Finance Documents

Tax Forms

MyFTB Business Representative Account Instructions

This document provides detailed instructions on how to register and use the MyFTB Business Representative account. It includes steps for account creation, activation, and important features available to users. Ideal for business entities needing access to their tax information online.

Retirement Plans

TRS Benefits Handbook Texas Retirement System

This TRS Benefits Handbook offers essential information regarding retirement benefits for Texas educators. It outlines procedures, responsibilities, and relevant laws crucial for members. This resource is designed to facilitate understanding of the TRS retirement processes.

Banking

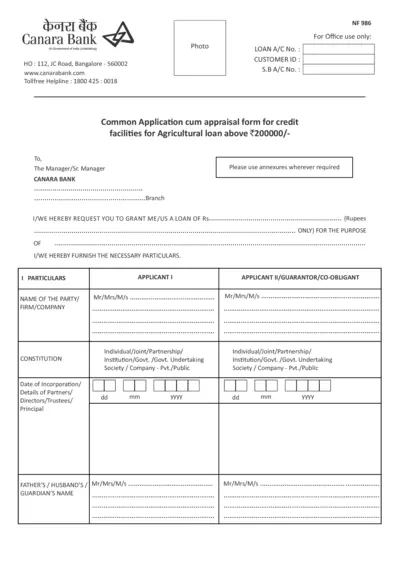

Canara Bank Agricultural Loan Application Form

This file is a comprehensive application form for obtaining agricultural loans from Canara Bank. It contains necessary fields for applicants to provide detailed information about their financial status and loan requirements. Completing this form accurately will facilitate the loan approval process.

Banking

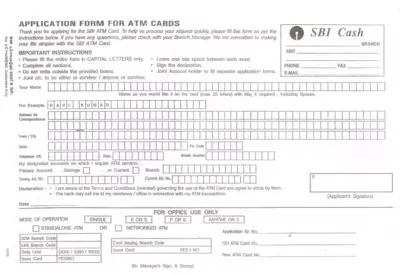

Application Form for SBI ATM Cards

This form allows users to apply for an SBI ATM card. Complete the form as per the instructions for quick processing. Ensure all fields are filled accurately to avoid delays.

Banking

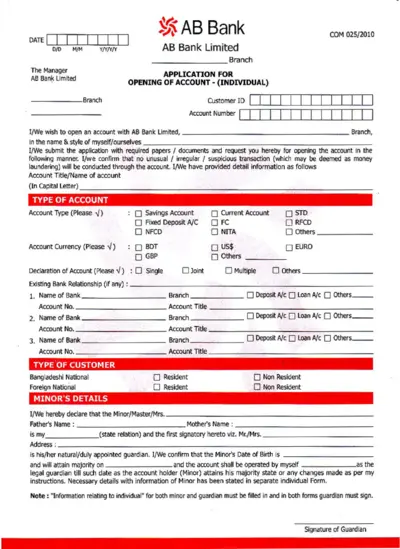

AB Bank Application for Individual Account Opening

This file provides the necessary application form for opening an individual account at AB Bank Limited. Users can follow the instructions and fill out the form to submit their application. It contains information about account types, customer details, and declaration requirements.

Tax Forms

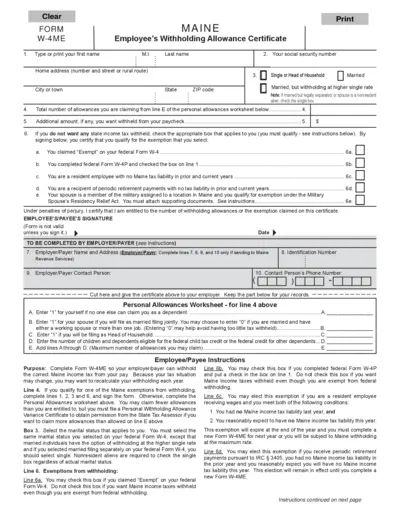

Maine Employee Withholding Allowance Certificate W-4ME

The Maine Employee's Withholding Allowance Certificate (Form W-4ME) is essential for employees to declare their withholding preferences. Properly filling out this form ensures accurate state income tax withholding. This guide offers step-by-step instructions to help you complete the W-4ME correctly.

Tax Forms

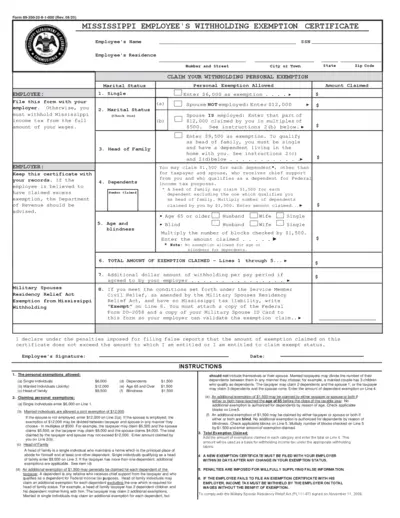

Mississippi Employee Withholding Exemption Certificate

The Mississippi Employee's Withholding Exemption Certificate is a crucial form for employees in Mississippi. It helps in determining personal exemptions for state income tax withholding. This certificate needs to be submitted to your employer to avoid unnecessary withholding.

