Personal Finance Documents

Tax Forms

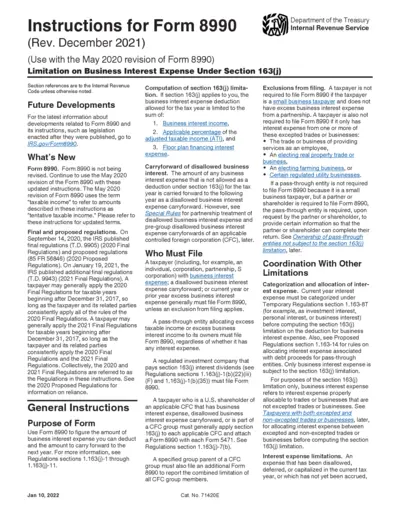

Instructions for Form 8990 Business Interest Expense

This file contains instructions for Form 8990 related to the limitation on business interest expenses under Section 163(j). It guides taxpayers on how to compute business interest expense deductions and outlines who must file the form. Essential for individuals and businesses navigating tax regulations.

Tax Forms

Maryland 2023 Form 510 Pass-Through Entity Tax Return

This file contains the 2023 instructions for the Maryland Pass-Through Entity Income Tax Return. It is essential for partnerships, S corporations, LLCs, and business trusts filing in Maryland. Follow the guidelines carefully to ensure accurate submissions and avoid delays.

Tax Forms

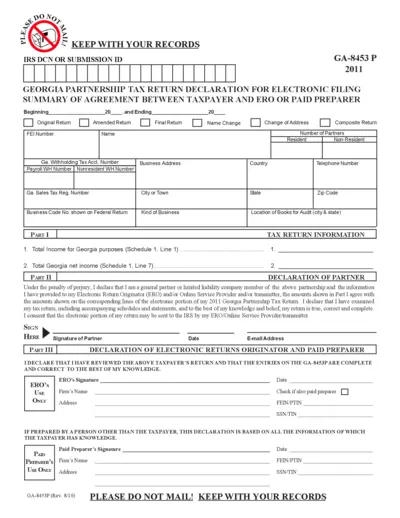

Georgia Partnership Tax Return Declaration Form

The GA-8453 P form is essential for Georgia partnerships to declare their tax electronically. It summarizes the agreement between the taxpayer and the ERO or paid preparer. This form should be retained for record-keeping purposes.

Banking

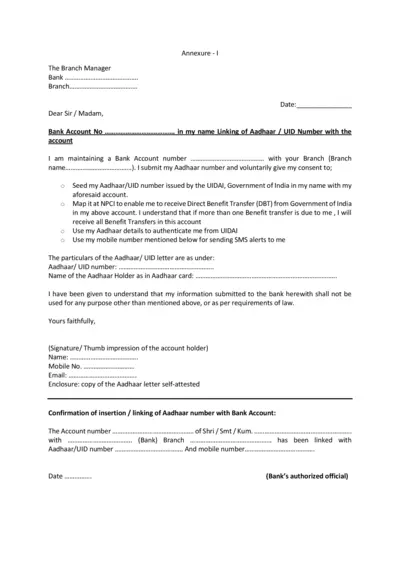

Aadhaar Linking Consent Form for Bank Account

This file is a form for linking your Aadhaar number with your bank account. Users can submit their consent for DBT transfers and the use of mobile alerts. It ensures that the bank uses your information solely for this purpose.

Banking

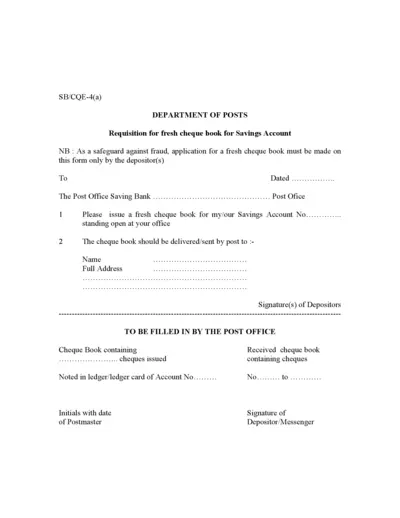

Cheque Book Requisition Form for Savings Accounts

This form is required to request a fresh cheque book for a savings account. It must be completed by the account holder. Ensure proper details are filled to avoid delays.

Tax Forms

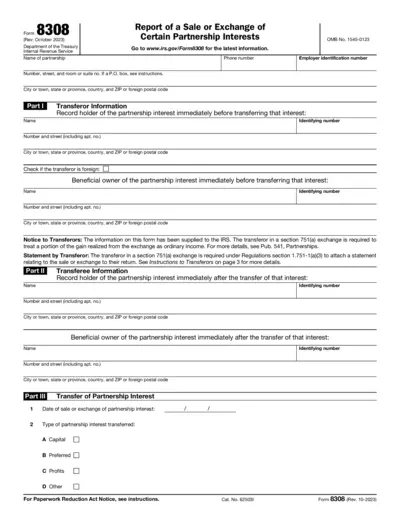

IRS Form 8308 Sale or Exchange of Partnership Interests

Form 8308 is used to report the sale or exchange of certain partnership interests. It helps partnerships fulfill their federal tax obligations. This form is essential for proper reporting of capital gains.

