Mastering Form 5472: Filing Guide and Instructions

This file provides comprehensive guidance on filling out Form 5472, essential for foreign-owned corporations operating in the U.S. It covers filing requirements, penalties, and new reporting changes. Perfect for business owners and tax professionals needing clarity on international tax compliance.

Edit, Download, and Sign the Mastering Form 5472: Filing Guide and Instructions

Form

eSign

Add Annotation

Share Form

How do I fill this out?

Filling out Form 5472 requires attention to detail. Start by gathering all necessary information about the corporation and related parties. Follow the instructions carefully to ensure accurate reporting for the IRS.

How to fill out the Mastering Form 5472: Filing Guide and Instructions?

1

Gather all required information related to the foreign corporation and related parties.

2

Fill in the appropriate fields in the Form 5472 carefully.

3

Ensure that all transactions between related parties are accurately reported.

4

Review the completed form for any errors or omissions.

5

Submit the form along with your corporate tax return.

Who needs the Mastering Form 5472: Filing Guide and Instructions?

1

Foreign corporations operating in the U.S. need this form to comply with tax regulations.

2

U.S. subsidiaries of foreign companies must file this form to report foreign ownership.

3

Tax professionals require this document for accurate reporting on behalf of clients.

4

Businesses engaged in transactions with foreign entities need to disclose these for tax purposes.

5

Investors in foreign-owned corporations should understand their reporting requirements through this form.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Mastering Form 5472: Filing Guide and Instructions along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Mastering Form 5472: Filing Guide and Instructions online.

Editing this PDF on PrintFriendly is straightforward. You can upload the PDF and use our powerful editing tools to make the necessary changes. Once you've finished editing, download your customized document.

Add your legally-binding signature.

Signing the PDF on PrintFriendly is quick and easy. After editing, you can add your signature directly to the PDF. This feature ensures your document is ready for submission immediately.

Share your form instantly.

Sharing the PDF on PrintFriendly is hassle-free. After making edits, you can generate a shareable link to send to collaborators. This feature enables seamless collaboration on critical documents.

How do I edit the Mastering Form 5472: Filing Guide and Instructions online?

Editing this PDF on PrintFriendly is straightforward. You can upload the PDF and use our powerful editing tools to make the necessary changes. Once you've finished editing, download your customized document.

1

Upload your PDF document to PrintFriendly.

2

Use the editing tools to make your changes.

3

Add text, images, or annotations as needed.

4

Preview the edited document to ensure accuracy.

5

Download the final version of your PDF.

What are the important dates for this form in 2024 and 2025?

For Form 5472, the filing deadline aligns with the corporate tax return deadline, typically April 15th for calendar year filers. In 2024, ensure to stay updated on any changes that may affect submission dates. For 2025, timely filing will continue to be essential to avoid penalties.

What is the purpose of this form?

The primary purpose of Form 5472 is to provide the IRS with essential information regarding foreign-owned U.S. corporations and their transactions with related foreign entities. This form helps in enforcing compliance with international tax regulations and reporting requirements. Accurate submission of Form 5472 is crucial for maintaining transparency in financial reporting and ensuring equitable taxation.

Tell me about this form and its components and fields line-by-line.

- 1. Identification of Foreign Owner: Details of the foreign corporation or individual who owns 25% or more of the U.S. corporation.

- 2. Transaction Types: Specific transactions that occurred between the foreign owner and the U.S. corporation.

- 3. Financial Statements: Information on the financial performance of the U.S. corporation.

- 4. Contact Information: Details of the person preparing the form and their contact information.

- 5. Signature: Signature of the person preparing the form to certify its completeness and accuracy.

What happens if I fail to submit this form?

Failing to submit Form 5472 can lead to severe penalties and increased scrutiny from the IRS. Businesses may face audits or investigations if they do not comply with reporting requirements. It's crucial to meet deadlines to avoid such consequences.

- Penalties for Non-Filing: Failure to file Form 5472 can result in penalties of $25,000 per year for each form not filed.

- Increased IRS Scrutiny: Non-submission may attract IRS audits and investigatory actions.

- Legal Repercussions: Continued non-compliance can lead to legal issues and additional fines.

How do I know when to use this form?

- 1. Foreign Ownership: When a U.S. corporation has foreign ownership of 25% or more.

- 2. Transactions with Foreign Parties: When transactions occur between the U.S. corporation and foreign related parties.

- 3. Annual Reporting: For annual reporting on related party transactions as mandated by the IRS.

Frequently Asked Questions

What is Form 5472?

Form 5472 is an information return required for foreign-owned U.S. corporations to report transactions with foreign related parties.

Who needs to file Form 5472?

Any foreign-owned U.S. corporation must file this form if they have reportable transactions with foreign related parties.

How do I complete Form 5472?

Gather all necessary information, fill in the sections as instructed, and ensure accuracy before submission.

Can I edit Form 5472 on PrintFriendly?

