Personal Finance Documents

Loans

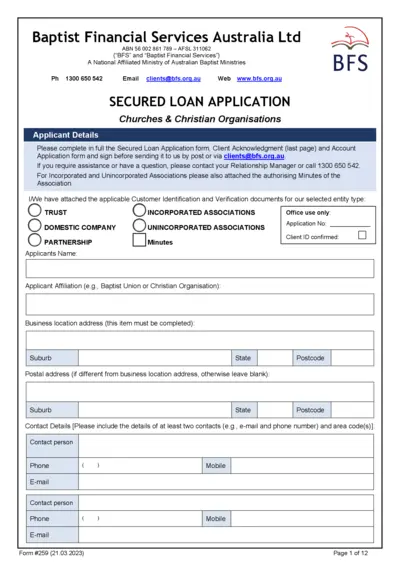

Secured Loan Application for Churches and Christian Organisations

This secured loan application is designed for churches and Christian organisations seeking financial assistance. It outlines the necessary details and instructions for completing the application form. Ensure all required documents are attached for a smooth submission process.

Tax Forms

FTB 3588 Payment Voucher for LLC e-filed Returns

The FTB 3588 form is essential for LLCs to pay their due taxes electronically. It is specifically designed for LLCs filing their returns online. Ensure you understand the instructions to avoid penalties and to comply fully with the California tax requirements.

Retirement Plans

Transamerica Retirement Solutions Opt Out Refund Form

This form is for participants who wish to opt out of automatic enrollment in the retirement plan. Participants must complete this form within 90 days of their first automatic deferral. Ensure that all information is accurate for successful processing.

Tax Forms

D-40B Nonresident Tax Refund Request Form

The D-40B form is used by nonresidents of the District of Columbia to request a refund of income tax withheld. This form is essential for individuals who lived in D.C. temporarily and have overpaid on their taxes. Completing this form is crucial for obtaining your due refund in a timely manner.

Banking

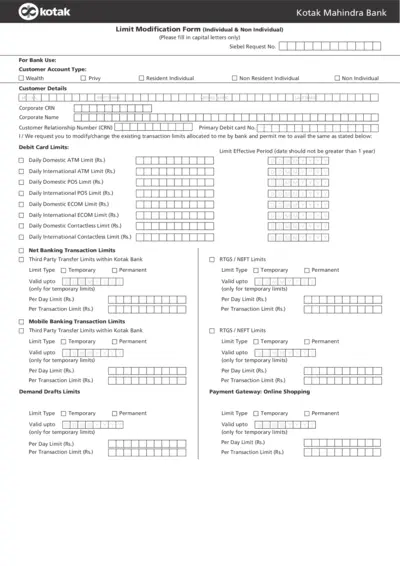

Kotak Mahindra Bank Limit Modification Form

This file contains the Limit Modification Form of Kotak Mahindra Bank for both individuals and non-individuals. It provides instructions for filling out the form to modify transaction limits. The form includes details on limits for debit cards, net banking, mobile banking, and more.

Tax Forms

California Power of Attorney CDTFA Form Instructions

This file contains the California Power of Attorney form instructions. It provides essential details for taxpayers and feepayers in California. Use this guide to understand how to appoint someone to handle your tax matters.

Tax Forms

IRS Schedule K-1 Form 1065 Instructions - 2024

The IRS Schedule K-1 form is essential for partnerships to report a partner's share of income, deductions, and credits. This draft contains preliminary information and instructions for the 2024 tax year. Ensure to use the final version after official release to comply with tax regulations.

Banking

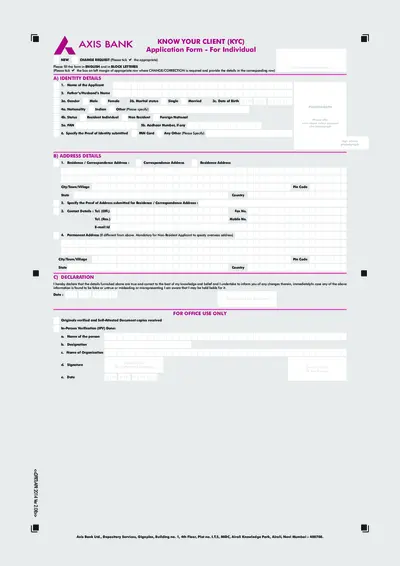

AXIS BANK KYC Application Form for Individuals

This Axis Bank KYC application form is for individuals. It allows applicants to submit their identity and address details. Ensure to fill it out accurately to avoid delays.

Tax Forms

Instructions for Filing Form BIR56A in Hong Kong

This file provides essential guidance on completing the Form BIR56A for Salaries Tax. It contains detailed instructions and requirements for employers. Users must refer to specific guidelines to ensure accurate submission.

Banking

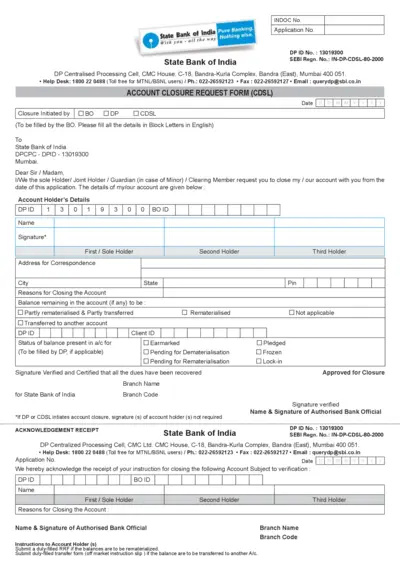

Account Closure Request Form for SBI

This document is a request form for closing an account with the State Bank of India. It allows account holders to provide necessary details for account closure. Ensure all information is accurate to facilitate the process.

Tax Forms

IRS W-7 Application for Taxpayer Identification Number

Form W-7 is used by individuals who need an IRS Individual Taxpayer Identification Number (ITIN) for tax purposes. It is essential for those who are not eligible for a social security number. Completing this form helps facilitate U.S. tax compliance and reporting.

Banking

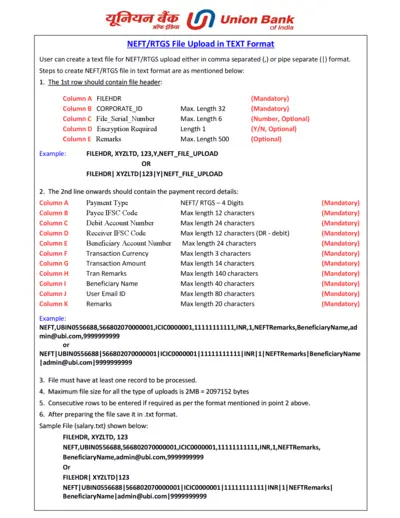

Union Bank NEFT/RTGS File Upload Instructions

This file provides detailed instructions for creating NEFT/RTGS uploads in text format. Users can easily create upload files using comma or pipe separated values. Follow the specified guidelines to ensure successful file submission.