Fannie Mae Collateral Underwriter FAQs June 2022

This document provides detailed FAQs about Fannie Mae's Collateral Underwriter, offering insights on appraisal risk assessment. It includes guidance on usage, training resources, and feedback mechanisms. Ideal for lenders and mortgage professionals seeking to enhance appraisal quality.

Edit, Download, and Sign the Fannie Mae Collateral Underwriter FAQs June 2022

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this document, carefully read each question and its corresponding answer for clear guidance. Make sure to highlight any specific feedback relevant to your usage case. Utilize the tools and resources provided to effectively manage appraisal quality.

How to fill out the Fannie Mae Collateral Underwriter FAQs June 2022?

1

Read the FAQs thoroughly.

2

Take note of key feedback provided.

3

Utilize the CU tools mentioned.

4

Refer to training resources for deeper understanding.

5

Engage with other professionals if needed.

Who needs the Fannie Mae Collateral Underwriter FAQs June 2022?

1

Lenders who need to enhance appraisal quality.

2

Appraisers seeking to understand risk factors.

3

Mortgage insurers assessing collateral risk.

4

Training coordinators responsible for CU training.

5

Compliance officers ensuring adherence to appraisal guidelines.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Fannie Mae Collateral Underwriter FAQs June 2022 along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Fannie Mae Collateral Underwriter FAQs June 2022 online.

With PrintFriendly, editing this PDF is seamless. You can highlight text, add notes, and modify content to suit your needs. The intuitive interface allows for quick adjustments directly within your web browser.

Add your legally-binding signature.

Signing this PDF on PrintFriendly is straightforward. Simply upload your document and use our signing tool to add your signature. You can easily position your signature wherever needed on the PDF.

Share your form instantly.

Sharing your PDF via PrintFriendly is easy and efficient. You can generate a shareable link or directly email the PDF to recipients. This allows for quick and convenient distribution of important documents.

How do I edit the Fannie Mae Collateral Underwriter FAQs June 2022 online?

With PrintFriendly, editing this PDF is seamless. You can highlight text, add notes, and modify content to suit your needs. The intuitive interface allows for quick adjustments directly within your web browser.

1

Open the PDF in PrintFriendly.

2

Click on the edit icon to enable editing mode.

3

Make necessary modifications to the document.

4

Once done, save your changes.

5

Download or share the edited PDF as needed.

What are the instructions for submitting this form?

Submit this form via email to your designated Fannie Mae contact or through the Uniform Collateral Data Portal (UCDP). For fax submission, send to the specified number listed in your submission guidelines. Ensure all information is accurate and complete to expedite processing.

What are the important dates for this form in 2024 and 2025?

Key dates for CU-related trainings and updates will be communicated via the CU webpage. Be vigilant for announcements in late 2024 and early 2025 regarding any regulatory changes. Regular updates will help keep you informed about submission and compliance requirements.

What is the purpose of this form?

The purpose of this form is to guide users towards improved appraisal quality through the effective use of Fannie Mae’s Collateral Underwriter. It serves as a foundational resource for understanding the tool's risk assessment capabilities and practical application in day-to-day operations. Additionally, it offers vital training resources to ensure proper usage by lenders and appraisers alike.

Tell me about this form and its components and fields line-by-line.

- 1. Risk Flags: Indicate potential issues like overvaluation or undervaluation.

- 2. Risk Score: Numerical value indicating appraisal risk.

- 3. Feedback Messages: Provide specific insights into appraisal quality.

What happens if I fail to submit this form?

Failing to submit this form on time may lead to appraisal processing delays and compliance issues.

- Compliance Risks: Non-compliance with Fannie Mae requirements may result in penalties.

- Approval Delays: Delayed appraisals could hinder the loan approval process.

- Increased Costs: Additional costs may arise if appraisals need to be redone.

How do I know when to use this form?

- 1. During Appraisal Submission: Ensure all CU feedback is reviewed before finalizing submission.

- 2. For Risk Analysis: Use when analyzing appraisal reports for potential issues.

- 3. For Compliance Reporting: Essential for documenting compliance with Fannie Mae standards.

Frequently Asked Questions

What is the main purpose of this document?

This document serves to guide users through the functionalities and benefits of Fannie Mae's Collateral Underwriter.

How can I access CU training resources?

Training resources are available on the CU webpage, including eLearning and webinars.

Is there a fee to use the CU application?

No, Fannie Mae offers CU at no cost to improve appraisal quality.

What should I do if I see a high CU risk score?

Review the flags and feedback, and consult with your appraisal team for further action.

