Real Property Tax Credit Application Form T-RPT100

The Real Property Tax Credit Application Form T-RPT100 is essential for Oahu homeowners seeking tax credit assistance. This form helps applicants provide necessary information to qualify for the real property tax credit. It contains important guidelines and requirements that must be followed to ensure eligibility.

Edit, Download, and Sign the Real Property Tax Credit Application Form T-RPT100

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out the T-RPT100 application form, begin by providing your parcel information accurately. Next, answer the qualification requirements to determine your eligibility. Finally, ensure all sections are completed before submitting your application to the appropriate address.

How to fill out the Real Property Tax Credit Application Form T-RPT100?

1

Read the form instructions carefully.

2

Complete all sections accurately with required information.

3

Attach necessary income documents as specified.

4

Review your application for any errors or missed information.

5

Submit the application to the designated address before the deadline.

Who needs the Real Property Tax Credit Application Form T-RPT100?

1

Homeowners on Oahu applying for tax credits.

2

Individuals who currently hold a home exemption.

3

Owners who do not possess other properties in Oahu.

4

Applicants expecting no changes in property ownership.

5

Those needing assistance with real property tax obligations.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Real Property Tax Credit Application Form T-RPT100 along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Real Property Tax Credit Application Form T-RPT100 online.

Editing the T-RPT100 PDF on PrintFriendly allows users to adjust text directly within the document. With the PDF editor, you can change details and ensure all forms are correctly filled out before submitting. The intuitive interface makes it easy to navigate and customize your PDF efficiently.

Add your legally-binding signature.

To sign the T-RPT100 PDF on PrintFriendly, simply click on the designated signature area once you’ve edited your information. You can add your digital signature, ensuring that the document is ready for submission. This feature simplifies the signing process directly within the PDF walkthrough.

Share your form instantly.

Sharing the completed T-RPT100 PDF is straightforward with PrintFriendly's sharing features. You can send the document via email or share it through social media platforms directly from the editing screen. This capability enhances collaboration with those involved in your application process.

How do I edit the Real Property Tax Credit Application Form T-RPT100 online?

Editing the T-RPT100 PDF on PrintFriendly allows users to adjust text directly within the document. With the PDF editor, you can change details and ensure all forms are correctly filled out before submitting. The intuitive interface makes it easy to navigate and customize your PDF efficiently.

1

Open the T-RPT100 PDF in PrintFriendly's editor.

2

Select the fields you want to edit and input your information.

3

Review your edits to ensure accuracy and completeness.

4

Use the save option to download your edited PDF.

5

Share the PDF via email or social media if necessary.

What are the instructions for submitting this form?

To submit the T-RPT100 form, mail it to the City and County of Honolulu, Department of Budget and Fiscal Services, Division of Treasury, Tax Relief Section, 715 South King Street, Room 505, Honolulu, HI 96813. Ensure you send your application before the deadline, October 1, 2018. For any inquiries, you may call the office at 768-3205 for further guidance.

What are the important dates for this form in 2024 and 2025?

Important dates for the T-RPT100 application include the deadline to file applications by October 1, 2018. Future applicants should be aware of similar deadlines for subsequent years, ensuring timely submission to qualify for the tax credit.

What is the purpose of this form?

The T-RPT100 form serves to assist homeowners in Oahu in applying for a real property tax credit that alleviates their tax burden. It provides a structured format to capture essential homeowner details, qualification criteria, and necessary income verification documentation. By submitting this form, applicants can secure potential tax relief for the upcoming fiscal year.

Tell me about this form and its components and fields line-by-line.

- 1. Parcel Information: Includes Tax Map Key, property address, and relevant zoning information.

- 2. Applicant Information: Captures the personal details of the homeowner including names and contact info.

- 3. Qualification Requirements: Presents a series of questions determining the eligibility for tax credit.

- 4. Income of All Titleholders: Requires income information and documentation for all individuals on the property title.

- 5. Affidavit and Certification: A declaration that all information provided is accurate and truthful.

- 6. Contact Person: Fields to designate a contact person for any further inquiries regarding the application.

- 7. Instructions for Submission: Gives guidance on how and where to submit the completed application.

