Hawaii Tax Advisory for Film Production Obligations

This file provides tax obligations for individuals in the motion picture, television, and film production industry in Hawaii. It outlines general excise tax obligations, forms required, and income tax details. This advisory is crucial for compliance with Hawaii tax laws.

Edit, Download, and Sign the Hawaii Tax Advisory for Film Production Obligations

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this advisory, obtain the necessary forms from the Department of Taxation. Complete each form according to the provided instructions. Finally, ensure all required documentation is submitted to the appropriate tax office.

How to fill out the Hawaii Tax Advisory for Film Production Obligations?

1

Obtain the relevant tax forms from the Department of Taxation.

2

Complete the forms as per the instructions provided.

3

Double-check all entries for accuracy.

4

Submit the completed forms to the Department of Taxation.

5

Keep a copy of submissions for your records.

Who needs the Hawaii Tax Advisory for Film Production Obligations?

1

Actors need this file to understand their tax obligations while working in Hawaii.

2

Directors require it to ensure compliance with Hawaii's tax laws during production.

3

Writers must review the advisory to grasp their financial responsibilities in the state.

4

Producers need this file to manage tax credits correctly.

5

Crew members should be aware of their tax obligations to avoid penalties.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Hawaii Tax Advisory for Film Production Obligations along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Hawaii Tax Advisory for Film Production Obligations online.

Editing this PDF on PrintFriendly is simple and efficient. You can make changes directly to the text using our intuitive PDF editor. Once you have finished editing, save your document for easy access.

Add your legally-binding signature.

Signing your PDF on PrintFriendly is a straightforward process. Just use the provided signature feature to add your signature digitally. After signing, you can save or share your signed document effortlessly.

Share your form instantly.

Sharing your PDF on PrintFriendly is quick and easy. You can generate a shareable link to distribute the document with others. This feature allows seamless collaboration and distribution of the advisory.

How do I edit the Hawaii Tax Advisory for Film Production Obligations online?

Editing this PDF on PrintFriendly is simple and efficient. You can make changes directly to the text using our intuitive PDF editor. Once you have finished editing, save your document for easy access.

1

Open the PDF using PrintFriendly's editor.

2

Select the text or images you wish to edit.

3

Make the necessary changes directly in the document.

4

Save your edited document to your device.

5

Share or download the PDF as needed.

What are the instructions for submitting this form?

To submit your forms, you can email them to tax.rules.office@hawaii.gov or fax them to (808) 587-1584. For online submissions, visit the Hawaii Tax Online platform at http://hitax.hawaii.gov. It is advisable to keep a copy of your submission for your records and follow up to confirm receipt.

What are the important dates for this form in 2024 and 2025?

Important dates for filing tax returns related to this advisory in 2024: January 20 (quarterly payment due), April 15 (annual income tax return for individuals), October 15 (extended filing deadline for annual income tax). In 2025, keep the same dates in mind as they generally remain consistent.

What is the purpose of this form?

This advisory aims to inform individuals involved in the motion picture and television production industry about their tax obligations in Hawaii. It specifies the requirements for general excise taxes and income taxes for both W-2 employees and independent contractors. Understanding these obligations is essential for ensuring compliance and avoiding potential penalties.

Tell me about this form and its components and fields line-by-line.

- 1. General Excise Tax Obligations: Details the gross receipts tax imposed on income earned in Hawaii.

- 2. W-2 Employee Obligations: Outlines income tax requirements for employees working in Hawaii.

- 3. 1099 Independent Contractors: Specifies tax obligations for independent contractors and loan-out companies.

- 4. Relevant Forms: Lists the forms needed for tax reporting and payment.

What happens if I fail to submit this form?

Failure to submit the required forms on time may result in penalties and interest on unpaid taxes. It is crucial to meet submission deadlines to avoid additional charges and complications with tax authorities.

- Penalties for Late Filing: A 5% monthly penalty on unpaid tax may apply, up to a maximum of 25%.

- Interest Accrual: Interest on unpaid amounts accrues at two-thirds of 1% per month.

- Potential Audits: Failure to comply may also trigger audits or further scrutiny by tax authorities.

How do I know when to use this form?

- 1. Tax Credit Claims: To claim motion picture tax credits available in Hawaii.

- 2. General Business Operations: For businesses conducting film-related activities in Hawaii.

- 3. Employment Tax Filings: For filing taxes on wages and compensation earned while working in the state.

Frequently Asked Questions

What is the purpose of this advisory?

This advisory outlines the tax obligations for individuals in the film production industry in Hawaii.

How can I edit this PDF?

You can edit the PDF directly using the PrintFriendly PDF editor by selecting text and making changes.

What forms do I need to submit?

You need to submit the relevant tax forms as specified in the advisory.

Is there a penalty for late submission?

Yes, there are penalties outlined in the advisory for failure to submit on time.

Can I sign the PDF electronically?

Yes, PrintFriendly allows you to add your digital signature to the PDF.

Where can I find the forms mentioned?