Yes, PrintFriendly offers an easy-to-use PDF editor for making changes to Form 5472.

What happens if I don’t file Form 5472?

Failure to file can result in significant penalties, including fines and increased scrutiny from the IRS.

How do I download the edited PDF?

After editing, simply click the download button to save your changes.

What if I need to share the form?

You can generate a shareable link to send the edited form to others.

Is there a deadline for filing Form 5472?

Form 5472 must be filed with your corporate tax return or by the due date of the return.

Can I get help with this form?

Yes, consider consulting a tax professional for assistance with Form 5472.

Are there any new changes for Form 5472 in 2024?

Yes, there are updated reporting requirements for 2024 that businesses must comply with.

Related Documents - Form 5472 Guide

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

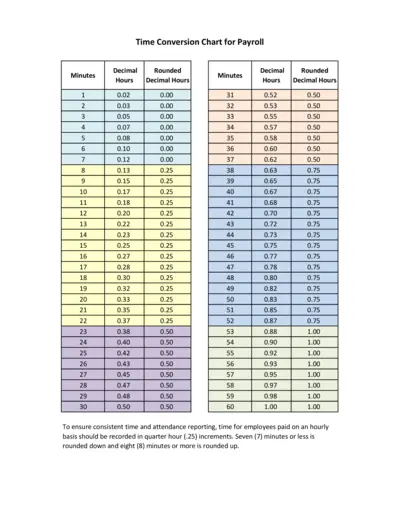

Time Conversion Chart for Payroll

This file provides a time conversion chart for payroll, converting minutes into decimal hours. It aids in accurate and consistent time reporting. Ideal for employees paid on an hourly basis.

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

QuickBooks Online Payroll Taxes and Liabilities Guide

This file provides comprehensive instructions on how to set up, pay, and file payroll taxes and liabilities using QuickBooks Online. Employers can track and report income taxes, CPP, and EI contributions. The guide also covers entering tax history and accessing various payroll forms and reports.

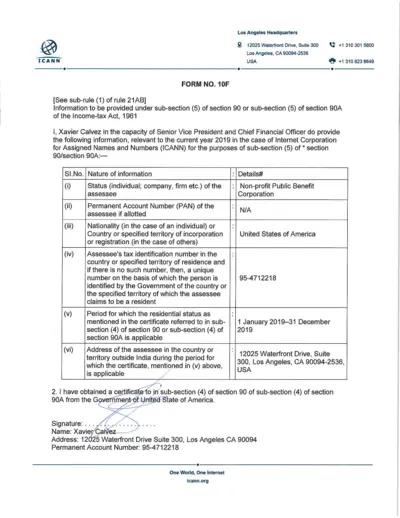

ICANN Income Tax Form 2019 for Tax Compliance

This file contains the information required under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961 for ICANN. It includes details about tax identification, residential status, and a verification declaration for the year 2019. The information is provided by Xavier Calvez, the Senior Vice President and Chief Financial Officer at ICANN.

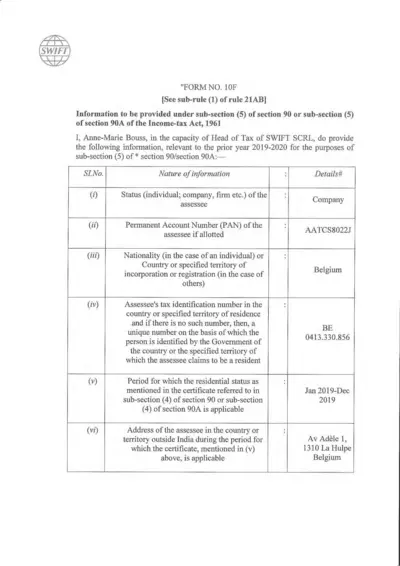

Form 10F: Information under Section 90/90A of Income-tax Act

Form 10F is used to provide information under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961. It is relevant for the prior year 2019-2020 for SWIFT SCRL in Belgium. This form includes details about the assessee's status, account numbers, residency period, and address.

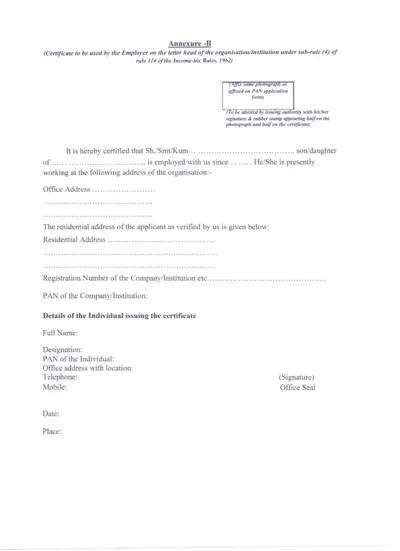

Employer Certificate for PAN Application - Income-tax Rules

This certificate is used by the employer to certify the employment status of an individual for PAN application under Income-tax Rules, 1962. It includes organization details, employee verification, and needs to be attested.

