Finance Documents

Tax Forms

Credit for Federal Tax Paid on Fuels Form 4136

Form 4136 allows taxpayers to claim a credit for federal tax paid on fuels. It's essential for businesses and individuals using nontaxable fuel. Make sure to follow the instructions carefully to maximize your credit.

Tax Forms

Instructions for Form 1120-S for S Corporations

This document contains detailed instructions for Form 1120-S, designed for S Corporations. It explains filing requirements, deadlines, and eligibility criteria essential for tax compliance. Understanding these guidelines ensures proper reporting of income, gains, losses, deductions, and credits.

Tax Forms

Form W-10 Dependent Care Provider Identification

Form W-10 is used to collect information from dependent care providers. This form helps ensure accurate reporting for child and dependent care expenses. Keep this form for your records and submit necessary details when claiming tax credits.

Banking

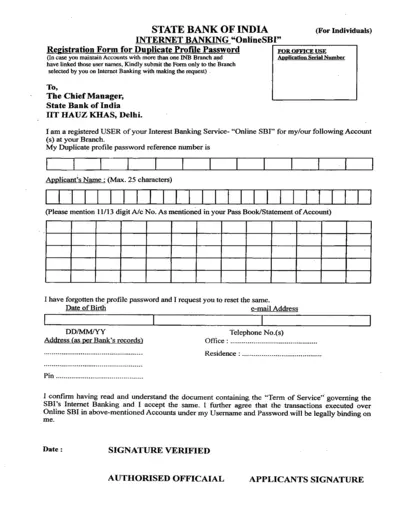

State Bank of India Duplicate Profile Password Form

This form is for requesting a duplicate profile password for OnlineSBI users. It is essential for those who have forgotten their profile password. Fill this form and submit it to your respective bank branch for processing.

Tax Forms

Instructions for Form 8865 IRS 2021

This file provides essential instructions for completing Form 8865, which is required for U.S. persons with certain foreign partnerships. It includes various schedules and filing requirements necessary for accurate reporting. Review this document for comprehensive guidance on international tax compliance.

Tax Forms

Instructions for Form W-3 Transmittal of Wage and Tax Statements

This file contains essential information for completing Form W-3. It is necessary for employers filing paper W-2 Forms to the SSA. This guide provides instructions on how to fill out and submit this form correctly.

Banking

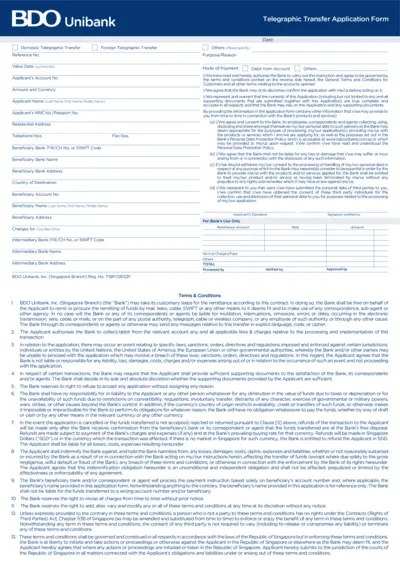

BDO Unibank Telegraphic Transfer Application Form

This document is a comprehensive guide for completing the BDO Unibank Telegraphic Transfer Application Form. It includes all the necessary details for remitting funds both domestically and internationally. Ensure accuracy in the provided information for a seamless transaction process.

Tax Forms

Schedule E Form 1040 for Rental Income Reporting

This form is used to report supplemental income and loss from rental real estate, royalties, partnerships, and S corporations. It is essential for tax reporting and ensuring compliance with IRS regulations. Users must ensure accurate completion to avoid issues with their tax return.

Banking

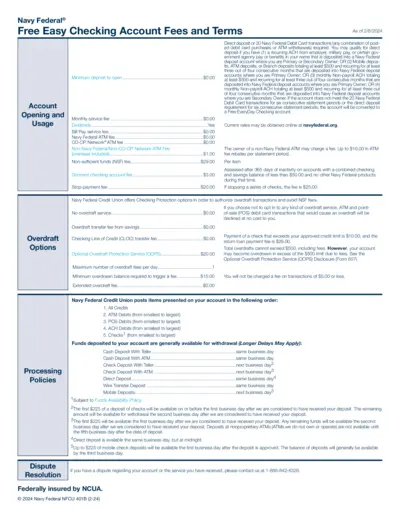

Navy Federal Free Easy Checking Account Fees Overview

Discover the fees and terms associated with the Navy Federal Free Easy Checking Account, including minimum deposit requirements, ATM fees, and overdraft options.

Banking

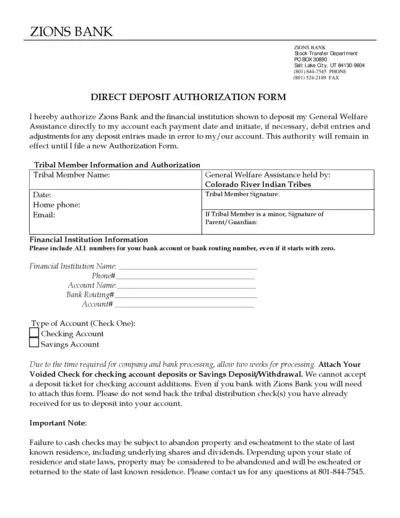

Zions Bank Direct Deposit Authorization Form

This file is a Direct Deposit Authorization form from Zions Bank. It allows tribal members to authorize deposits for General Welfare Assistance. Ensure to fill in all required fields accurately for processing.

Tax Forms

Virginia Department of Taxation Form 760-PMT Payment Coupon

The Virginia Department of Taxation Form 760-PMT is essential for individuals who need to make tax payments for 2016. This form allows you to remit estimated tax payments efficiently. Follow the provided instructions to ensure timely and accurate payment submission.

Banking

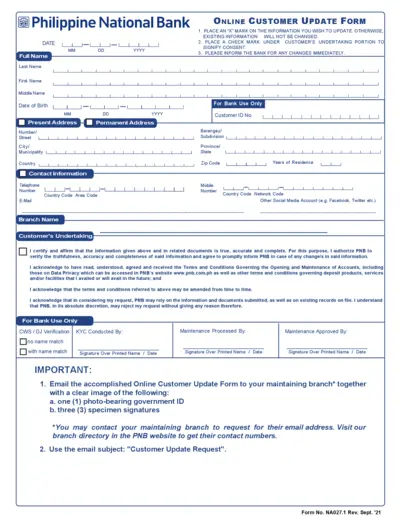

Philippine National Bank Customer Update Form

This file is an Online Customer Update Form from the Philippine National Bank. It is designed for customers who need to update their personal information. Ensure to provide accurate details and consent for any changes.