065 Instructions

The IL-1065 Instructions provide essential guidance for partnerships in Illinois regarding their Replacement Tax Return submission process. This document outlines important updates, general information, and specific instructions to ensure accurate filing. It serves as a crucial tool for compliance with Illinois tax laws.

Tax Forms

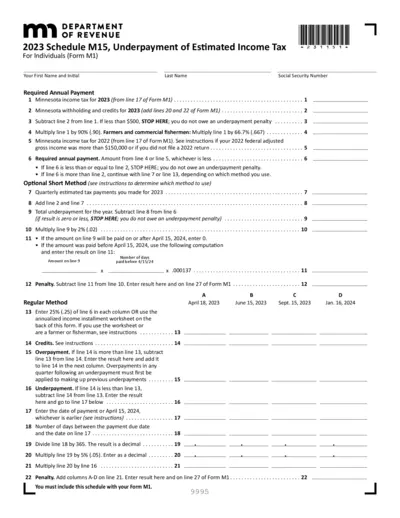

2023 Schedule M15 Underpayment of Estimated Income Tax

This file provides essential details about the 2023 Schedule M15, which determines underpayment penalties for estimated income tax. It is crucial for individuals who may owe taxes and want to ensure compliance. Follow the provided instructions for accurate completion.

Loans

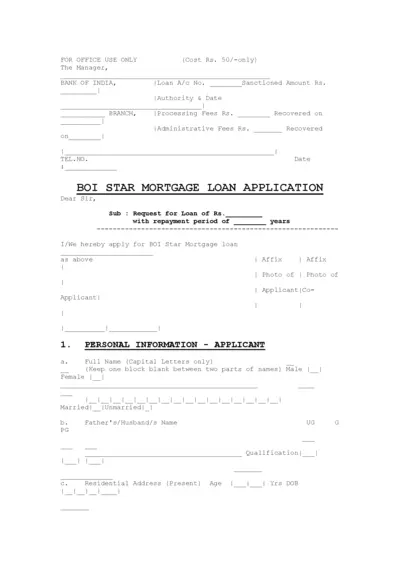

BOI Star Mortgage Loan Application Form

This file is an application form for the BOI Star Mortgage Loan. Users can fill out personal and employment information to apply for a loan. The form facilitates the loan request process through the Bank of India.

Banking

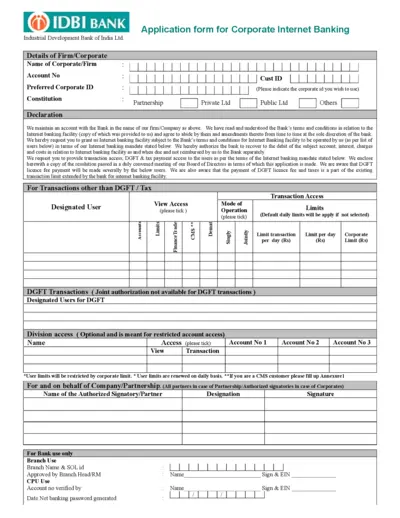

IDBI Bank Corporate Internet Banking Application Form

This application form allows corporations to request the Internet Banking facility with IDBI Bank. It includes details required for processing the request and terms to be agreed upon. Ensure all relevant fields are filled accurately for successful submission.

Tax Forms

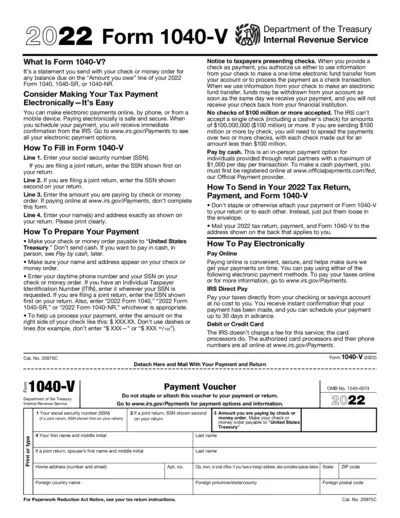

2022 Form 1040-V Payment Voucher Instructions

2022 Form 1040-V is a payment voucher to accompany your tax payments. It includes instructions on how to fill it out and make your payment effectively. Useful for taxpayers looking to fulfill their state and federal tax obligations.

