Finance Documents

Tax Forms

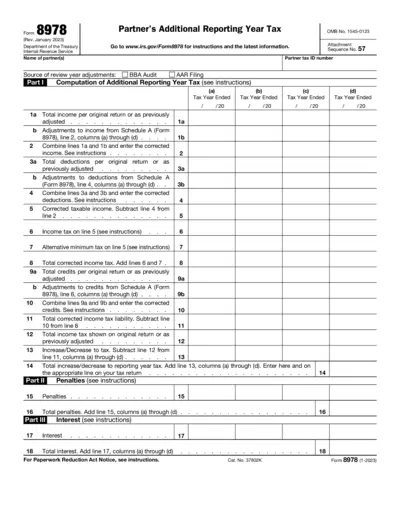

Form 8978 Additional Reporting Year Tax Instructions

Form 8978 provides detailed instructions for partners regarding Additional Reporting Year Tax. It outlines the necessary steps for computation and submission. This form is essential for ensuring accurate reporting during tax assessments.

Mutual Funds

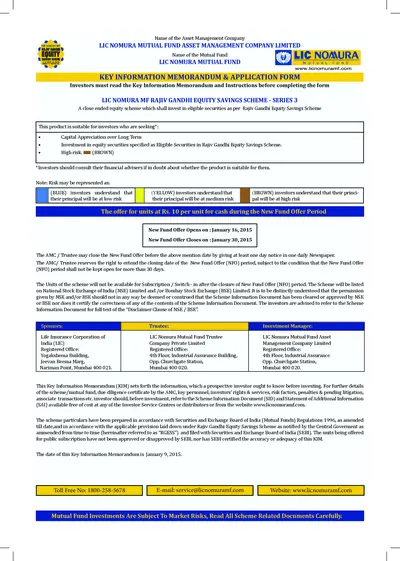

LIC Nomura MF Rajiv Gandhi Equity Savings Scheme

This file provides comprehensive details about the LIC Nomura Mutual Fund Rajiv Gandhi Equity Savings Scheme. It includes instructions for completing the application form and investment objectives for prospective investors. Essential risk factors and important dates for the New Fund Offer are also outlined.

Estate Planning

Revocable Living Trust Amendment Form Instructions

This file provides detailed instructions on how to complete a Revocable Living Trust Amendment Form. It is essential for individuals looking to amend beneficiary designations or other specific terms within their trust. Proper completion ensures compliance with relevant state laws.

Tax Forms

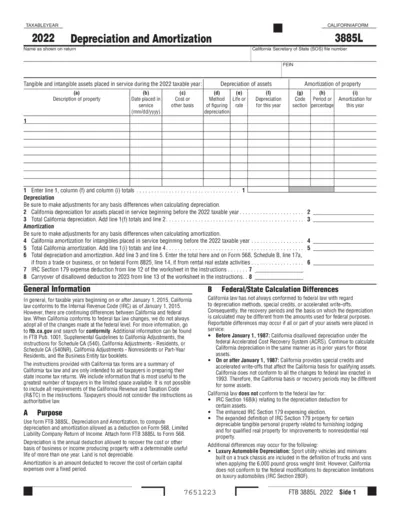

California Form 3885L - Depreciation and Amortization

California Form 3885L is used for computing depreciation and amortization deductions for the 2022 taxable year. This form assists businesses in calculating allowable deductions for tangible and intangible assets. It provides guidance on how to report these deductions accurately on the tax return.

Retirement Plans

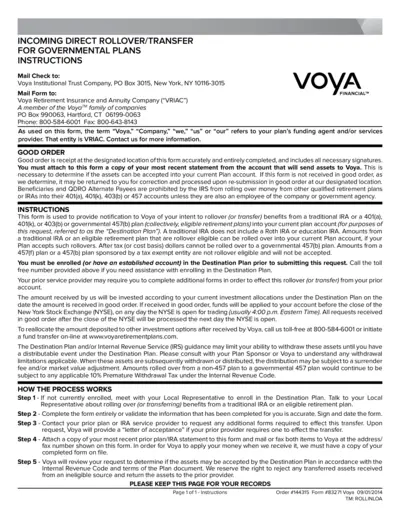

Incoming Direct Rollover Transfer Instructions

This file provides detailed instructions for rolling over or transferring benefits into your current plan account. It includes important contact information and guidance on completing necessary forms. Ideal for those looking to navigate governmental retirement plans.

Tax Forms

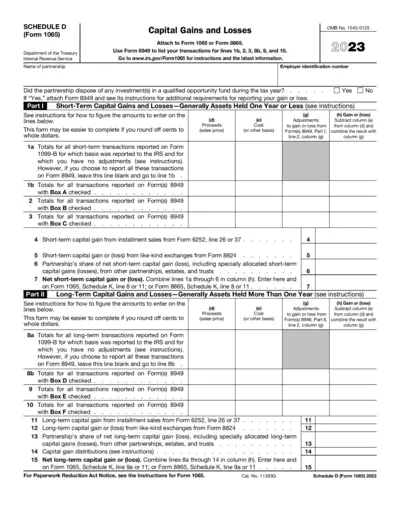

Schedule D Form 1065 Capital Gains Losses Instructions

Schedule D (Form 1065) provides essential information for partnerships to report capital gains and losses. This form is crucial for accurately reporting transactions and tax obligations. Use this guide to navigate the filling of this important IRS document.

