Certification for Exemption from Withholding Tax

Form N-289 is used to certify that withholding tax is not required upon the disposition of Hawaii real property. This form must be completed by the transferor/seller and provided to the transferee/buyer. The certification allows for tax exemption under specific conditions outlined in Hawaii Revised Statutes.

Edit, Download, and Sign the Certification for Exemption from Withholding Tax

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out Form N-289, begin by entering the transferor/seller's basic information at the top of the form. Next, check the appropriate box indicating the reason for tax exemption. Finally, complete the required sections A and B with specific details related to the property transfer.

How to fill out the Certification for Exemption from Withholding Tax?

1

Enter the transferor/seller's name, identification number, and address.

2

Check the box that applies to the reason for non-withholding.

3

Complete sections A and B describing the transfer.

4

Sign the declaration to confirm accuracy.

5

Submit the form to the transferee/buyer for their records.

Who needs the Certification for Exemption from Withholding Tax?

1

Homeowners selling property in Hawaii to confirm tax exemption.

2

Real estate professionals assisting clients in property transactions.

3

Accountants and tax advisors managing clients’ tax documentation.

4

Trustees managing real estate assets on behalf of beneficiaries.

5

Corporate entities disposing of real property in compliance with tax laws.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Certification for Exemption from Withholding Tax along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Certification for Exemption from Withholding Tax online.

PrintFriendly allows you to edit Form N-289 effortlessly. You can click on any text field to modify entries and make necessary adjustments. This user-friendly editing capability ensures that your form is accurate before finalizing.

Add your legally-binding signature.

Signing Form N-289 on PrintFriendly is made simple. Users can either type their signature or insert a scanned signature image directly into the PDF. This feature provides flexibility and convenience when completing your form.

Share your form instantly.

You can easily share your completed Form N-289 using PrintFriendly's sharing options. Simply click the share button to send the PDF via email or through social media. This makes it easy to distribute your certification to relevant parties.

How do I edit the Certification for Exemption from Withholding Tax online?

PrintFriendly allows you to edit Form N-289 effortlessly. You can click on any text field to modify entries and make necessary adjustments. This user-friendly editing capability ensures that your form is accurate before finalizing.

1

Open the PDF document on PrintFriendly.

2

Select the text you wish to edit and make your changes.

3

Add or remove any necessary information as per your requirements.

4

Review the document for accuracy and completeness.

5

Download the edited PDF to your device.

What are the instructions for submitting this form?

Form N-289 must be provided to the transferee/buyer and is not to be submitted directly to the Department of Taxation. Retain copies of the completed form for your records, ensuring both parties have a clear understanding of tax obligations. For any inquiries about the form, you can reach the Hawaii Department of Taxation via their customer service number 808-587-4242.

What are the important dates for this form in 2024 and 2025?

Important dates for Form N-289 submission include key tax filing deadlines specific to Hawaii's tax regulations. Ensure that you are aware of the quarterly dates for property transactions and apply for exemptions in a timely manner. 2024 deadlines will follow the same timeline as in previous years; stay updated with the Department of Taxation.

What is the purpose of this form?

Form N-289 serves to certify that withholding of tax is not necessary when selling or transferring real property in Hawaii. This certification helps streamline the process for sellers who qualify as residents or meet specific tax exemption criteria outlined in the Hawaii Revised Statutes. Using this form ensures compliance while providing tax relief for qualifying property transactions.

Tell me about this form and its components and fields line-by-line.

- 1. Transferor/Seller's Identification Number: Last 4 digits of the SSN or FEIN.

- 2. Transferor/Seller's Address: Home or office address depending on the type of seller.

- 3. Exemption Reason: Checkboxes to select the reason for tax exemption.

- 4. Description of the Transfer: A brief description of the property transfer.

- 5. Legal Summary: Summary supporting why no gain or loss recognition is required.

What happens if I fail to submit this form?

Failing to submit Form N-289 may lead to unintended tax withholding during the property transfer. It is crucial for sellers to provide this form to ensure that proper tax exemptions are recognized under Hawaii law. Without this certification, the buyer may be required to withhold a percentage of the sales price for tax purposes.

- Additional Tax Liability: You could face unexpected tax obligations.

- Delayed Transactions: Failure to submit may delay the property transfer.

- Compliance Issues: Inaccuracies may lead to complications with tax authorities.

