Finance Documents

Banking

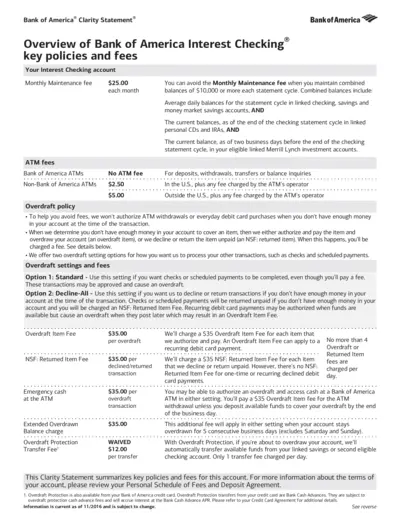

Bank of America Clarity Statement Overview

This file provides detailed information regarding Bank of America's Interest Checking account, including key policies and fees associated with it. Users can learn about how to avoid fees, overdraft policies, ATM fees, and more. It serves as a comprehensive guide for managing personal finances.

Tax Forms

Instructions for Form 8082: AAR and Inconsistent Treatment

This file provides essential instructions for Form 8082, including guidelines for filing an Administrative Adjustment Request (AAR) or reporting inconsistent treatment. It serves as a crucial resource for partners in TEFRA or BBA partnerships, S corporation shareholders, and other pass-through entity stakeholders to ensure compliance with IRS regulations. Understanding how to accurately fill out this form will help avoid potential penalties and ensure correct reporting.

Tax Forms

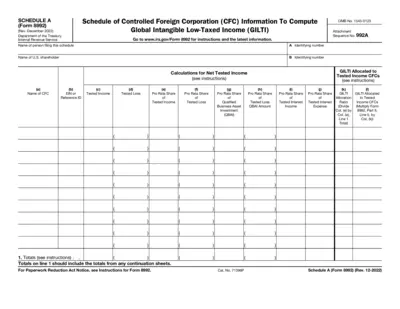

Schedule A Form 8992 GILTI Instructions

Schedule A (Form 8992) provides instructions for U.S. shareholders on how to report Global Intangible Low-Taxed Income (GILTI) and calculate net tested income from Controlled Foreign Corporations (CFCs). This form is essential for compliance with U.S. tax laws regarding foreign income. Access the latest information and guidelines on filling out this schedule at the IRS website.

Tax Forms

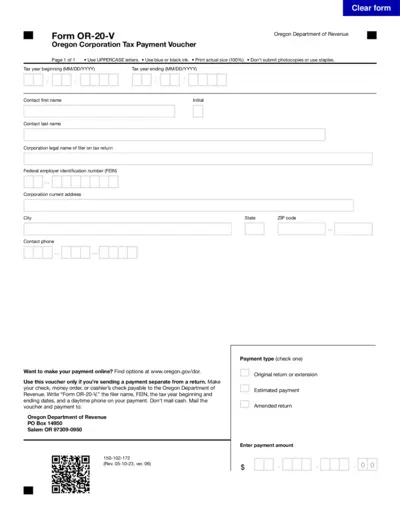

Oregon Corporation Tax Payment Voucher Instructions

This document provides essential instructions for completing the Oregon Corporation Tax Payment Voucher. It is necessary for businesses filing their taxes in Oregon. Use this guide to ensure accurate submission and payment.

Tax Forms

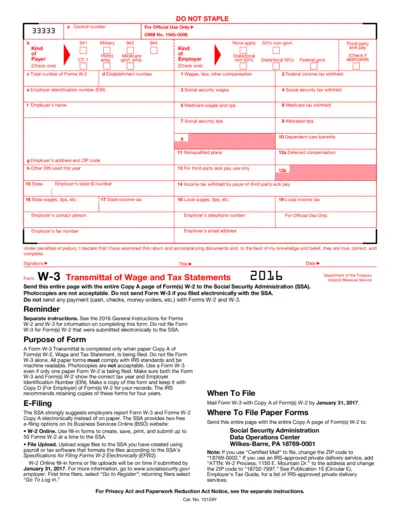

Form W-3: Transmittal of Wage and Tax Statements

Form W-3 is a transmittal form that accompanies Paper Form(s) W-2. It is used to report wage and tax statements to the Social Security Administration. Employers must submit this form to ensure proper recording of employee wages and taxes.

Tax Forms

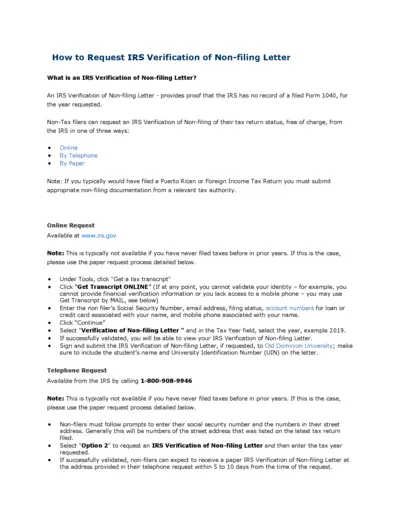

Request IRS Verification of Non-filing Letter

This file provides detailed instructions for requesting an IRS Verification of Non-filing Letter. It is essential for non-tax filers to prove their non-filing status to educational institutions or other organizations. Follow the guide for online, telephone, or paper request methods.