Can I share my CU access with others?

No, sharing of credentials is prohibited for security reasons.

How does CU help in appraisal analyses?

CU provides real-time feedback, risk scores, and flags that facilitate better appraisal evaluations.

What kind of feedback does CU provide?

CU provides flags for overvaluation, undervaluation, and quality assessments.

Can I submit PDFs edited in PrintFriendly?

Yes, you can edit and then download your PDFs for submission.

Is CU mandatory for all lenders?

No, it's encouraged but not required for Fannie Mae sellers.

What happens if I fail to use CU insights?

You may miss important appraisal flags, which can affect loan quality.

Related Documents - CU FAQs June 2022

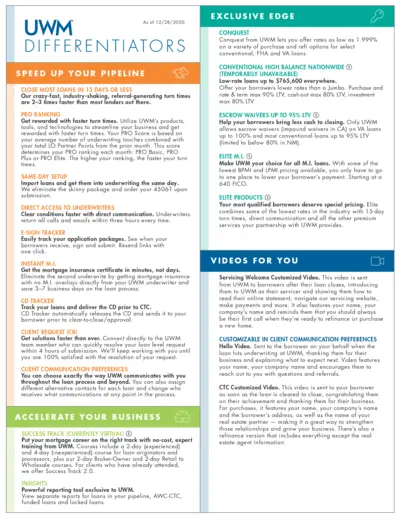

UWM File Details and Instructions

This file provides detailed information and instructions on the services and products offered by UWM. It highlights various features such as turn times, direct access to underwriters, E-sign tracker, and more. Users can find guidance on how to accelerate their business practices.

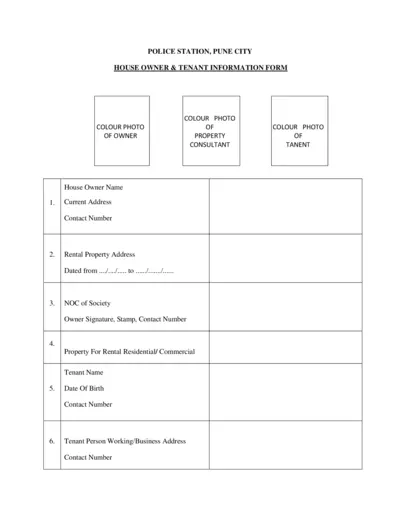

Police Station Pune City House Owner & Tenant Information Form

This form is for house owners in Pune City to provide necessary information about their tenants to the police station. It includes details about the owner, tenant, and rental property. It ensures proper verification and record-keeping.

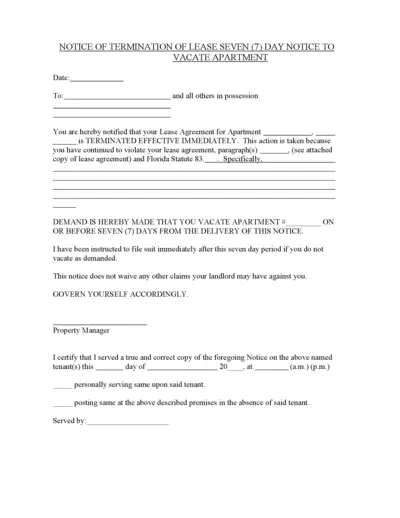

Notice of Termination of Lease - Seven Day Notice

This document serves as a Notice of Termination of Lease. It is used to notify tenants that their lease agreement is terminated immediately. The tenant is required to vacate the premises within seven days.

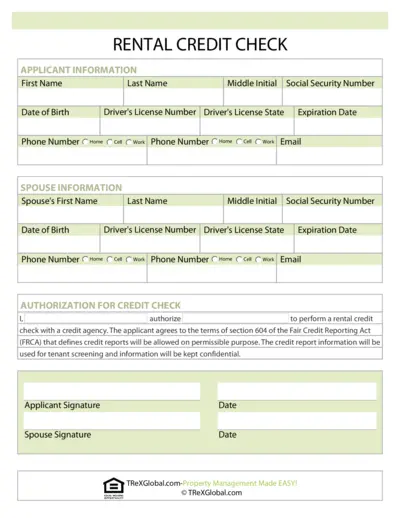

Rental Credit Check Authorization Form

This document is used to authorize a rental credit check for potential tenants. It requires personal information for both the applicant and their spouse. It ensures compliance with the Fair Credit Reporting Act (FCRA) for tenant screening purposes.

