EFTPS Express Enrollment for New Businesses

This file provides essential information and instructions about the EFTPS Express Enrollment for new businesses. It outlines how to activate your enrollment, schedule tax payments, and use EFTPS effectively. Perfect for any business looking to manage their federal tax payments electronically.

Edit, Download, and Sign the EFTPS Express Enrollment for New Businesses

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, gather your EIN and bank information ready. Follow the step-by-step instructions included in your EFTPS PIN package. Ensure to review all details before submitting to prevent any errors.

How to fill out the EFTPS Express Enrollment for New Businesses?

1

Gather your EIN and bank account information.

2

Follow the instructions provided in your EFTPS PIN package.

3

Verify all entered details for accuracy.

4

Submit the form once all information is confirmed.

5

Keep a copy of your confirmation for your records.

Who needs the EFTPS Express Enrollment for New Businesses?

1

New businesses that have recently received an EIN need this form to set up tax payments electronically.

2

Established businesses that want to streamline their tax payment process can benefit from using EFTPS.

3

Accountants and tax professionals assisting clients with federal tax matters require this form for efficient management.

4

Tax agencies that need a reliable method for their clients to fulfill tax obligations should utilize this form.

5

Anyone transitioning from paper coupon payments (FTD coupons) to electronic payments should complete this form to avoid penalties.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the EFTPS Express Enrollment for New Businesses along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your EFTPS Express Enrollment for New Businesses online.

Editing this PDF on PrintFriendly is simple and intuitive. First, upload the document you wish to modify, and then utilize our editing tools to make necessary adjustments. Once edited, you can download the updated file for your records.

Add your legally-binding signature.

Signing the PDF on PrintFriendly is fast and user-friendly. Just upload your document and select the signing option to add your signature effortlessly. After signing, you can download the finalized document immediately.

Share your form instantly.

Sharing your PDF on PrintFriendly is incredibly convenient. Once your document is ready, simply select the share option to send it directly to your contacts. You can also generate a shareable link for easy access.

How do I edit the EFTPS Express Enrollment for New Businesses online?

Editing this PDF on PrintFriendly is simple and intuitive. First, upload the document you wish to modify, and then utilize our editing tools to make necessary adjustments. Once edited, you can download the updated file for your records.

1

Upload the PDF document you want to edit.

2

Use the editing tools to make necessary changes.

3

Review your edits for accuracy and completeness.

4

Save your changes once you are satisfied.

5

Download the edited PDF to your device.

What are the instructions for submitting this form?

To submit this form, ensure all fields are completed accurately, including your EIN and bank details. Once filled, follow the submission instructions as outlined in your EFTPS PIN package. If submitting online, ensure to have your confirmation number handy for quick processing and verification.

What are the important dates for this form in 2024 and 2025?

For the EFTPS form, important dates include the deadlines for tax payments which generally follow the IRS calendar. Always check the IRS website for specific due dates for federal taxes. Ensure timely activation and use of EFTPS to avoid any potential penalties.

What is the purpose of this form?

The purpose of the EFTPS Express Enrollment form is to streamline and facilitate electronic payment of federal taxes for new businesses. By enrolling, businesses can manage their tax obligations conveniently online or via phone. This process is essential for maintaining compliance with federal tax requirements while avoiding delays in payments.

Tell me about this form and its components and fields line-by-line.

- 1. EIN: Employer Identification Number required for identification.

- 2. Bank Information: Details of the bank account from which payments will be made.

- 3. Contact Information: Information like phone number for verification and communication.

- 4. Internet Password: Password needed to access online EFTPS services.

- 5. Confirmation Number: Number received upon successful enrollment.

What happens if I fail to submit this form?

Failing to submit this form may delay your ability to make federal tax payments electronically. This can lead to missed payments and potential penalties from the IRS. It is crucial to complete the enrollment promptly to avoid such issues.

- Missed Deadlines: Late payments can result in penalties and interest charges.

- Inconvenience: Relying on paper coupons can make tracking payments difficult.

- Compliance Issues: Not using EFTPS may lead to complications with IRS compliance.

How do I know when to use this form?

- 1. New Business Setup: For businesses newly formed that require an official mechanism for tax payments.

- 2. Transitioning from FTD Coupons: When businesses want to shift from paper to electronic payments.

- 3. Tax Compliance: For maintaining compliance with federal tax responsibilities.

Frequently Asked Questions

How do I activate my EFTPS Enrollment?

