Finance Documents

Tax Forms

Credit for Prior Year Minimum Tax Corporations Form

Form 8827 is used by corporations to calculate the minimum tax credit from previous tax years. It assists in determining any carryforward of minimum tax credits for use in the current tax period. This form is essential for corporations needing to comply with Internal Revenue Service regulations regarding minimum tax liabilities.

Tax Forms

PA-8453 Pennsylvania Individual Income Tax Form

The PA-8453 form is necessary for Pennsylvania taxpayers who are electronically filing their Individual Income Tax returns. It serves as a declaration for electronic filing, ensuring accuracy in submitted tax information. Proper completion of this form is crucial for a successful tax filing process, enabling smooth processing of refunds or payments due.

Tax Forms

Massachusetts Sales and Use Tax Return ST-9 Instructions

This document provides instructions for filing the Massachusetts Sales and Use Tax Return, Form ST-9. It includes detailed guidelines for calculating gross sales, taxable sales, and total sales tax owed. Perfect for Massachusetts businesses engaging in sales or rentals of tangible personal property.

Tax Forms

Schedule A 2023 Form 1040-NR Itemized Deductions

Schedule A for Form 1040-NR provides details on itemized deductions for non-resident individuals. This essential tax form helps you declare qualifying deductions to reduce your taxable income. Follow the instructions carefully to ensure accurate reporting.

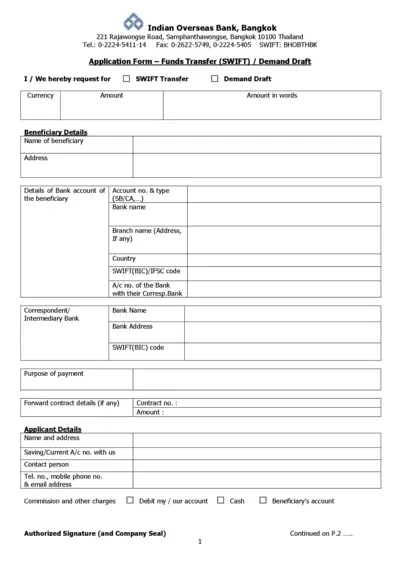

Banking

Indian Overseas Bank Funds Transfer Application

This application form is used to request funds transfer at Indian Overseas Bank in Bangkok. It includes sections for filling beneficiary and applicant details, as well as bank account information. Ensure all required fields are completed accurately to avoid delays.

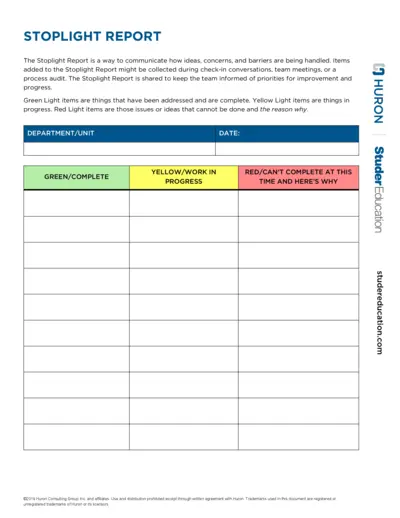

Annual Reports

Stoplight Report for Project Management

The Stoplight Report helps teams communicate progress on ideas and issues. It categorizes items into Green, Yellow, and Red lights for immediate clarity. Utilize this report to enhance team collaboration and track improvements.

Tax Forms

Oregon Individual Income Tax Payment Voucher Instructions

Form OR-40-V provides essential instructions for making payments to the Oregon Department of Revenue. This guide is ideal for those filing individual income tax in Oregon. Learn how to correctly fill out the payment voucher for timely processing.

Tax Forms

IRS Form 8615 Instructions for Tax on Children's Income

IRS Form 8615 is used to calculate the tax for certain children who have unearned income. This form is essential for parents filing tax returns for their children. Follow the detailed instructions to ensure accurate completion.

Tax Forms

Louisiana Department of Revenue Tax Forms Request

This file provides a comprehensive list of tax forms available from the Louisiana Department of Revenue. It includes instructions for requesting various forms and additional information on tax filing. Ideal for Louisiana residents and businesses needing accurate tax documents.

Tax Forms

North Carolina Sales Use Tax Return Form E-500

The North Carolina Sales and Use Tax Return Form E-500 is essential for businesses reporting sales tax. This form must be accurately filled out to comply with North Carolina tax regulations. It ensures businesses report gross receipts and pay any applicable taxes.

Tax Forms

Kentucky Single Member LLC LLET Return Form 725-EZ

The Kentucky Single Member LLC LLET Return Form 725-EZ is a tax return specifically designed for single-member limited liability companies. This form simplifies the tax filing process for LLCs owned by a single individual, ensuring compliance with Kentucky tax regulations. Properly completing this form allows business owners to fulfill their tax obligations efficiently.

Tax Forms

Schedule 2 Form 1040 2023 Additional Taxes Instructions

Schedule 2 of Form 1040 provides essential information related to additional taxes for individuals. This document guides users in reporting specific taxes, including alternative minimum tax and many others. It serves as an important attachment for accurate and complete tax returns.