How do I know when to use this form?

- 1. Principal Residence Sale: Used when the property sold has been a principal residence.

- 2. Non-resident Seller: Applicable when a non-resident seller disposes of property.

- 3. Applying for Tax Relief: Submitting for tax relief under existing tax provisions.

Frequently Asked Questions

What is Form N-289?

Form N-289 is a certification for exemption from the withholding of tax on the disposition of Hawaii real property.

Who should fill out Form N-289?

The transferor/seller of the Hawaii real property needs to complete this form.

Where do I submit Form N-289?

You must provide Form N-289 to the transferee/buyer and not submit it to the Department of Taxation.

What happens if I do not fill out Form N-289?

Failure to submit this form could lead to unexpected tax withholding during the property transfer.

Can I edit Form N-289 on PrintFriendly?

Yes, you can easily edit Form N-289 on PrintFriendly before saving it.

Is Form N-289 necessary for all property sales?

Form N-289 is only necessary if the transferor is a non-resident person and conditions for exemption are met.

How do I download Form N-289 after editing?

After making your edits, simply click the download button to save the completed form.

Can I sign Form N-289 electronically?

Yes, you can sign the form electronically by typing or inserting your signature.

What should I do if I need help filling out the form?

You can refer to the instructions included in the form or contact a tax professional.

What is the purpose of Form N-289?

The purpose is to inform the transferee/buyer that tax withholding is not required under specific conditions.

Related Documents - Form N-289

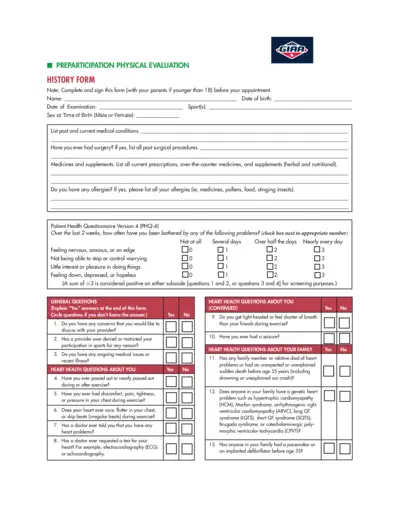

Preparticipation Physical Evaluation Form

The Preparticipation Physical Evaluation Form is used to assess the physical health and fitness of individuals before they participate in sports activities. It covers medical history, heart health, bone and joint health, and other relevant medical questions.

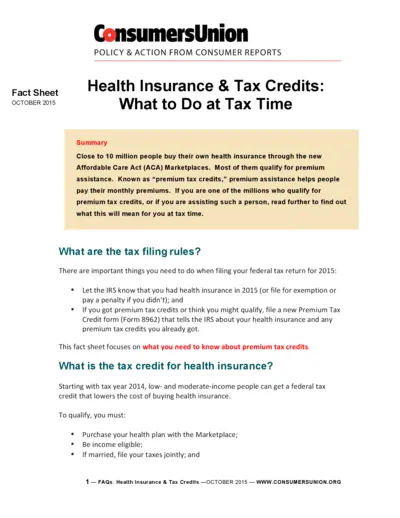

Health Insurance Tax Credits Guide 2015

This document provides a comprehensive guide on health insurance and premium tax credits for the 2015 tax year. It explains the tax filing rules, eligibility criteria, and detailed instructions for claiming and reporting premium tax credits. Essential for individuals who bought health insurance through the ACA Marketplaces.

TSP-77 Partial Withdrawal Request for Separated Employees

The TSP-77 form is used by separated employees to request a partial withdrawal from their Thrift Savings Plan account. It includes instructions for completing the form, certification, and notarization requirements. The form must be filled out completely and submitted along with necessary supporting documents.

Ray's Food Place Donation Request Form Details

This file contains the donation request form for Ray's Food Place. Complete the general information section and follow the guidelines to submit your donation request at least 30 days in advance. The form includes fields for organization details and donation specifics.

Health Provider Screening Form for PEEHIP Healthcare

This file contains the Health Provider Screening Form for PEEHIP public education employees and spouses. It includes instructions on how to fill out the form for wellness program participation. The form collects personal, medical, and screening details to assess wellness.

