Finance Documents

Tax Forms

Payment Voucher Form FTB 3588 Instructions for LLCs

This document provides the instructions for completing Form FTB 3588, which is required for LLCs to pay estimated fees. Ensure compliance with the legal requirements and pay timely to avoid penalties. Follow the outlined steps for accurate completion to secure your financial obligations.

Banking

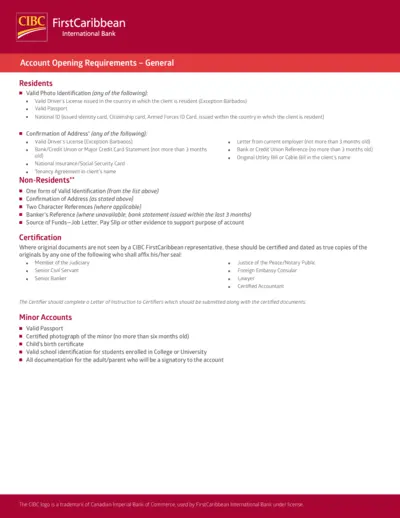

CIBC FirstCaribbean Account Opening Requirements

This file outlines the account opening requirements for CIBC FirstCaribbean. It includes necessary documents for both residents and non-residents. Ensure you meet the criteria before submitting your application.

Tax Forms

Instructions for Forms 8804, 8805, and 8813

This file provides detailed instructions for Forms 8804, 8805, and 8813, including updates and reminders about filing. It is essential for partnerships dealing with effectively connected income and foreign partners. Review this document for compliance and correct submission practices.

Tax Forms

Summary of W-2 Statements for New York State

This file contains the Summary of W-2 Statements for New York State, crucial for tax returns. It provides guidance on filing IT-2 and relevant employer information. Utilize this document to accurately report earnings and withholdings.

Tax Forms

Connecticut Sales and Use Tax Resale Certificate

This file contains the Sales and Use Tax Resale Certificate for the state of Connecticut. It is essential for businesses involved in wholesale, retail, or manufacturing. Proper completion of this certificate ensures tax-exempt purchases for resale or lease.

Loans

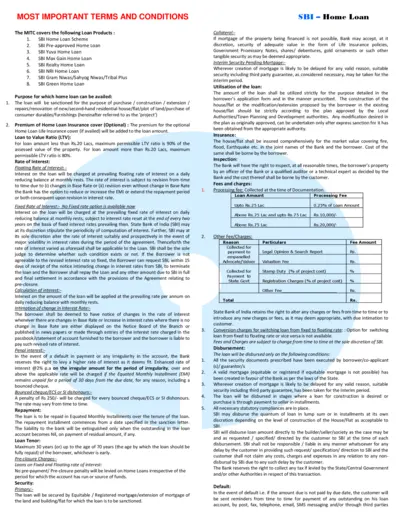

State Bank of India Home Loan Terms and Conditions

This document outlines the terms and conditions of various home loan products offered by the State Bank of India (SBI). It includes details on loan amounts, interest rates, and repayment options. Ideal for potential borrowers seeking comprehensive information on SBI's home loan offerings.

Banking

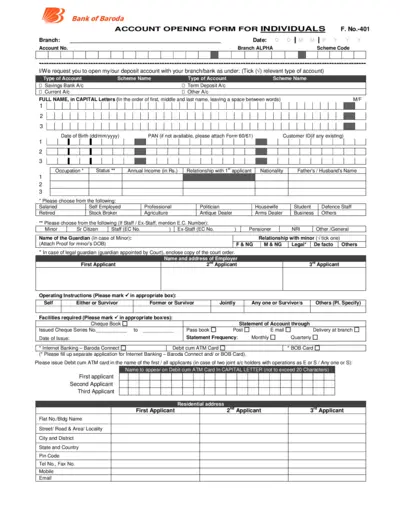

Bank of Baroda Account Opening Form Instructions

This document provides a detailed account opening form for individuals at the Bank of Baroda. It includes all necessary fields and instructions required for filling out the form. Ensure all sections are completed correctly to facilitate smooth processing of your application.

Tax Forms

Illinois Amended Individual Income Tax Return Form

The Illinois Form IL-1040-X is used to amend your individual income tax return. It allows taxpayers to correct errors or make changes to their previously filed returns in Illinois. Complete the form accurately to ensure compliance with state tax regulations.

Banking

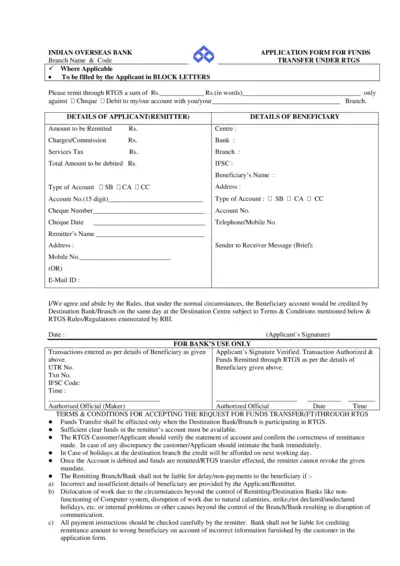

Indian Overseas Bank Funds Transfer Application Form

This application form is required for transferring funds through RTGS at Indian Overseas Bank. It collects details of the remitter and beneficiary for successful transactions. Complete the form accurately to ensure your funds are remitted without delay.

Tax Forms

How to Complete Form 3911 for Payment Tracing

This file provides detailed instructions on how to fill out Form 3911 to trace a missing 2021 Economic Impact Payment and Advanced Child Tax Credit Payment. It includes essential steps and contact information for the IRS. Follow these guidelines to ensure your form is filled out correctly.

Tax Forms

NC-4 Employee Withholding Allowance Certificate

The NC-4 form is essential for employees in North Carolina to adjust their state tax withholding. It allows employees to claim withholding allowances based on their financial situation. Completing this form accurately helps ensure the correct amount of state income tax is withheld from your pay.

Tax Forms

Instructions for Form 4136 - Credit for Federal Tax Paid on Fuels

This file contains the instructions needed to complete Form 4136 for claiming credits related to fuel taxes. Users will find details about specific credits available for biodiesel, renewable diesel, and certain nontaxable uses. It's an essential resource for anyone eligible for fuel tax credits.