Tax Forms

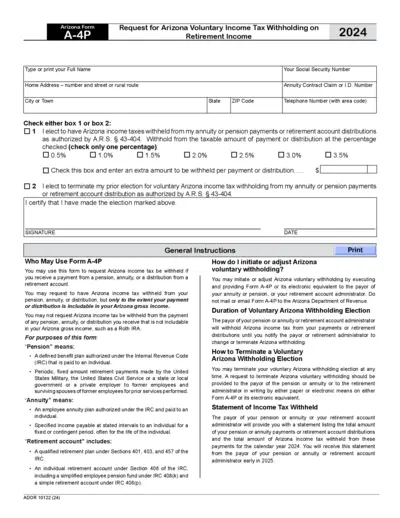

Arizona Form A-4P Voluntary Income Tax Withholding

This form is used to request Arizona income tax withholding on retirement income. It allows individuals to elect withholding from annuity or pension payments. The form details the necessary information and instructions for making this request.

Tax Forms

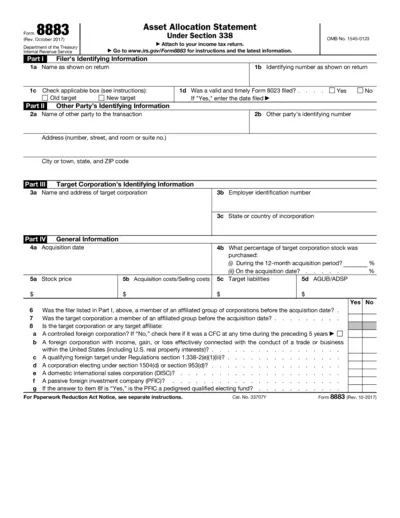

Form 8883 Asset Allocation Statement for IRS Tax Filing

Form 8883 is the Asset Allocation Statement required by the IRS for reporting asset transfers in transactions under Section 338. It helps users accurately allocate the selling price and assess tax implications. Properly filling out this form ensures compliance with IRS regulations.

Tax Forms

IRS Form 5498 Instructions and Information

This document provides detailed information on IRS Form 5498, which is used for reporting IRA contributions. It includes guidance on filling out the form and the necessary steps for submission. Users can learn about who needs this form and how to effectively use it.

Annual Reports

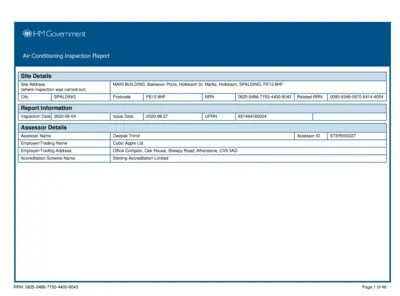

Air Conditioning Inspection Report by HM Government

This Air Conditioning Inspection Report provides essential information and guidelines for air conditioning systems. It includes inspection findings, assessor details, and compliance with regulations. Vital for building owners seeking energy efficiency improvements.

Banking

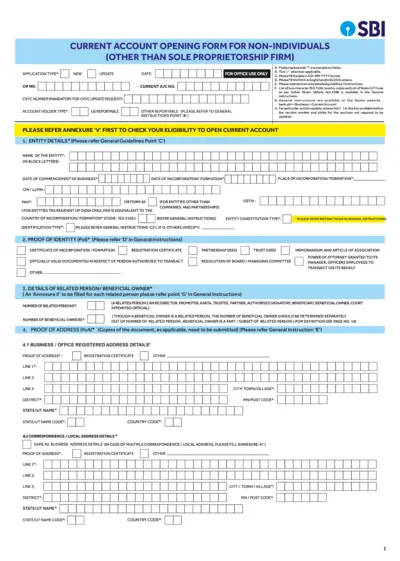

SBI Current Account Opening Form for Non-Individuals

This form is designed for non-individual entities to open a current account at SBI. It includes detailed instructions for completion and submission. Ensure all mandatory fields are filled accurately.

Tax Forms

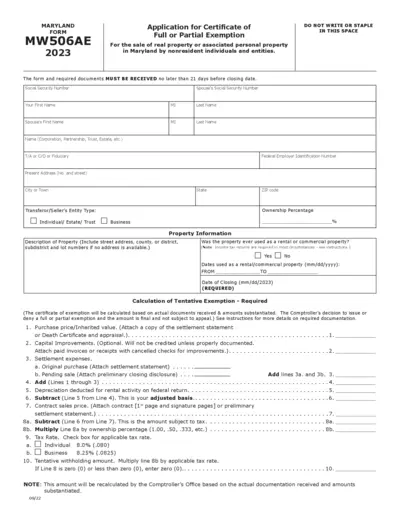

Maryland Form MW506AE Application for Exemption

The Maryland Form MW506AE is an application used for seeking a certificate of full or partial exemption for the sale of real property. This form is crucial for nonresident individuals and entities engaging in property sales in Maryland. Ensure you follow the guidelines to submit your application on time.