Finance Documents

Banking

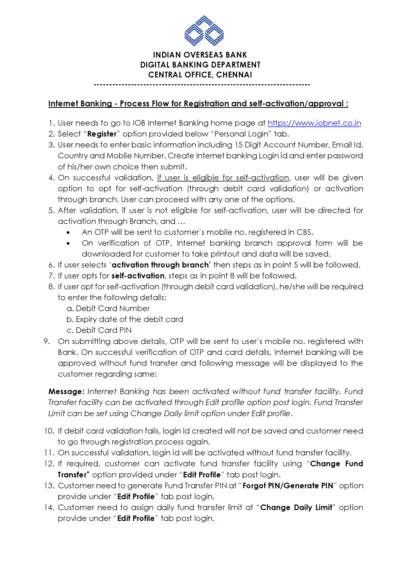

IOB Internet Banking Registration Process Instructions

This document provides comprehensive instructions for registering and activating Internet Banking with Indian Overseas Bank. Users will find step-by-step guidance to complete their registration online. Perfect for existing customers looking to enable digital banking services.

Banking

Lloyds Bank Account Application Form Instructions

This document provides detailed instructions on applying for personal bank accounts with Lloyds Bank International and Lloyds Bank Gibraltar. It includes certification requirements and eligibility criteria for opening various account types. Follow the guidelines to ensure successful submission and processing of your application.

Tax Forms

Form 5472: Information Return for Foreign Corporations

Form 5472 is an information return required for a 25% foreign-owned U.S. corporation or foreign corporation engaged in a U.S. trade or business. It provides the IRS with detailed information regarding foreign ownership and related party transactions. Filing this form is crucial for compliance with U.S. tax laws.

Banking

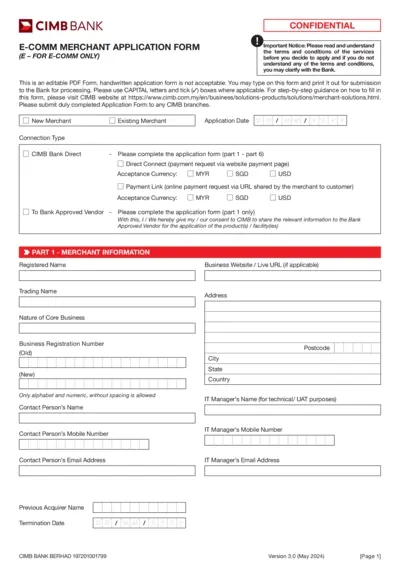

CIMB Bank E-Comm Merchant Application Form

The CIMB Bank E-Commerce Merchant Application Form is designed for new and existing merchants seeking to establish online payment solutions. This confidential document outlines the terms and conditions for merchant services, including guidelines for completion. Ensure you understand the requirements before submitting your application to CIMB Bank.

Tax Forms

Real Property Tax Credit Application Form T-RPT100

The Real Property Tax Credit Application Form T-RPT100 is essential for Oahu homeowners seeking tax credit assistance. This form helps applicants provide necessary information to qualify for the real property tax credit. It contains important guidelines and requirements that must be followed to ensure eligibility.

Banking

Santander Direct Deposit Setup Guide

This file provides comprehensive instructions on how to set up direct deposit for your Santander account. Learn about the benefits, required information, and how to access your account numbers. A must-have resource for anyone looking to simplify their banking experience.

Tax Forms

2022 Colorado Nonresident Partner Agreement

This file is a Colorado Nonresident Partner or Shareholder Agreement form for reporting Colorado income. It is essential for nonresident individuals involved in partnerships or S corporations in Colorado. The agreement ensures compliance with state tax obligations.

Tax Forms

IRS Instructions for Form 2106 - Employee Business Expenses

This document provides detailed instructions on completing IRS Form 2106 for Employee Business Expenses. It includes eligibility criteria, expense categories, and reimbursement guidelines. Essential for specific employees to accurately report their business-related expenses.

Tax Forms

Form 8995-A Instructions for Deduction of Qualified Business Income

This document provides comprehensive guidance for completing Form 8995-A. It outlines eligibility criteria and step-by-step procedures for calculating qualified business income deductions. Understanding these instructions is essential for individuals and entities seeking tax relief under Internal Revenue Code provisions.

Tax Forms

Missouri Employer's Return of Income Taxes Withheld

This document is essential for employers in Missouri to report income taxes withheld from employees' wages. It includes provisions for amendments and updates to registration. Ensure accuracy to avoid penalties and maintain compliance.

Banking

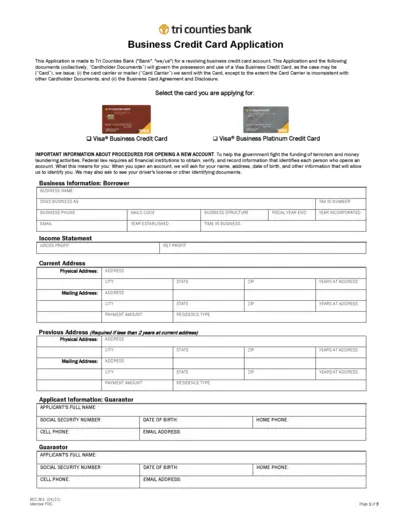

Tri Counties Bank Business Credit Card Application

This document is an application for a revolving business credit card account at Tri Counties Bank. It outlines the necessary business and personal information required to apply. Use this application to access various credit card options tailored for businesses.

Retirement Plans

Cal Savers Employee Opt Out Form Instructions

The Cal Savers Employee Opt-Out Form allows employees to voluntarily opt out of payroll contributions to their retirement savings. This form ensures that your savings are in your control and allows you to manage your retirement funds effectively. If you decide to opt out, you can do so at any time and return to participating later.