What happens if I fail to submit this form?

Failing to submit the T-RPT100 form on time may result in disqualification from receiving the tax credit. Missing the application deadline could have financial implications and increase tax liabilities for the homeowner. It's critical to adhere to submission guidelines to prevent potential fines or penalties.

- Ineligibility for Tax Credit: Without submission, you will not be considered for the tax relief program.

- Financial Penalties: Late or non-submissions may lead to fines imposed by tax authorities.

- Tax Burden Increase: Failure to apply could result in a higher tax obligation due to the absence of the credit.

How do I know when to use this form?

- 1. To Apply for Tax Credit: Homeowners use this form to claim real property tax credits.

- 2. To Document Changes: Essential for reporting any modifications in property ownership or income levels.

- 3. To Ensure Compliance: Using this form helps meet regulatory requirements for tax exemptions.

Frequently Asked Questions

What is the T-RPT100 form used for?

The T-RPT100 form is used to apply for the Real Property Tax Credit for homeowners in Oahu.

Who needs to fill out this form?

Homeowners who currently hold a home exemption and meet certain eligibility criteria should fill out this form.

What documents are required when submitting this form?

You need to submit income documents such as W-2s or tax return transcripts along with your application.

How do I submit the T-RPT100 form?

Submit the completed form by mailing it to the designated address before the October 1 deadline.

Can I edit the PDF directly?

Yes, you can easily edit the T-RPT100 PDF using PrintFriendly's editing tools.

How do I print the T-RPT100 form after editing?

After completing your edits, use the PrintFriendly interface to print your finalized document.

What are the eligibility requirements for the tax credit?

To qualify, you must have a home exemption and meet the income limits set for the tax credit.

Is there a deadline for submitting the application?

Yes, the deadline to file the T-RPT100 application is October 1, 2018.

Do I need to reapply every year?

Yes, you must file annually to continue receiving the tax credit.

Where can I find assistance for this form?

You can contact the Department of Budget and Fiscal Services for help with filling out the T-RPT100 form.

Related Documents - T-RPT100 Form

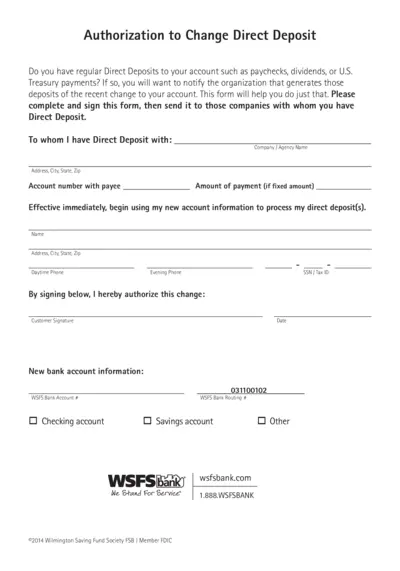

Authorization to Change Direct Deposit Form

This form is for notifying organizations of changes to your direct deposit account. Complete and sign this form and send it to the companies handling your direct deposits. The form includes sections for personal information and new account details.

Sprouts Farmers Market 2023 Annual Meeting Proxy Statement

This document contains details about the 2023 Annual Meeting of Stockholders for Sprouts Farmers Market, Inc. It includes information on the meeting date, items of business, and instructions for proxy voting. Access to proxy materials and voting instructions are also provided.

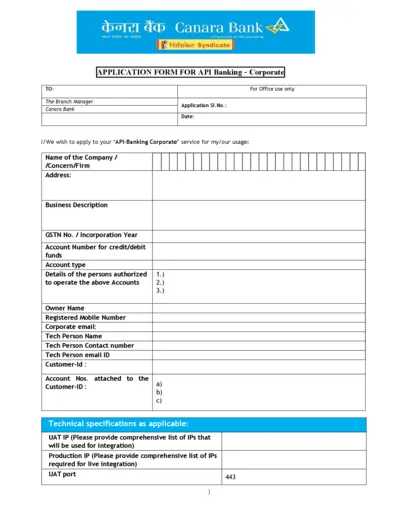

Canara Bank API Banking Application Form

This file is an application form for Canara Bank's API Banking services for corporate entities. The form includes sections to provide company details, technical specifications and authorized personnel. It requires the applicant to declare understanding and acceptance of terms and conditions related to the service.