Banking

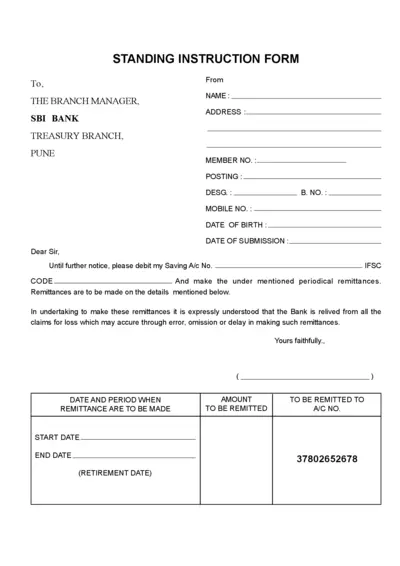

Standing Instruction Form for SBI Bank Transfers

This form is used to set up standing instructions for periodic bank transfers. It allows users to automate their remittances from their SBI bank account. Filling out this form ensures timely payments without manual intervention.

Tax Forms

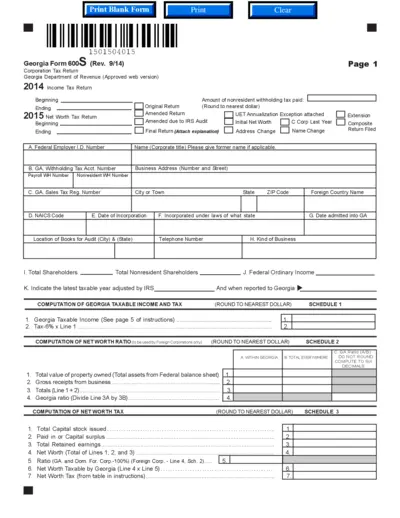

Georgia Form 600S Corporation Tax Return

The Georgia Form 600S is a Corporation Tax Return required for filing by corporations in Georgia. This form aids in reporting income, tax liabilities, and other pertinent financial information. Proper completion is essential to avoid issues with the Georgia Department of Revenue.

Tax Forms

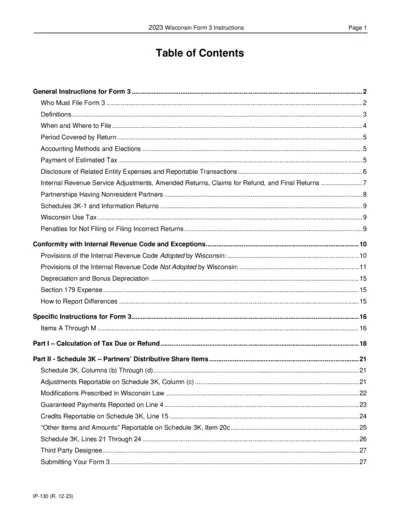

2023 Wisconsin Form 3 Instructions and Guidelines

This document provides detailed instructions for completing Wisconsin Form 3, intended for partnerships and LLCs. It includes information on filing requirements, definitions, and calculations relevant to the form. Users will find guidance on necessary schedules and what to expect when filing.

Tax Forms

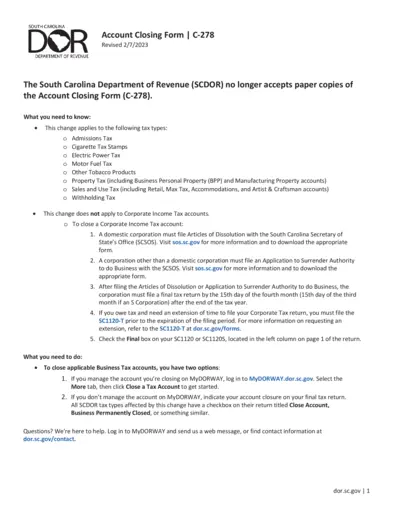

South Carolina Account Closing Form C-278 Instructions

The South Carolina Account Closing Form (C-278) is essential for businesses looking to close their tax accounts. This form ensures compliance with state regulations set by the Department of Revenue. Learn about the steps and requirements for submitting this important form.

Tax Forms

IRS Schedule C Form 1040 Instructions

The IRS Schedule C (Form 1040) provides profit or loss information for business proprietors. Learn how to accurately complete this tax form for the 2024 tax year. Essential guidelines for filing correctly and meeting regulatory requirements.