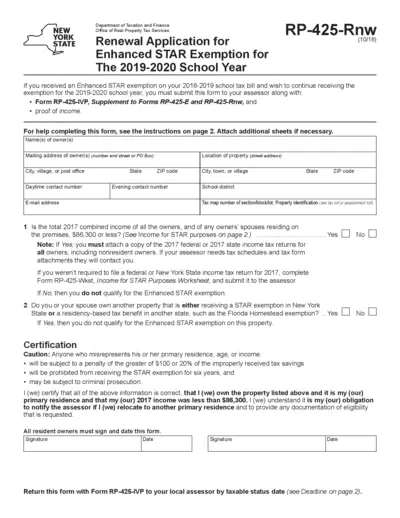

Renewal Application for Enhanced STAR Exemption 2019-2020

The form is used to reapply for the Enhanced STAR exemption on school taxes for the 2019-2020 school year. It requires income proof and the completion of Form RP-425-IVP. Submission is necessary to the local assessor by the taxable status date.

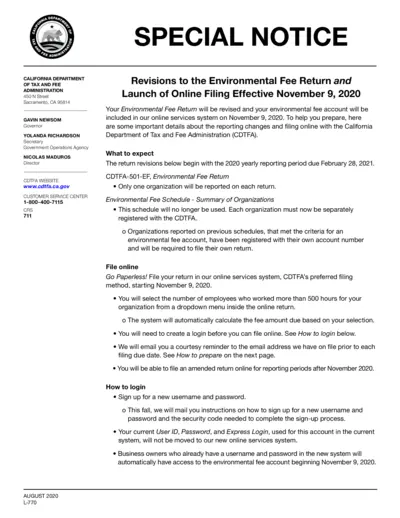

Revisions to Environmental Fee Return & Online Filing

This file details the revisions to the environmental fee return and the launch of online filing effective November 9, 2020. It includes important information on what to expect, how to login, and how to prepare for filing. The instructions provided are essential for organizations required to file the Environmental Fee Return.

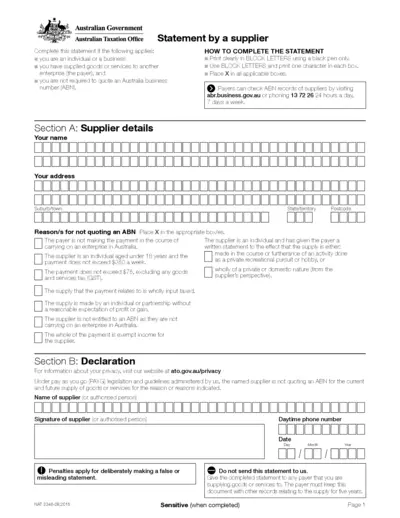

Statement by a Supplier - Australian Taxation Office Form

This form is used by individuals or businesses supplying goods or services without quoting an Australian Business Number (ABN). It helps in providing reasons for not quoting an ABN. The payer must keep this completed form for their records for five years.

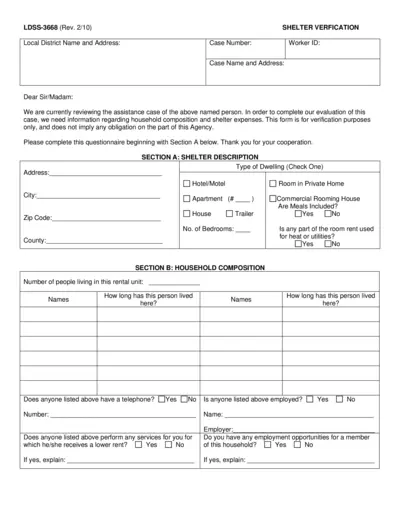

Shelter Verification Form for Assistance Evaluation

This form is used to verify household composition and shelter expenses for assistance evaluation purposes. It includes sections for shelter description, household composition, and shelter expenses. Complete the questionnaire for accurate verification.

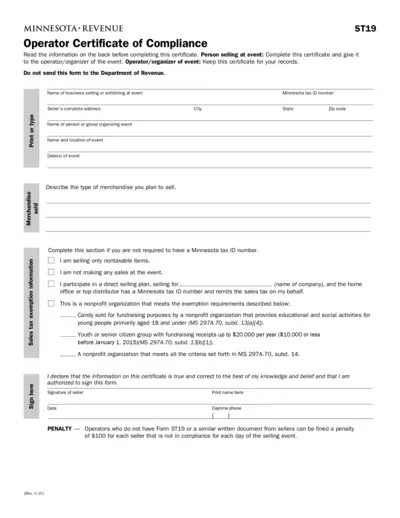

Minnesota ST19 Operator Certificate of Compliance

The Minnesota ST19 Operator Certificate of Compliance is required by law for sellers and event operators to certify compliance with sales tax regulations. The form must be completed by the seller and provided to the operator of the event. Penalties apply for non-compliance.