Tax Forms

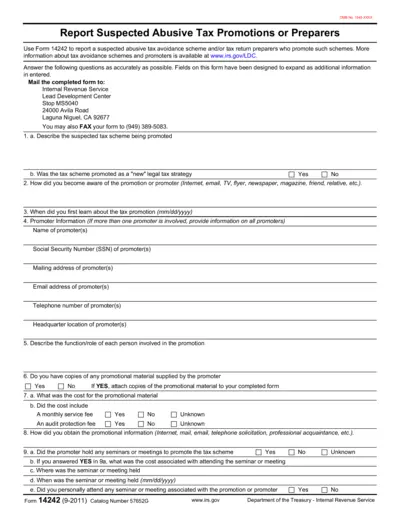

Report Suspected Abusive Tax Promotions Form 14242

Form 14242 allows individuals to report suspected abusive tax avoidance schemes. This form is crucial for those suspicious of tax promotions or preparers. Accurate reporting helps the IRS in enforcing tax laws.

Tax Forms

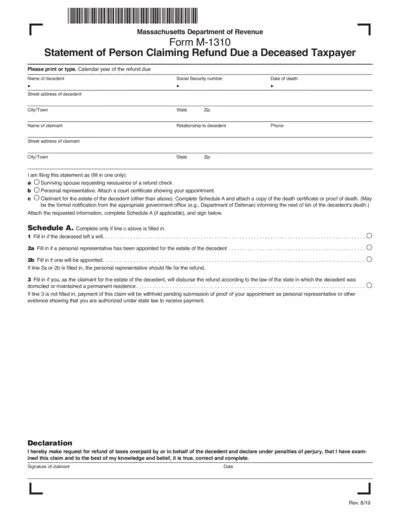

Massachusetts M-1310 Refund Claim for Deceased Taxpayer

The Massachusetts Department of Revenue Form M-1310 is used by survivors or personal representatives to claim refunds due to deceased taxpayers. This form requires details about the decedent and the claimant to ensure accurate processing of refunds. It is important to follow all instructions accurately to avoid delays.

Banking

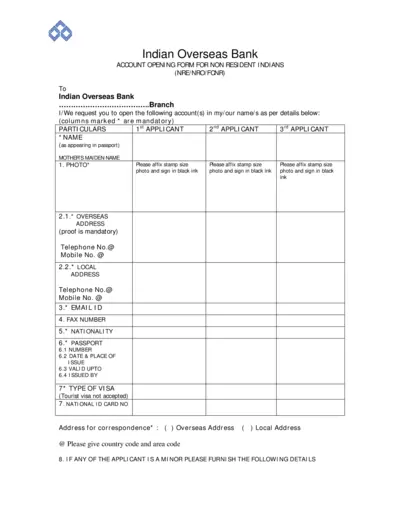

Indian Overseas Bank Account Opening Form for NRIs

This document is the Indian Overseas Bank Account Opening Form for Non-Resident Indians. It provides instructions and details for opening NRE, NRO, or FCNR accounts. Complete the required fields accurately to facilitate a smooth application process.

Tax Forms

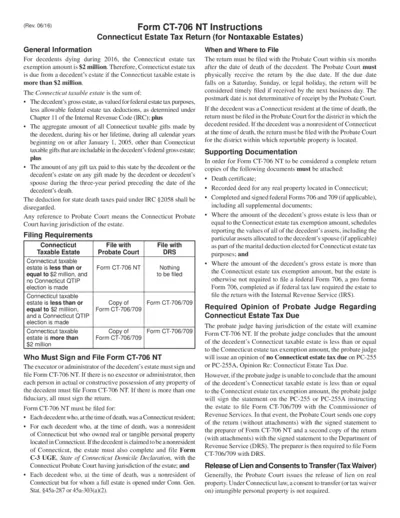

Connecticut Estate Tax Return Form CT-706 NT

This form provides comprehensive instructions for filing the Connecticut Estate Tax Return for nontaxable estates. It outlines requirements, filing processes, and documentation needed. Ideal for executors, administrators, and legal beneficiaries.

Tax Forms

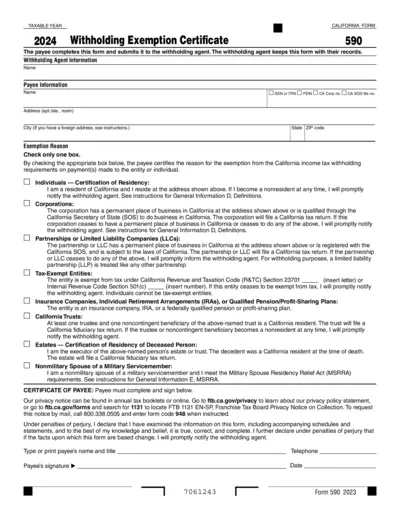

California Withholding Exemption Certificate Form 590

The California Withholding Exemption Certificate Form 590 is designed for individuals and entities to certify their exemption status from California income tax withholding. This form must be completed and submitted to the withholding agent to maintain compliance with state tax regulations. Understanding how to accurately fill out this form is crucial for residents and businesses operating in California.

Tax Forms

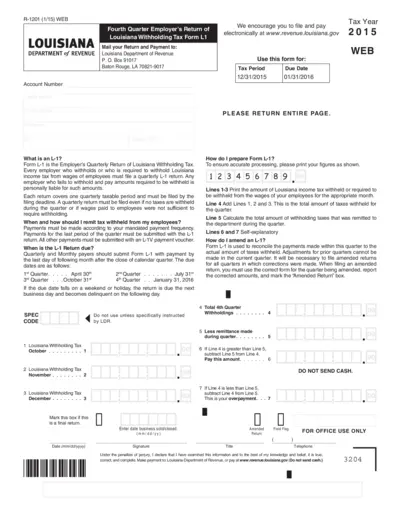

Louisiana Withholding Tax Form L1 Instructions

Form L-1 is the Employer's Quarterly Return for Louisiana Withholding Tax. Employers must file this return if withholding taxes are taken from employee wages. This document provides essential guidelines for accurate submission and payment.