Tax Forms

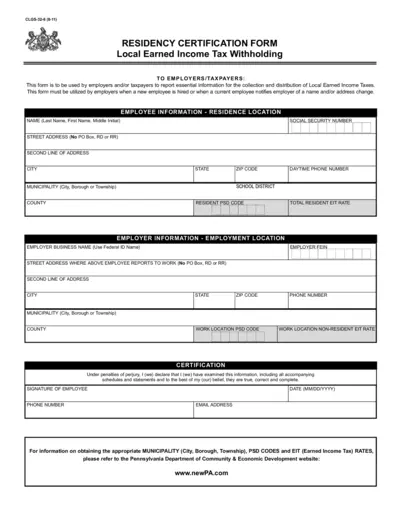

Residency Certification Form for Local Earned Income Tax

The Residency Certification Form is essential for employers and taxpayers reporting local earned income tax information. This form is required for new hires or for updates in employee information such as name or address. It ensures accurate tax reporting and compliance.

Banking

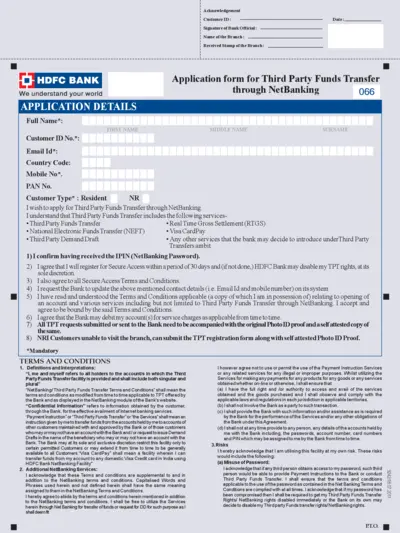

HDFC Bank Third Party Funds Transfer Application

This file contains the application form for requesting Third Party Funds Transfer through HDFC Bank NetBanking. It includes terms and conditions that users must agree to before submitting the application. Fill out this form with the necessary details to apply for the services offered.

Banking

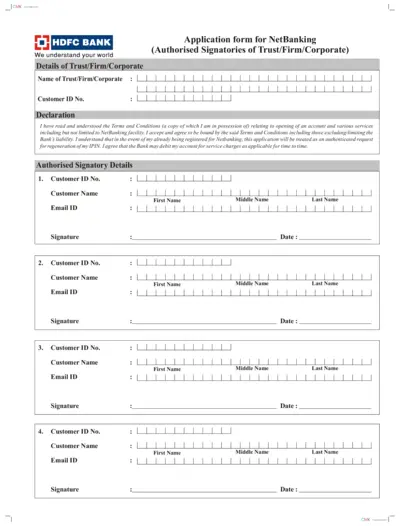

Application Form for NetBanking - HDFC Bank

This Application Form for NetBanking allows authorized signatories to apply for online banking services. Users must fill out their details accurately to ensure timely processing. By submitting this form, you agree to the bank's terms and conditions.

Tax Forms

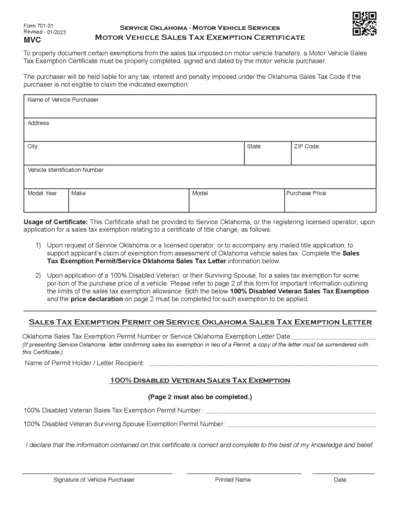

Motor Vehicle Sales Tax Exemption Certificate

The Motor Vehicle Sales Tax Exemption Certificate is essential for documenting exemptions from sales tax on vehicle transfers. This form must be completed, signed, and presented by eligible purchasers, such as disabled veterans. Ensure to understand the specific requirements to benefit from available exemptions.

Banking

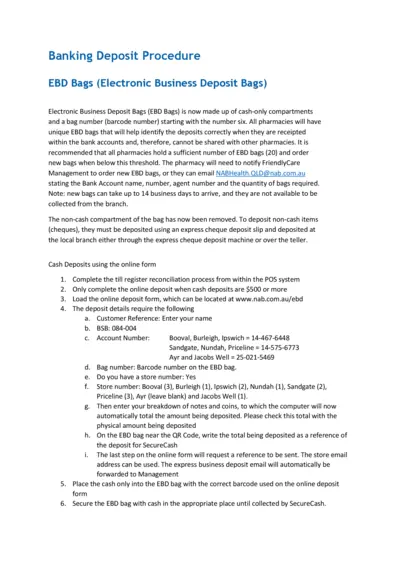

Banking Deposit Procedure - EBD Bags Overview

This file contains the essential banking deposit procedures for pharmacies using Electronic Business Deposit Bags (EBD Bags). It provides step-by-step instructions for completing cash deposits and ordering new bags, ensuring proper identification and security. The information is crucial for maintaining efficient and compliant banking practices.

Tax Forms

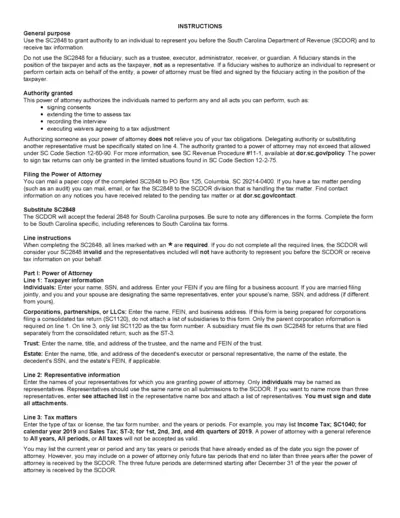

South Carolina SC2848 Power of Attorney Instructions

The SC2848 form authorizes an individual to represent you before the South Carolina Department of Revenue. It is essential for taxpayers needing assistance in handling their tax matters. Ensure all required sections are completed to avoid invalidation of the form.