Personal Finance Documents

Tax Forms

Instructions for Form IT-196 New York State Tax

This document provides comprehensive instructions for completing Form IT-196 for New York State tax purposes. It caters to residents, nonresidents, and part-year residents to effectively itemize their deductions and optimize their tax returns. Users can benefit from detailed guidance on medical expenses, taxes, and mortgage interest deductions.

Banking

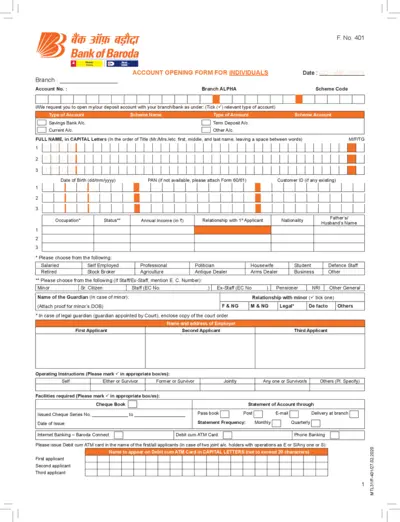

Account Opening Form for Individuals Bank of Baroda

This document is an Account Opening Form for individuals wishing to open an account with Bank of Baroda. It includes essential details required to process the account opening request. Ensure all fields are filled out accurately for a seamless application process.

Banking

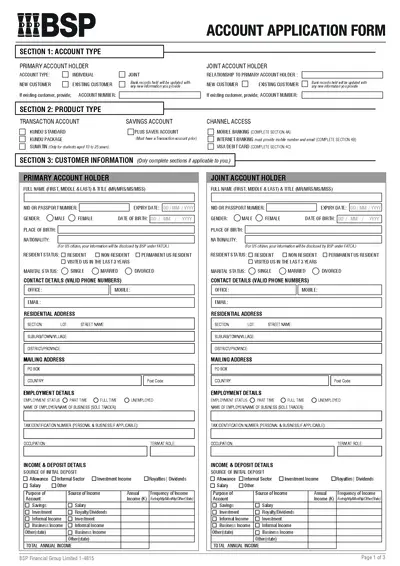

BSP Account Application and Referee Form Instructions

This document provides essential details for opening a bank account with BSP. It includes sections for account types, customer information, and necessary identification requirements. Ensure to complete all relevant sections accurately to facilitate your application process.

Tax Forms

New York State Sales Tax Exempt Purchase Certificate

This file is the ST-123 form used for claiming sales tax exemptions in New York. It is applicable for IDA agents or project operators. The form outlines the necessary steps to complete for tax-exempt purchases related to specific projects.

Banking

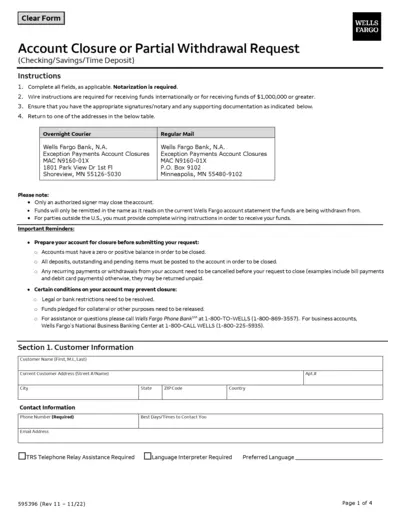

Wells Fargo Account Closure Withdrawal Request Form

This form is essential for customers looking to close or partially withdraw funds from their Wells Fargo accounts. It outlines the necessary steps and documentation required to complete the process seamlessly. Ensure to follow all instructions carefully for a smooth account closure experience.

Tax Forms

Form 8655 Reporting Agent Authorization Instructions

Form 8655 allows taxpayers to authorize a reporting agent to file returns, make payments, and receive tax information. This form helps streamline tax processes for businesses. Use this to ensure compliance with IRS regulations.

Tax Forms

Instructions for Form 8986 Partner's Share of Adjustments

Form 8986 provides essential instructions for partners regarding the share of adjustments to partnership-related items. This document is vital for those involved in partnerships, ensuring proper understanding and compliance with IRS regulations. Users can easily navigate through the necessary steps to fill out the form correctly.

Tax Forms

Georgia Individual Income Tax Return Form 500

The Georgia Form 500 is an individual income tax return that residents need to file for the 2020 tax year. This form is essential for reporting income, deductions, and credits to the Georgia Department of Revenue. It is designed for individuals, ensuring accurate assessment of state tax obligations.

Tax Forms

ITR-1 SAHAJ Indian Income Tax Return

The ITR-1 SAHAJ form is designed for Indian residents with income up to Rs. 50 lakh. It helps individuals report income from salaries and property. Ensure you meet the eligibility criteria before filing.

Banking

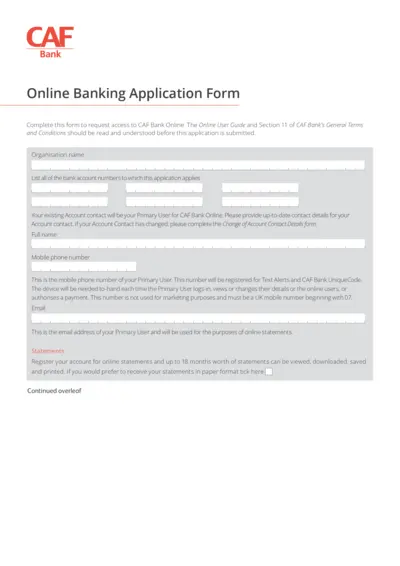

CAF Bank Online Banking Application Form

This form is designed to request access to CAF Bank Online. Users must complete the form and understand the associated terms and conditions. Ensure all details are accurate to facilitate smooth processing.

Tax Forms

California Pass-Through Entity Elective Tax Payment

This file provides instructions for Form FTB 3893, which is used by California pass-through entities to elect to pay a 9.3% tax. It outlines the eligibility, payment processes, and forms required for tax compliance.

Tax Forms

U.S. Nonresident Alien Income Tax Return Form 1040NR

The Form 1040NR is used by nonresident aliens to report their U.S. income and calculate their tax obligations. This form ensures that foreign nationals comply with U.S. tax laws. By filling out this form, nonresidents can determine their eligibility for any deductions or exemptions.