Personal Finance Documents

Tax Forms

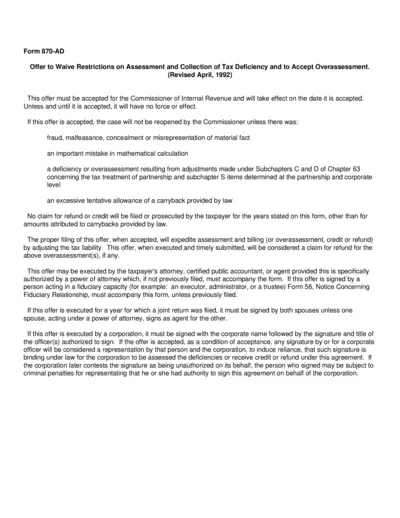

Form 870-AD Offer to Waive Tax Deficiency Restrictions

Form 870-AD is used to waive restrictions on the assessment and collection of tax deficiencies. This form must be accepted by the Commissioner of Internal Revenue to take effect. Proper submission expedites tax liability adjustment and claims for refunds.

Estate Planning

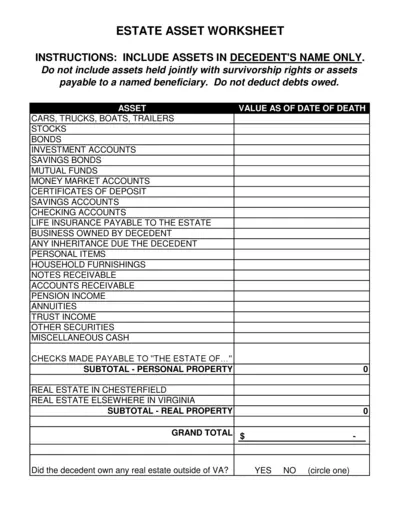

Estate Asset Worksheet for Effective Decedent Management

This Estate Asset Worksheet is designed to help executors and administrators list all assets owned by a decedent. This document ensures a comprehensive assessment for estate settlement. Follow the guidelines carefully to ensure all relevant assets are included.

Banking

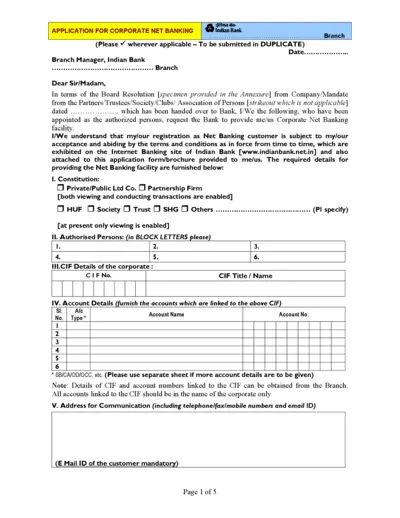

Corporate Net Banking Application Form - Indian Bank

This form is required for companies seeking Corporate Net Banking facilities provided by Indian Bank. It outlines the necessary information and authorization needs for corporate users. Proper completion of this application ensures prompt processing and access to bank services.

Banking

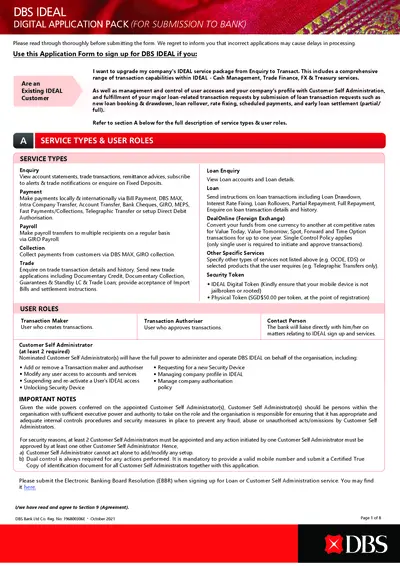

DBS IDEAL Digital Application Pack for Bank Submission

This file contains the DBS IDEAL Digital Application Pack, essential for businesses to sign up or upgrade their IDEAL services. It includes detailed instructions and service types available under the IDEAL platform. Users are advised to read the form thoroughly before submission to avoid delays.