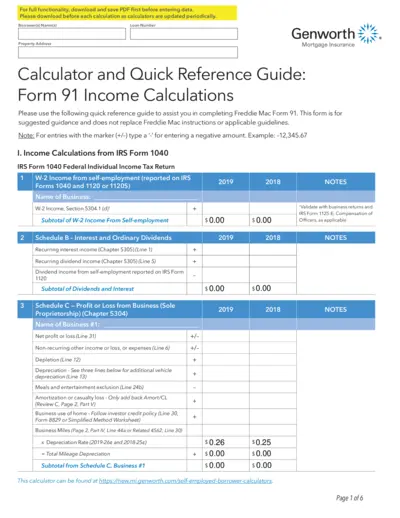

Freddie Mac Form 91 Mortgage Insurance Calculation Tool

This PDF is a guide for completing Freddie Mac Form 91. It includes instructions for calculating income from various sources. The guide also details how to use the Genworth Mortgage Insurance Calculator.

Health Informatics Practicum Thank You Letter Template

This file is a thank you letter template for a practicum experience in Health Informatics. It helps users express their gratitude for the opportunity and the learnings gained. The letter highlights the user's appreciation for the staff and the professional experience.

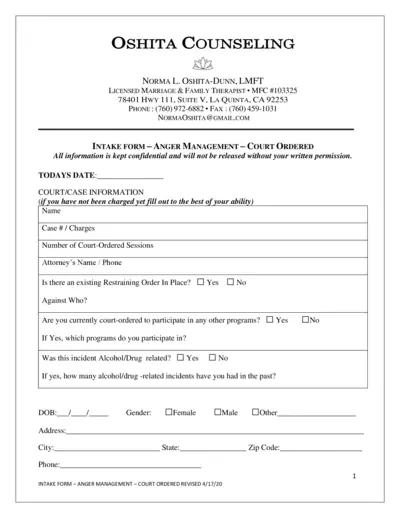

Court-Ordered Anger Management Intake Form

This intake form is designed for individuals required to complete anger management sessions by court order. It collects personal, legal, and psychological information to help therapists provide appropriate therapy. Confidentiality is ensured.

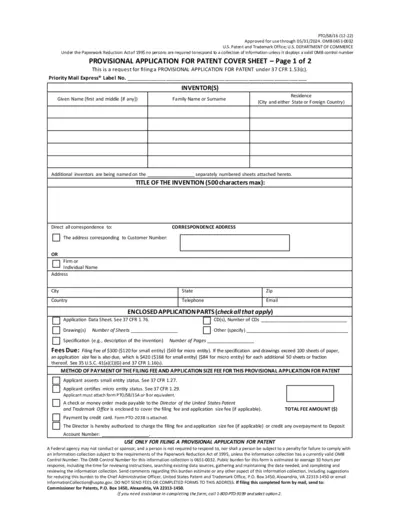

Provisional Patent Application Cover Sheet - Instructions

This file is a cover sheet for a provisional patent application under 37 CFR 1.53(c). It includes inventor details, invention title, correspondence address, fees due, and payment methods.

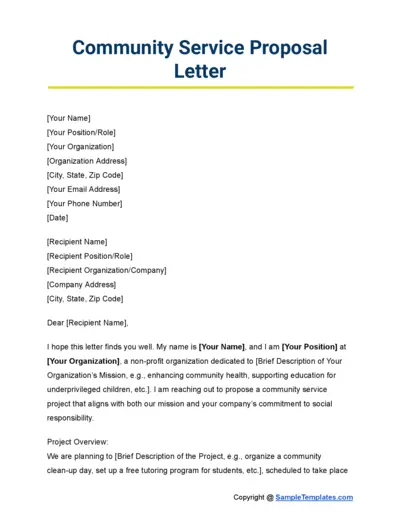

Community Service Proposal Template

This file is a community service proposal template. It helps organizations outline their proposed service project in a structured format. It includes sections for project overview, support needed, benefits of collaboration, and next steps.

Stockdale & Leggo Rental Application Form

This rental application form from Stockdale & Leggo is required for each adult residing in the property. The form includes fields for personal details, identification, and employment information. Successful applicants will be notified immediately and must pay the full bond and first month's rent within 24 hours.

New York Last Will and Testament Guide

This document is a New York Last Will and Testament in accordance with state law. It provides a legal framework for distributing your property after death. It includes instructions for appointing a personal representative and managing expenses and taxes.

TVS Tenant Verification Application to Rent Form

This file is an application to rent form used by TVS Tenant Verification Service Inc. It gathers applicant information, rental history, employment details, and personal references. The form is designed to assess tenant eligibility and creditworthiness.