Tax Forms

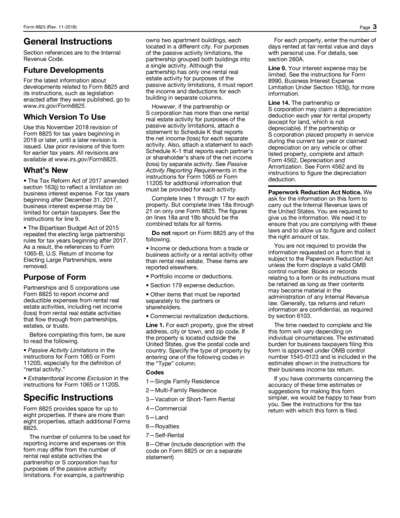

Form 8825 General Instructions for Tax Filing

Form 8825 is used by partnerships and S corporations to report income and deductible expenses from rental real estate activities. This guide provides detailed instructions to help you accurately fill out and file this essential tax form. Stay updated on the latest tax regulations and ensure compliance with your submissions.

Banking

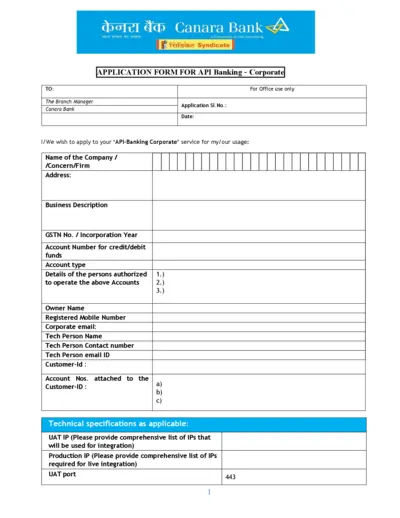

Canara Bank API Banking Corporate Application Form

This document outlines the application process for Canara Bank's API Banking Corporate services. It includes all required fields and information that businesses need to provide when applying. Ensure all details are correct for a successful application.

Tax Forms

Form 2290 Heavy Highway Vehicle Use Tax Return

Form 2290 serves as the Heavy Highway Vehicle Use Tax Return for the tax period from July 1, 2017, to June 30, 2018. This form is essential for reporting heavy highway vehicle usage and calculating corresponding taxes. It is important for vehicle owners to file accurately and on time to avoid penalties.

Tax Forms

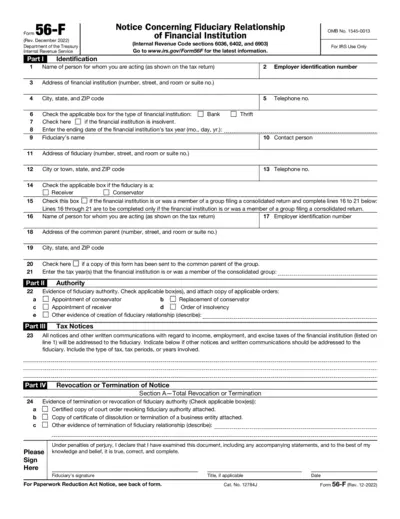

IRS Form 56-F Notify of Fiduciary Relationship

The IRS Form 56-F is used to notify the IRS of a fiduciary relationship with a financial institution. It is mandatory for fiduciaries to file this form within a specific time frame to ensure compliance with tax laws. This document includes detailed instructions for completing and submitting the form.

Tax Forms

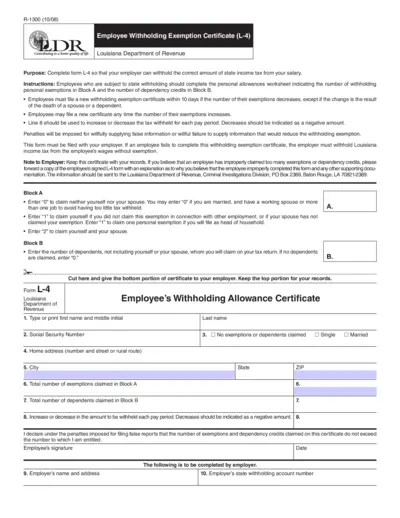

Employee Withholding Exemption Certificate L-4

The Employee Withholding Exemption Certificate (L-4) allows employees in Louisiana to declare the correct amount of state income tax withheld from their salaries. This form is essential for ensuring that employees do not overpay or underpay their taxes. It provides clear instructions for determining personal allowances and dependency credits.