Personal Finance Documents

Tax Forms

2022 Colorado Nonresident Partner Agreement

This file is a Colorado Nonresident Partner or Shareholder Agreement form for reporting Colorado income. It is essential for nonresident individuals involved in partnerships or S corporations in Colorado. The agreement ensures compliance with state tax obligations.

Tax Forms

IRS Instructions for Form 2106 - Employee Business Expenses

This document provides detailed instructions on completing IRS Form 2106 for Employee Business Expenses. It includes eligibility criteria, expense categories, and reimbursement guidelines. Essential for specific employees to accurately report their business-related expenses.

Tax Forms

Form 8995-A Instructions for Deduction of Qualified Business Income

This document provides comprehensive guidance for completing Form 8995-A. It outlines eligibility criteria and step-by-step procedures for calculating qualified business income deductions. Understanding these instructions is essential for individuals and entities seeking tax relief under Internal Revenue Code provisions.

Tax Forms

Missouri Employer's Return of Income Taxes Withheld

This document is essential for employers in Missouri to report income taxes withheld from employees' wages. It includes provisions for amendments and updates to registration. Ensure accuracy to avoid penalties and maintain compliance.

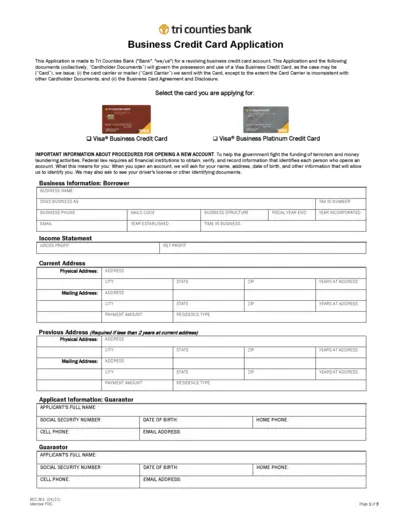

Banking

Tri Counties Bank Business Credit Card Application

This document is an application for a revolving business credit card account at Tri Counties Bank. It outlines the necessary business and personal information required to apply. Use this application to access various credit card options tailored for businesses.

Retirement Plans

Cal Savers Employee Opt Out Form Instructions

The Cal Savers Employee Opt-Out Form allows employees to voluntarily opt out of payroll contributions to their retirement savings. This form ensures that your savings are in your control and allows you to manage your retirement funds effectively. If you decide to opt out, you can do so at any time and return to participating later.

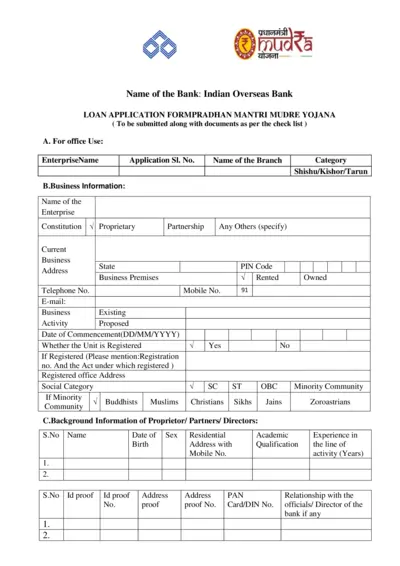

Loans

Pradhan Mantri Mudra Yojana Loan Application Form

This file is a loan application form for the Pradhan Mantri Mudra Yojana. It is designed to help small businesses obtain financial assistance. Fill it out with the required information and submit it to your bank for processing.

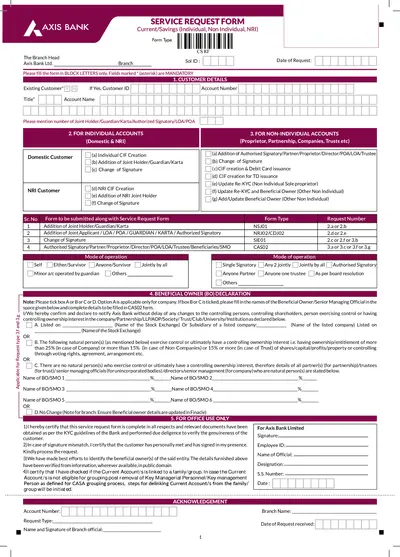

Banking

Axis Bank Service Request Form for Customers

This service request form allows individuals and businesses to make various service requests to Axis Bank. It includes sections for customer details, beneficial owner declarations, and more. Proper completion of this form is essential for timely processing of requests.

Tax Forms

Form ST3 Certificate of Exemption Instructions

This document provides instructions for completing the Form ST3 Certificate of Exemption. It is essential for purchasers and sellers to correctly apply and validate exemptions from sales tax. Ensure compliance with Minnesota Department of Revenue requirements.

Tax Forms

Partner Instructions Schedule K-1 Form 1065

The Partner's Instructions for Schedule K-1 informs partners about their share of income, deductions, and credits from partnerships. This document is essential for accurate tax reporting. It provides guidelines for understanding the reported items and responsibilities of the partners.

Tax Forms

Indiana Annuitant's Request for Tax Withholding

This form allows annuitants in Indiana to request withholding of state and county income tax. It is essential for managing tax liabilities on pension or annuity payments. Complete the form accurately to ensure proper tax withholding.

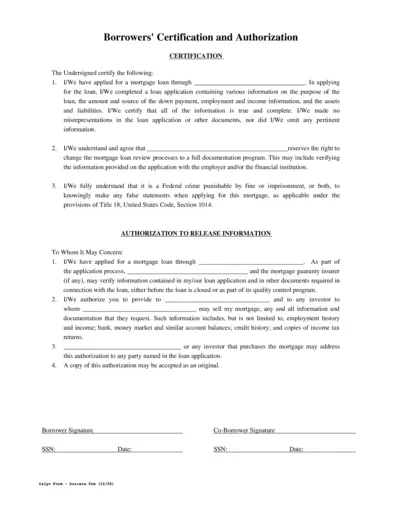

Loans

Borrowers' Certification and Authorization Form

This form allows borrowers to certify their financial information for a mortgage application, ensuring all provided data is accurate and complete. It also authorizes the lender to verify employment and income details. Proper completion of this form is crucial for processing your mortgage loan application efficiently.