Personal Finance Documents

Tax Forms

Instructions for Form 1120-REIT - IRS Tax Guide

This file contains important IRS instructions for filing Form 1120-REIT, which is used to report income and deductions for Real Estate Investment Trusts. It includes guidelines for eligibility, required fields, and submission procedures. Anyone involved with REITs should refer to this document for compliance and reporting.

Tax Forms

Instructions for Form 1065 U.S. Partnership Income

This document provides detailed instructions for completing Form 1065, the U.S. Return of Partnership Income. It outlines requirements and procedures for partnerships to report their income, gains, losses, deductions, and credits. Use this comprehensive guide to ensure compliance with IRS regulations.

Tax Forms

IRS Form 1042-S Instructions for Foreign Income

The IRS Form 1042-S is crucial for reporting U.S. source income paid to foreign persons. This form outlines income types, withholding requirements, and necessary codes. Use it to ensure compliance with U.S. tax laws related to foreign income.

Banking

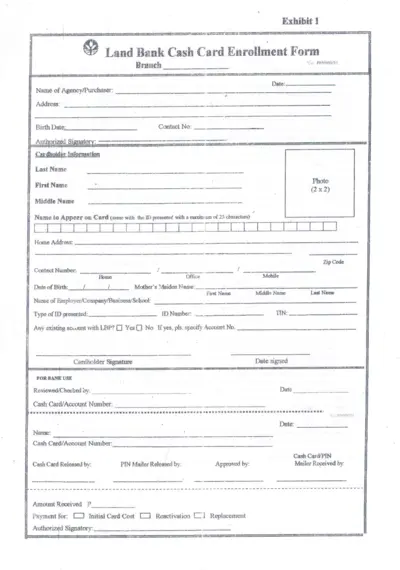

Land Bank Cash Card Enrollment Form Instructions

This file contains the Land Bank Cash Card Enrollment Form, necessary for agencies and purchasers to enroll for a prepaid debit card. It includes instructions on completing the form and understanding the terms and conditions associated with the card. Additionally, it provides essential details required for filling out the form accurately.

Banking

LANDBANK weAccess Institutional Internet Banking FAQ

This file provides detailed information on LANDBANK weAccess, an internet banking facility for institutions. It includes enrollment instructions and operational requirements. Perfect for institutional clients looking for online banking solutions.

Banking

Financial Inclusion Bank Account Opening Form

This document is designed for individuals who wish to open a financial inclusion account in a bank. It contains all necessary details to complete the application process. Ensure all information provided is accurate and up-to-date.

Tax Forms

IRS Form 4868 Instructions for Extension 2023

This document provides essential details about IRS Form 4868, which allows individuals to request an automatic extension for filing their U.S. individual income tax return. The instructions guide users on proper completion while highlighting the significance of adhering to deadlines. It serves as a comprehensive resource for taxpayers needing extra time.

Banking

CashPro Remote Deposit Online User Guide

This user guide provides comprehensive instructions for using the CashPro Remote Deposit service offered by Bank of America Merrill Lynch. It covers everything from initial setup to troubleshooting common issues. Ideal for both consumers and businesses looking to utilize remote deposit functionality effectively.

Tax Forms

Alabama W-2 Schedule Form Instructions and Details

The Alabama W-2 Schedule is essential for reporting wages and ensuring accurate income tax assessments. Complete this form to claim the Alabama income tax withheld from your wages. Ensure all required statements are attached for proper processing.

Banking

Account Opening Form for Non Individuals - Bank of Baroda

This file contains the account opening form for non-individuals at Bank of Baroda. It provides necessary fields for business entities to open a bank account. Complete the form accurately to ensure a smooth account opening process.

Banking

Capitec Bank Job Application Form Instructions

This document provides a detailed guide on how to fill out the Capitec bank job application form correctly. It includes step-by-step instructions and tips for applicants. Use this resource to ensure your application is complete and professional.

Tax Forms

Instructions for Form 1042-S Reporting for 2024

This file provides detailed instructions for completing Form 1042-S, which reports income subject to withholding for foreign persons. It covers essential filing guidelines, definitions, and responsibilities of withholding agents. Users will find crucial information on deadlines, necessary codes, and reporting requirements.