Finance Documents

Tax Forms

Georgia Individual Income Tax Return Form 500

The Georgia Form 500 is an individual income tax return that residents need to file for the 2020 tax year. This form is essential for reporting income, deductions, and credits to the Georgia Department of Revenue. It is designed for individuals, ensuring accurate assessment of state tax obligations.

Tax Forms

ITR-1 SAHAJ Indian Income Tax Return

The ITR-1 SAHAJ form is designed for Indian residents with income up to Rs. 50 lakh. It helps individuals report income from salaries and property. Ensure you meet the eligibility criteria before filing.

Banking

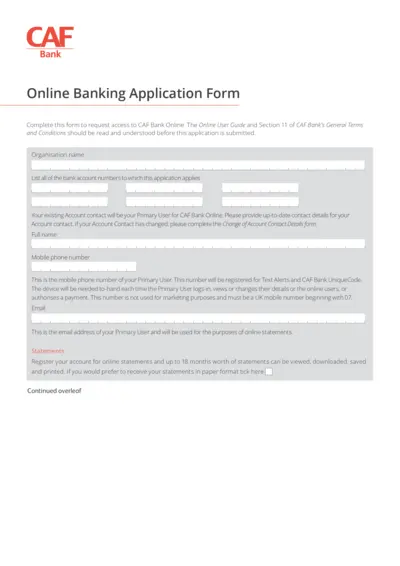

CAF Bank Online Banking Application Form

This form is designed to request access to CAF Bank Online. Users must complete the form and understand the associated terms and conditions. Ensure all details are accurate to facilitate smooth processing.

Tax Forms

California Pass-Through Entity Elective Tax Payment

This file provides instructions for Form FTB 3893, which is used by California pass-through entities to elect to pay a 9.3% tax. It outlines the eligibility, payment processes, and forms required for tax compliance.

Tax Forms

U.S. Nonresident Alien Income Tax Return Form 1040NR

The Form 1040NR is used by nonresident aliens to report their U.S. income and calculate their tax obligations. This form ensures that foreign nationals comply with U.S. tax laws. By filling out this form, nonresidents can determine their eligibility for any deductions or exemptions.

Banking

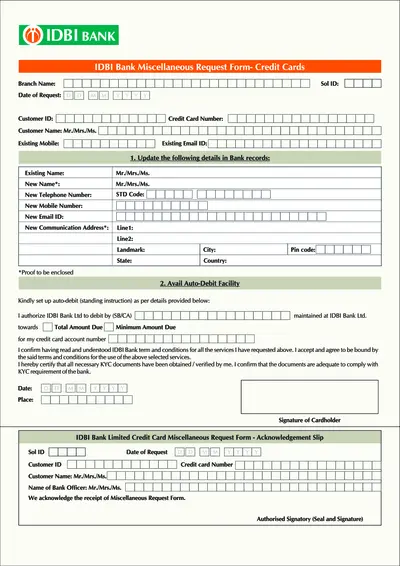

IDBI Bank Miscellaneous Request Form for Credit Cards

This form is used to request miscellaneous services related to IDBI Bank credit cards. It allows customers to update personal details and set up auto-debit facilities. Complete the form accurately to ensure prompt processing of your request.

Tax Forms

Form 8606 Instructions for Nondeductible IRAs

Form 8606 allows taxpayers to report nondeductible IRA contributions and calculate their basis in traditional IRAs. It's essential for ensuring accurate taxation of IRA distributions. Use this form if you made nondeductible contributions to a traditional IRA or converted IRAs in 2023.

Banking

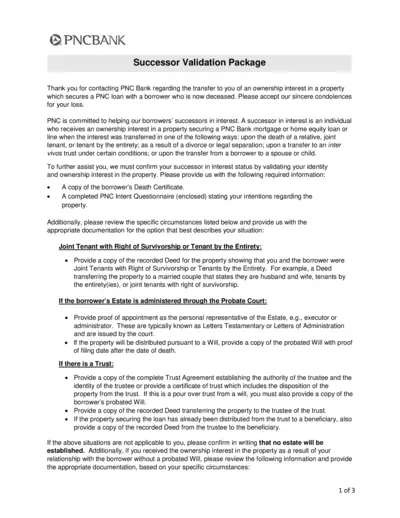

PNC Bank Successor Validation Package Form

This form provides instructions for validating ownership status of a property connected to a deceased borrower's PNC loan. The document outlines the necessary documents required based on different relationship scenarios with the borrower. Follow the guidelines to ensure timely processing of your application.

Tax Forms

Gift Aid Claim Form Instructions and Guidance

This file provides detailed instructions on how to fill out the Gift Aid claim form ChR1. It includes key points, guidelines, and ordering information. Essential for charities and organizations seeking tax relief on donations.

Tax Forms

Form 1128 Application for Tax Year Change

Form 1128 is used by entities to adopt, change, or retain a tax year. This form assists applicants in obtaining necessary approvals from the IRS. Completing this form accurately ensures compliance with tax regulations.

Tax Forms

Instructions for Form 1120 U.S. Corporation Income Tax Return

This file contains detailed instructions for completing Form 1120, which is essential for U.S. corporations to report their income and tax liabilities. It outlines who must file, important deadlines, and guidelines for each section of the form. Use this guide to ensure your tax filing is accurate and complete.

Tax Forms

2023 Instructions for Schedule C Profit or Loss

This file provides detailed instructions for filing Schedule C, used to report income or loss from a business operated or profession practiced as a sole proprietor. Important tax updates and deductions for the year 2023 are highlighted. Suitable for self-employed individuals seeking tax guidance.