Forms can be found on the Department of Taxation website.

Do W-2 employees have tax obligations?

Yes, W-2 employees are subject to Hawaii income tax for wages earned in HI.

How often should I file GET?

GET must be filed periodically as outlined in the advisory.

What if I have more questions?

Contact a tax professional familiar with Hawaii tax laws for detailed assistance.

Can I download this PDF?

Yes, after editing it, you can download the edited PDF to your device.

Related Documents - Hawaii Film Tax Advisory

Entrepreneurial Musicianship: Tips for Writing Your Bio

This document provides musicians with practical tips and guidelines for writing an effective bio to enhance their marketing and reputation.

Disney Beauty and the Beast JR. Actor's Script

This file is the actor's script for Disney's Beauty and the Beast JR. It contains the complete script, glossary of terms, and additional information for actors. Perfect for school productions and professional shows.

The Incredibles Original Screenplay by Brad Bird

This file contains the original screenplay for 'The Incredibles' by Brad Bird. It includes dialogue, scene descriptions, and character details. Ideal for fans and students of animation and film.

BMI Agreement Terms with Publisher

This file is a comprehensive agreement between Broadcast Music Inc. (BMI) and a Publisher. It outlines terms, rights, and obligations related to musical compositions. The document specifies payment schedules and rights transfer.

50 Violent Rap Lyrics That Will Make You Cringe

This document showcases 50 violent rap lyrics that have been collected over the years, including quotes from famous rappers like Eminem, Future, and Cam'ron. The collection emphasizes the harsh realities often depicted in rap music and stops to highlight some of the most extreme examples. This document serves as both a commentary on violence in hip-hop and a collection of notable lyrics.

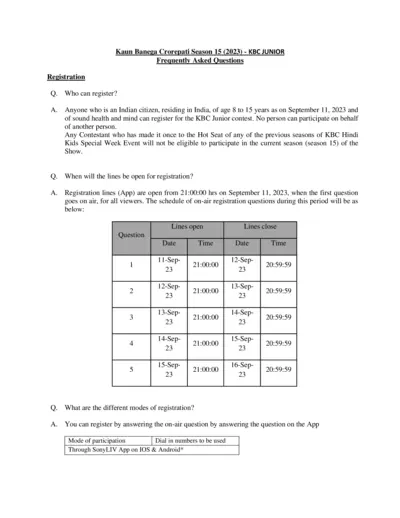

Kaun Banega Crorepati Junior Season 15 - Registration & Audition FAQs

This file contains Frequently Asked Questions (FAQs) related to the Kaun Banega Crorepati Junior, Season 15 registration and audition process, eligibility criteria, and steps to participate.

Santa Cruz DJ Song Request Form - Event Planning

The Santa Cruz DJ Song Request Form helps you list and submit specific music requests important to your event. It ensures your favorite tracks are played at your event. Complete and submit the form to get started.

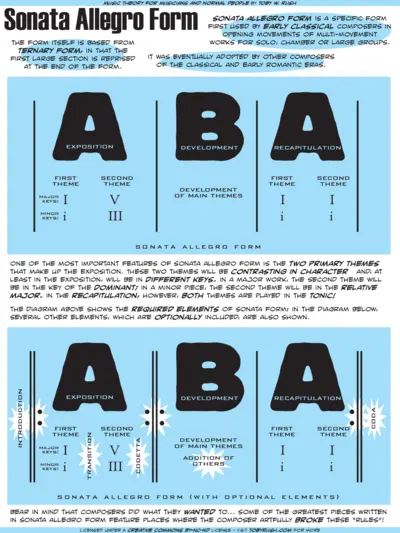

Music Theory for Musicians and Normal People by Toby W. Rush

This document provides an in-depth look at Sonata Allegro Form, its structure, and its applications in classical and early romantic music. It includes explanations of themes, keys, and various required and optional elements. Perfect for musicians and music enthusiasts looking to understand this classical form.

A View from the Bridge by Cherokee Paul McDonald

A View from the Bridge is a short story by Cherokee Paul McDonald originally published in 1990. It tells the tale of a boy and a narrator engaging in a fishing adventure. This narrative unfolds through dialogue and vivid descriptions.

CINTAS Fellowship Application Form 2022

The CINTAS Fellowship Application Form allows Cuban artists to apply for funding and support in their creative projects. This form includes personal details, artist statements, and project descriptions, which are required for the application process. Complete and submit by the deadline for consideration.

501 Writing Prompts for Creative Writing Practice

This file contains a variety of writing prompts designed to stimulate creativity and enhance writing skills. Suitable for writers of all levels, these prompts inspire new ideas and encourage the writing process. Use this resource to break through writer's block or to practice daily writing.

Lifetouch Portrait Order Instructions and Packages

This file contains comprehensive details about Lifetouch portrait packages, photo dates, and ordering instructions. Parents and students can find guidance on how to select packages and fill out the order form. It also includes information about satisfaction guarantees and pricing options.