Personal Finance Documents

Tax Forms

Form 8991 - Tax on Base Erosion Payments

Form 8991 is used to report the tax on base erosion payments of taxpayers with substantial gross receipts. It must be filled out accurately to meet IRS requirements. Ensure all relevant income and deductions are reported in compliance with tax regulations.

Credit Cards

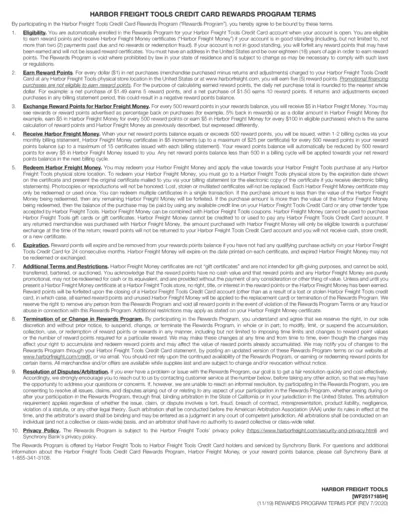

Harbor Freight Tools Credit Card Rewards Program

This file outlines the terms and conditions of the Harbor Freight Tools Credit Card Rewards Program. It includes details on eligibility, earning reward points, redeeming Harbor Freight Money, and expiration. Ideal for cardholders to understand their benefits and responsibilities.

Banking

Zions Bank Direct Deposit Authorization Form

This form authorizes Zions Bank to deposit funds directly to your account. Complete this form to manage your direct deposit preferences. Ensure all holders sign before submission.

Tax Forms

NC-4P Withholding Certificate for Pension Payments

The NC-4P form is essential for North Carolina residents receiving pension or annuity income. It specifies how state income tax should be withheld from these payments. Properly filling out this form ensures compliance with tax obligations.

Savings Accounts

Consumer Account Closure Request Checklist

This document outlines the steps needed to close your consumer account with BECU. It provides essential instructions and required forms for a smooth closure process. Follow the detailed guidance to ensure all necessary documents are submitted correctly.

Banking

GCB Account Opening Form - Individual & Joint Usage

The GCB Account Opening Form is essential for individuals and groups wishing to establish accounts with GCB. This document outlines necessary requirements for account creation, including identification and proof of address. Fill out this form accurately to ensure a smooth account opening process and compliance with banking regulations.

Tax Forms

SC Use Tax Worksheet and Instructions

This file contains the South Carolina Use Tax Worksheet and detailed instructions for filling it out. It is essential for individuals and businesses to accurately report and pay their Use Tax. Get guidance on the required fields and submission process to ensure compliance with state laws.

Tax Forms

Form 2106 Employee Business Expenses for 2023

Form 2106 is used by employees to claim business-related expenses. It helps document expenses for vehicle use, travel, and other business costs. This form is essential for Armed Forces reservists and qualified performing artists.

Tax Forms

Hawaii Form TA-2 Transient Accommodations Tax Instructions

This file contains the annual return and reconciliation form for Hawaii's Transient Accommodations Tax. It provides guidelines on tax computation and filing requirements for various districts in Hawaii. Users must complete the form accurately to comply with state tax regulations.

Tax Forms

2023 New Jersey Form NJ-1040NR Tax Return Instructions

This PDF provides detailed instructions for filing the 2023 New Jersey Form NJ-1040NR. It outlines filing requirements, deductions, and tax rates. This guide is essential for nonresidents who need to file New Jersey income taxes.

Banking

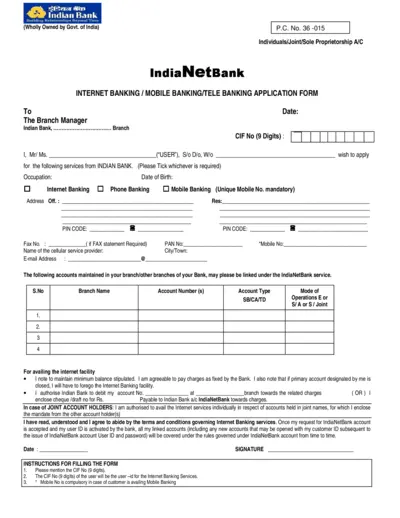

Indian Bank Internet Banking Application Form

This file is an application form for Internet Banking services from Indian Bank. It contains sections for personal details, account information, and service requests. Users must fill out the form accurately to access online banking features.

Tax Forms

Ohio Income Tax Return IT 10 Zero Liability

The 2022 Ohio IT 10 is an Individual Income Tax Return for taxpayers with zero liability. It must be filed by those who are not required to pay taxes in Ohio. This form helps taxpayers to report their income and fulfill state requirements.