Estate Planning

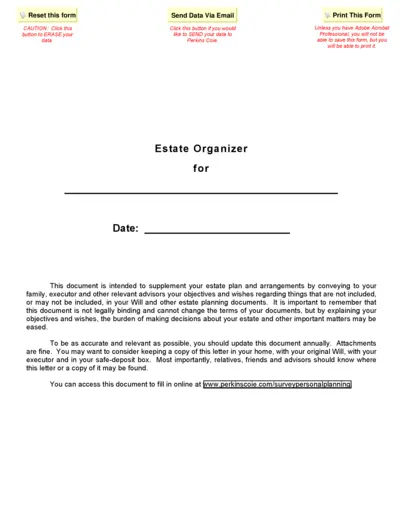

Estate Organizer Form Instructions and Guide

This Estate Organizer form is designed to help you compile essential information for your estate. Use it to communicate your wishes and arrangements clearly. Keep this document updated annually for the most accurate representation of your intentions.

Tax Forms

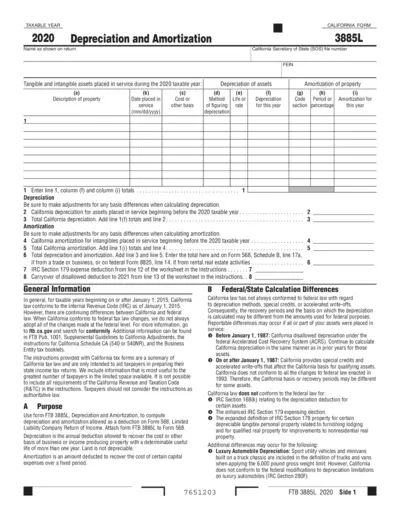

California Form 3885L Depreciation and Amortization

The California Form 3885L is used for reporting depreciation and amortization allowed as a deduction on Form 568 for the 2020 tax year. This form helps taxpayers accurately compute their depreciation for qualified property and ensure compliance with California tax laws. Utilize this guide to navigate the details of your assets and deductions effectively.

Tax Forms

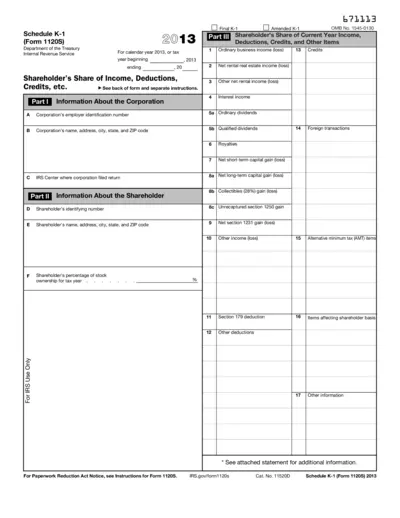

Schedule K-1 Form 1120S Instructions 2013

This file contains the Schedule K-1 (Form 1120S) for the year 2013 detailing shareholders' incomes, deductions, and credits. It provides essential information for tax reporting and filing for shareholders of S corporations. Users can refer to this document for guidance on filling out their tax returns accurately.

Tax Forms

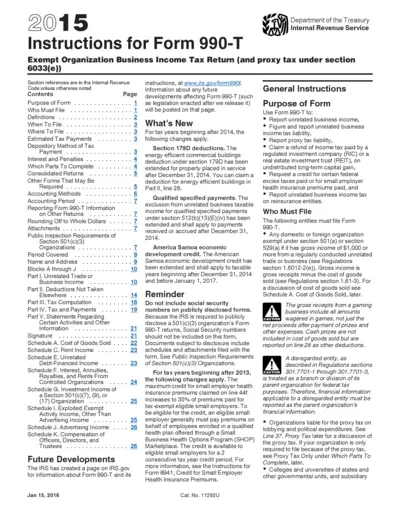

Instructions for Form 990-T Exempt Organizations

This file contains instructions for completing Form 990-T, an income tax return for exempt organizations. It provides guidelines for organizations to report unrelated business income. Users will find essential information regarding who must file, how to fill out the form, and important dates.