To activate your EFTPS enrollment, follow the instructions included in your EFTPS PIN package and call the designated number for activation.

What should I do if I don't receive my EFTPS PIN?

If you haven't received your EFTPS PIN after a week, contact EFTPS Customer Service for assistance.

How can I schedule my tax payments?

You can schedule tax payments through EFTPS online or by phone at least one calendar day before the tax due date.

Can I still use FTD coupons?

Yes, you can still order FTD coupons, but activating your EFTPS enrollment is recommended for streamlined payments.

Is there a fee to use EFTPS?

No, EFTPS is a free service provided by the U.S. Department of the Treasury for electronic tax payments.

What if my bank account information is incorrect?

If the bank information is incorrect, the payment may bounce back and incur penalties; ensure accuracy when entering details.

How quickly can I start using EFTPS after activation?

You can start using EFTPS immediately after activation if you choose not to verify your bank account information.

How do I check the status of my payments?

You can verify your payment status online or by calling EFTPS Customer Service for assistance.

Can I view my payment history with EFTPS?

Yes, you can view up to 16 months of your payment history through EFTPS.

What if I have further questions about EFTPS?

For additional questions, you can call the EFTPS Customer Service for support.

Related Documents - EFTPS Enrollment Guide

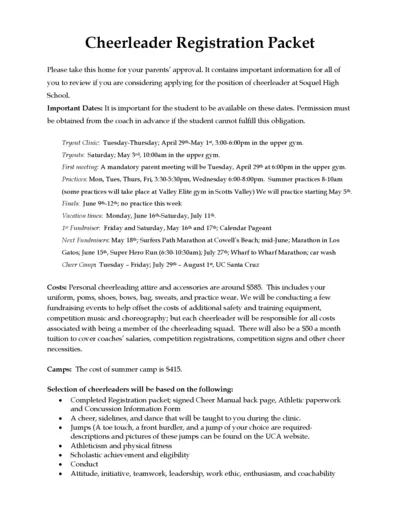

Soquel High School Cheerleader Registration Packet 2024-2025

This file contains important information for students considering applying for the cheerleader position at Soquel High School. It includes dates, costs, and instructions for tryouts and participation. Make sure to review and get parental approval before proceeding.

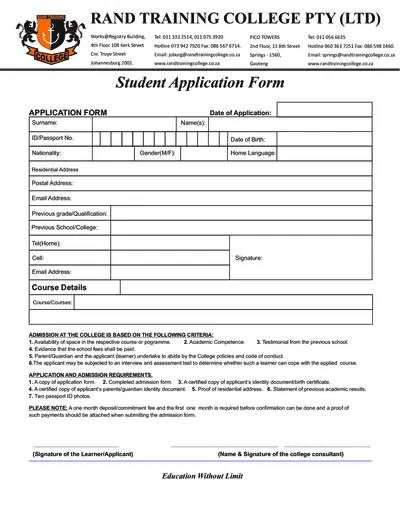

Student Application Form for Rand Training College

This file is a student application form for Rand Training College, including admission requirements and course details. It requires personal information, previous academic records, and other supporting documents. Complete the form to apply for courses offered by the college.

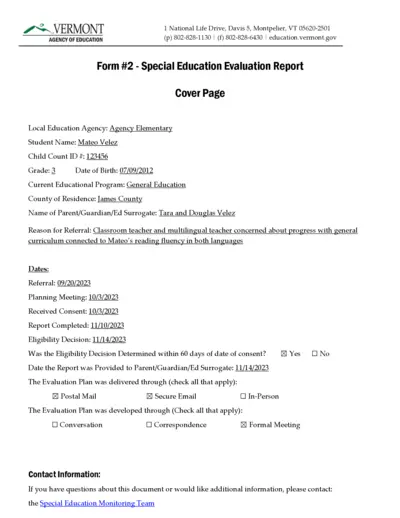

Special Education Evaluation Report - Vermont Agency

This file contains the Special Education Evaluation Report for a student named Mateo Velez. It includes details about the evaluation plan, team members involved, and assessment procedures used. The document is designed to determine the student's eligibility for special education services.

