Personal Finance Documents

Tax Forms

NC-40 PTE Estimated Income Tax Instructions

This file provides detailed instructions for completing the NC-40 PTE form for estimated income tax payments for taxed partnerships in North Carolina. It outlines who must file and important deadlines. Ensure compliance with the instructions to avoid penalties.

Banking

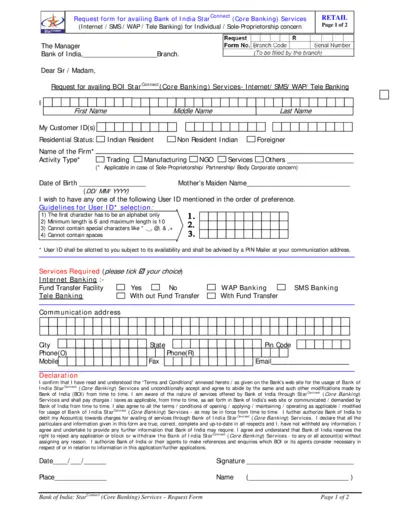

Bank of India StarConnect Request Form

This form is essential for individuals and sole proprietorships seeking to avail Bank of India StarConnect services. It facilitates requests for internet, SMS, WAP, and tele banking services. Ensure all fields are filled accurately to avoid processing delays.

Tax Forms

Illinois RUT-25-LSE Use Tax Return for Lease

The RUT-25-LSE form is required for reporting use tax for leased vehicles in Illinois. It is essential for lessors and lessees engaging in leases from out-of-State retailers. Proper completion is necessary for compliance with Illinois tax laws.

Tax Forms

NYC MTA Surcharge Return Form CT-3-M Instructions

This file contains detailed instructions for completing Form CT-3-M, the MTA Surcharge Return for corporations in New York State. It outlines filing requirements, deadlines, and notable updates for 2023. Businesses operating within the Metropolitan Commuter Transportation District must complete this form accurately to comply with state laws.

Tax Forms

Instructions for Form 1139 Corporation Refund

This document provides detailed instructions for completing Form 1139, used by corporations to apply for a tentative refund. It outlines the necessary information, eligibility requirements, and specific guidelines for various tax scenarios. Understanding these instructions ensures that corporations can accurately file for tax refunds related to net operating losses and other credits.

Banking

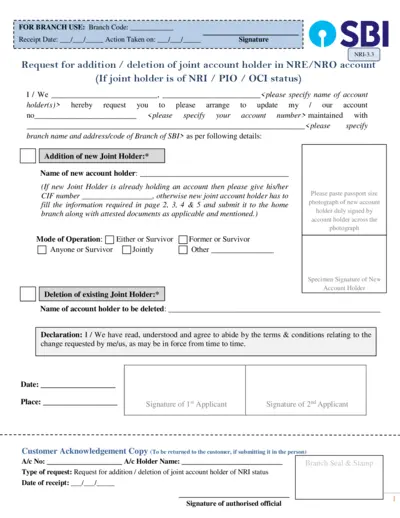

Request for Joint Account Holder Addition/Deletion

This file facilitates the request for adding or removing joint account holders in NRE/NRO accounts at SBI. It includes essential personal details and identification requirements. Ensure all documents are attested and submitted to the home branch.

Loans

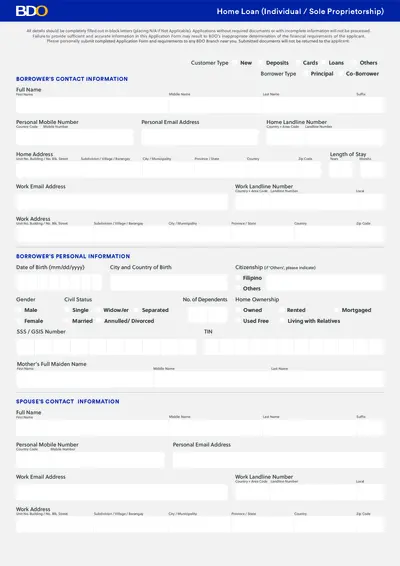

BDO Home Loan Application Guidelines and Instructions

This file contains comprehensive details about the BDO Home Loan application process, including required information and necessary documents. Applicants must ensure all sections are filled out correctly to avoid delays in processing. Follow the outlined instructions for a smooth application experience.

Tax Forms

Self-Employment Tax Schedule SE Form 1040

This document provides essential details on filing the Self-Employment Tax using Schedule SE, part of Form 1040. Users can find instructions, necessary calculations, and key details to ensure compliance with IRS regulations. It's vital for self-employed individuals seeking to accurately report their income and calculate taxes owed.

Banking

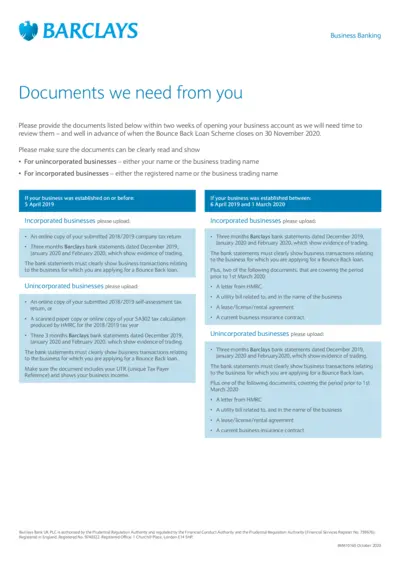

Barclays Business Banking Document Submission Guide

This file contains essential instructions and documents required for business account opening at Barclays. It details the document types based on business incorporation status and timeline. Ensure to follow the guidelines for a smooth application process.

Tax Forms

Form 5695 Instructions for Residential Energy Credits

Form 5695 is used for claiming residential energy credits on your tax return. Ensure to follow the detailed instructions for accurate completion. This form is essential for those who made energy-efficient improvements to their homes.

Tax Forms

MyTax DC - User Guide How to Request Certificate of Resale

This user guide provides detailed steps on how to request a Certificate of Resale via MyTax.DC.gov. It includes instructions, necessary fields, and contact details. Perfect for business owners and taxpayers needing resale certification.

Tax Forms

Form 8396 Mortgage Interest Credit Instructions

Form 8396 is used for calculating the mortgage interest credit for the tax year 2023. This form is essential for individuals who hold a Qualified Mortgage Credit Certificate and can help in claiming credits. Ensure that you meet the requirements and accurately fill out the form to claim your credit.