Tax Forms

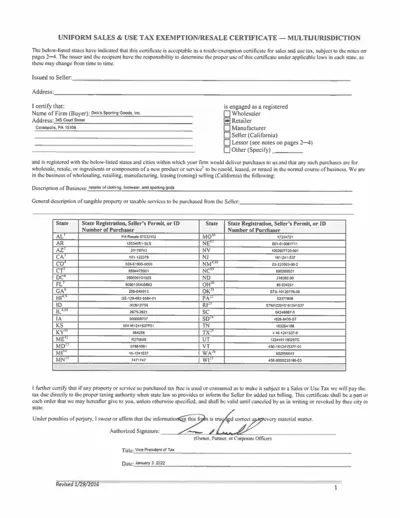

Uniform Sales & Use Tax Exemption Certificate

The Uniform Sales & Use Tax Exemption Certificate is a multi-jurisdictional form accepted by various states. This certificate allows buyers to claim tax exemption for eligible purchases. Ensure to provide accurate information and check state-specific guidelines.

Tax Forms

W-3 Transmittal of Wage and Tax Statements 2024

This file is the W-3 Transmittal of Wage and Tax Statements for 2024. It provides essential details for employers filing W-2 forms. Use this form to report wages and tax information to the SSA.

Tax Forms

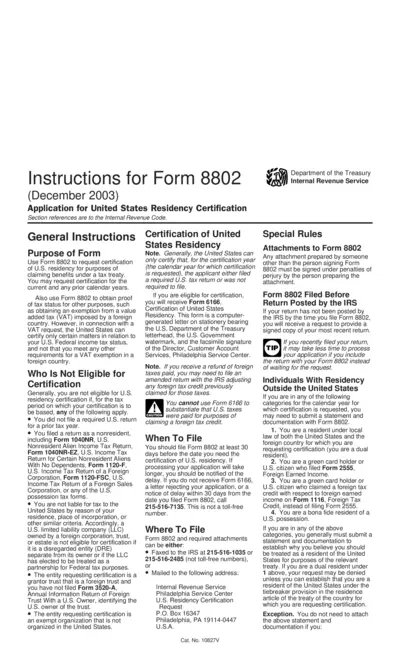

Instructions for Form 8802 Application for Residency Certification

Form 8802 helps individuals request certification of U.S. residency for tax treaty benefits. This form is essential for verifying tax status to claim exemptions, especially from foreign taxes. It is applicable for the current and any prior calendar years.

Banking

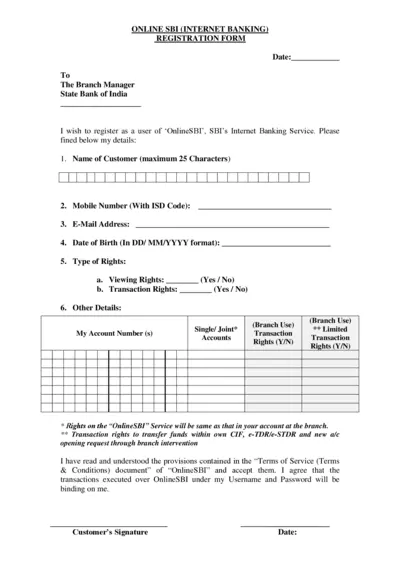

SBI Online Banking Registration Form

This document is a registration form for OnlineSBI, SBI's Internet Banking Service. Fill in your details including name, mobile number, and account information. Ensure to review the Terms of Service before submission.