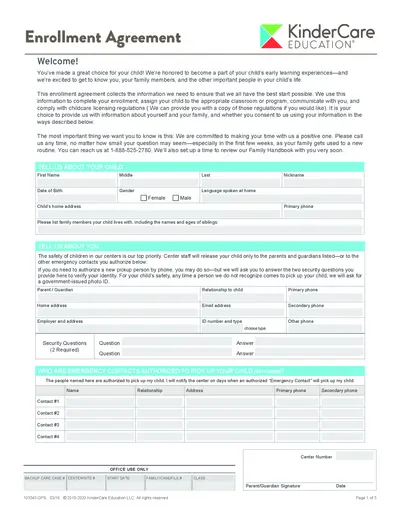

KinderCare Education Enrollment Agreement Form

This file is the enrollment agreement for KinderCare Education. It collects crucial information for your child's enrollment, classroom/program assignment, and compliance with childcare licensing regulations. Make sure to fill it out accurately to ensure a smooth enrollment process.

Bonafide Student Certificate & Scholarship Consent Forms

This file contains the Bonafide Student Certificate template, consent form for the use of Aadhaar/EID numbers in a state scholarship application, and an institution verification form for scholarship applications. It is intended for students applying for state scholarships and institutions verifying student information.

Undergraduate Bursary and Loan Opportunities for 2024 at University of Cape Town

This file provides information about the bursary and loan opportunities available for undergraduate students at the University of Cape Town for the academic year 2024. It includes details about financial aid, scholarships, and bursaries offered by the university and external organizations. Students can find instructions on how to apply and important contact information in this comprehensive guide.

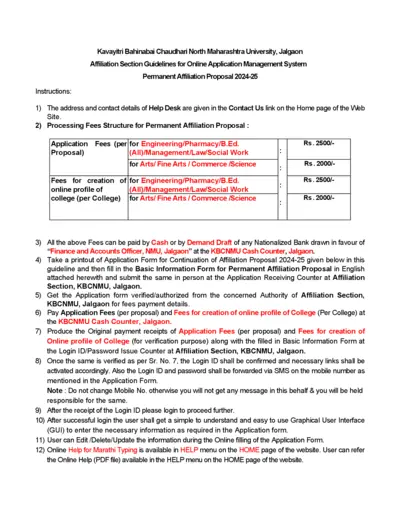

KBCNMU Permanent Affiliation Proposal 2024-25 Guidelines

This file provides detailed guidelines for filling out the Permanent Affiliation Proposal for 2024-25 for Kavayitri Bahinabai Chaudhari North Maharashtra University. It includes instructions for processing fees, submission process, and necessary documents. The document is essential for institutions seeking permanent affiliation with the university.

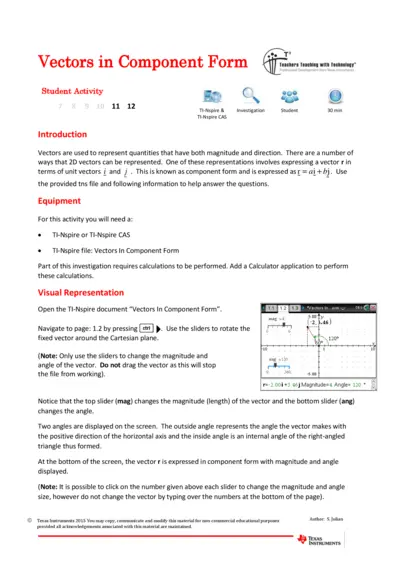

Vectors in Component Form - TI-Nspire Student Activity

This file is a student activity guide for learning about vectors in component form using the TI-Nspire or TI-Nspire CAS. It includes a series of questions and visualizations to help students understand vectors. Perfect for teachers and students seeking interactive vector mathematics activities.

The Interlopers Quiz and Answers

This file contains a quiz based on the story 'The Interlopers,' including multiple-choice questions and answers. It is designed to test comprehension and recall of the story's details and themes. Teachers and students can use this quiz for educational purposes.

Applying to Campion College Sixth Form: Guidelines and Requirements

This document provides detailed information about applying to Campion College Sixth Form, including aims of sixth form studies, subject selections, and admission requirements. It is intended for both students and their parents/guardians. Additionally, it outlines the ethos and vision of Campion College.

The Reject Shop Limited Annual Report 2020-2021

This file contains the consolidated preliminary final report for The Reject Shop Limited for the financial year ending on June 27, 2021. It includes sales revenue from continuing operations, net profit, and dividend information. Additional details and commentary on trading results are available in the FY21 result announcement and presentation.

KCSE Biology Essay Questions with Marking Schemes

This file contains a collection of biology essay questions along with marking schemes for KCSE. It is designed to help students understand how to structure their essays and what key points to include. It's an essential tool for exam preparation.