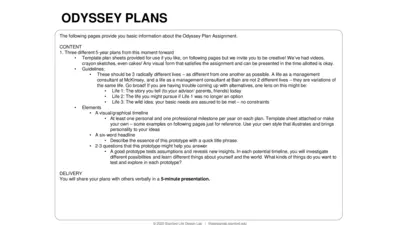

Odyssey Plan Assignment Guide: Create Your Future in 3 Steps

This file provides the guidelines and templates for creating three distinct 5-year Odyssey Plans. It encourages creative visual representations and exploration of multiple life possibilities. It is designed to help users test assumptions and gain new insights about potential life paths.

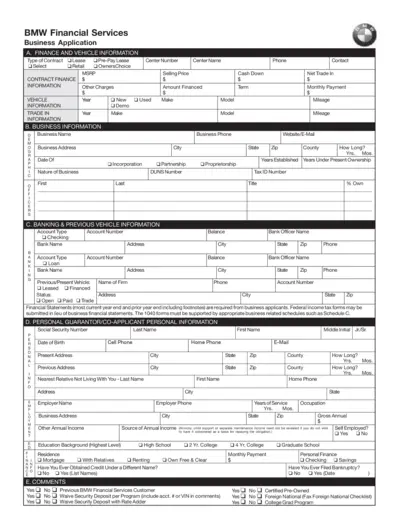

BMW Financial Services Business Application Form

This form is used to apply for various financing options through BMW Financial Services, including lease, retail, pre-pay lease, and OwnersChoice. It collects detailed information about finance, vehicle, business, banking, and personal guarantor information. Instructions and certifications required for business entities and personal guarantors are included.

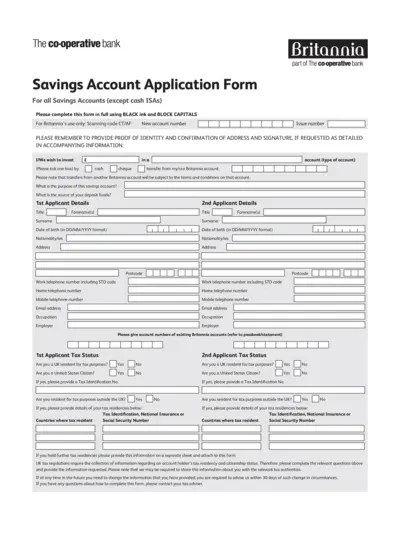

Savings Account Application Form - The Co-operative Bank

This application form is needed to apply for a savings account with The Co-operative Bank. It requires personal information, tax status, and account preferences. Follow the instructions carefully for successful submission.

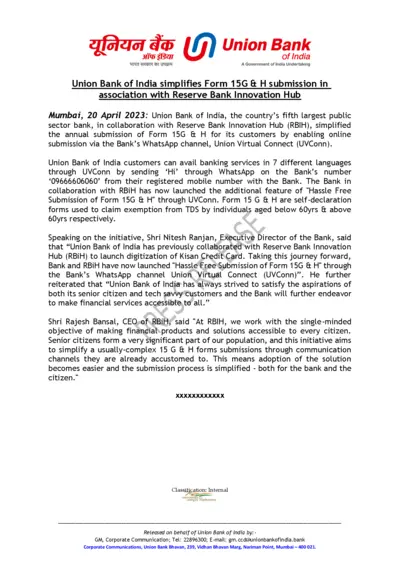

Union Bank of India Simplifies Form 15G & H Submission via WhatsApp

Union Bank of India has simplified the annual submission of Form 15G & H by enabling online submission via its WhatsApp channel Union Virtual Connect in association with RBIH. This initiative aims to make the submission process easier for senior citizens and tech-savvy customers. It provides banking services in 7 different languages through WhatsApp.

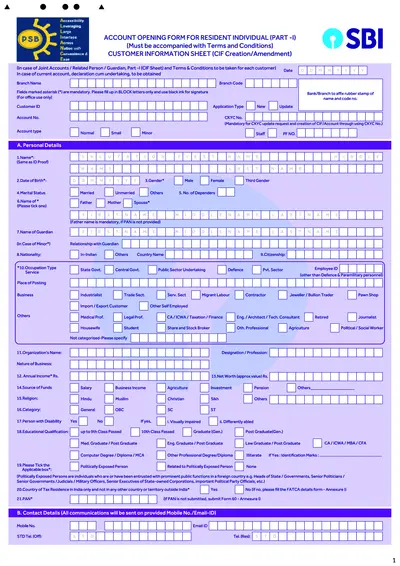

SBI Account Opening Form for Resident Individuals

This file is an account opening form for resident individuals of SBI. It includes detailed sections that need to be filled for creating a Customer Information File. The form must be accompanied by terms and conditions and is suitable for various types of accounts including saving bank, current account, and term deposits.

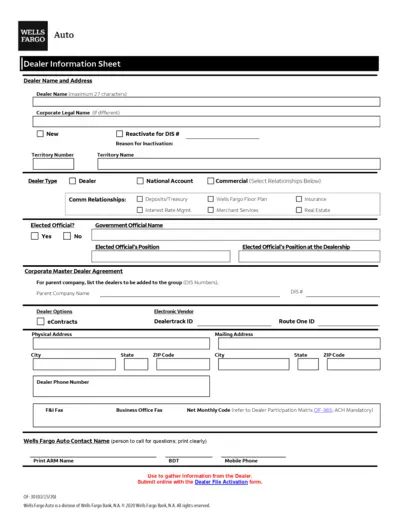

Wells Fargo Auto Dealer Profile Form

This document contains information and instructions for Wells Fargo Auto Dealers on completing the Dealer Information Sheet, ACH Profile Authorization Form, and Franchise Dealer Profile. Dealer's details, bank account information, and dealership legal details are required.

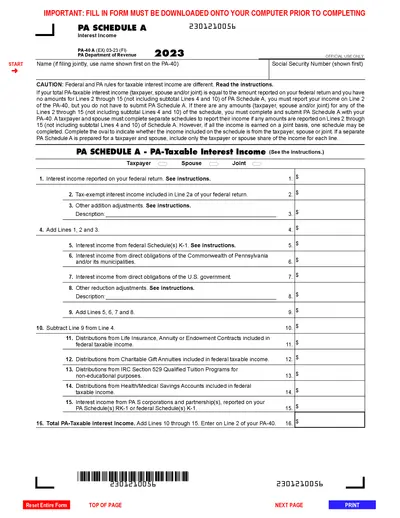

PA-40 A: 2023 Interest Income Schedule A Instructions

This file provides the instructions and details for completing the PA-40 Schedule A to report interest income for Pennsylvania tax purposes. It includes information on taxable interest, required schedules, and specific line items. Instructions for filling out, editing, and submitting the form are also provided.

Internet Banking Application | BANKWEST

This file contains the application form for BANKWEST's Internet Banking service. Users are required to provide their personal details and sign the document. The form is mandatory to open an Internet account with BANKWEST.

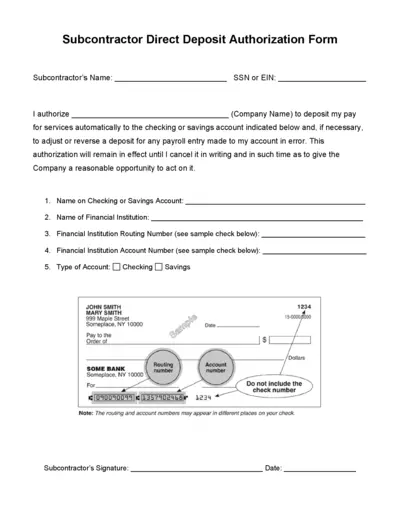

Subcontractor Direct Deposit Authorization Form

This form is used by subcontractors to authorize direct deposit of their pay into a chosen checking or savings account. It allows the company to make automatic payroll deposits. The form requires financial institution details and account information.