Common Law Marriage Declaration Form for FEHB Program

This form is used to declare a common law marriage for the purpose of enrolling a spouse under the Federal Employees Health Benefits (FEHB) Program. It requires personal details, marriage information, and additional documentation. Submission instructions and legal implications are included.

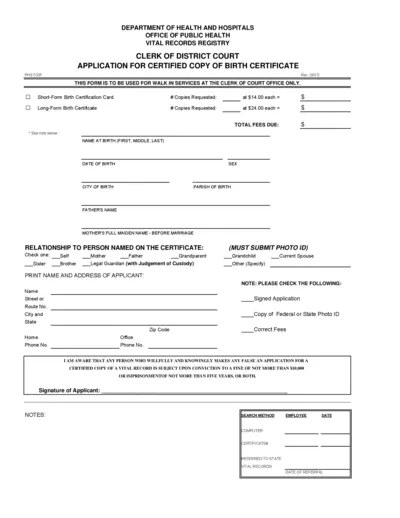

Application for Certified Copy of Birth Certificate

This form is used to request a certified copy of a birth certificate from the Clerk of Court Office. It includes details about the applicant, the person named on the certificate, and requires a photo ID and the correct fee. This form is only for walk-in services.

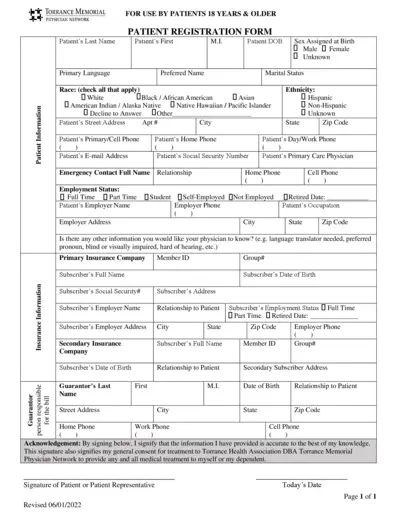

Torrance Memorial Physician Network Forms for Patients 18+

This file contains important forms for patients 18 years and older registered with Torrance Memorial Physician Network. It includes patient registration, acknowledgment of receipt of privacy practices, and financial & assignment of benefits policy forms. Complete these forms to ensure your medical records are up-to-date and to understand your financial responsibilities.

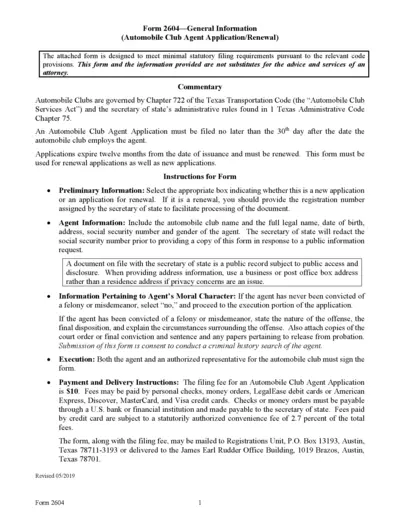

Texas Automobile Club Agent Application Form

This file is the Texas Automobile Club Agent Application or Renewal form, which must be submitted within 30 days after hiring an agent. The form includes fields for agent identification, moral character information, and requires signature from both the agent and an authorized representative of the automobile club. Filing fees and submission instructions are also provided.

Sterile Dressings for Wound Care

This file provides detailed information about Xeroform and oil emulsion dressings used for various types of wounds. It includes product descriptions, indications for use, and information on sizes and quantities. Essential for medical professionals dealing with wound care.

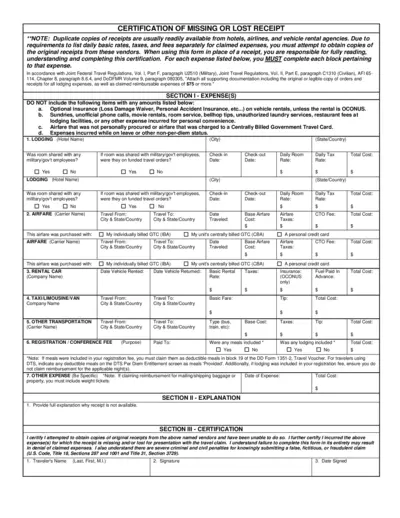

CERTIFICATION OF MISSING OR LOST RECEIPT Form

This file is a Certification of Missing or Lost Receipt form that must be completed when the original receipts for expenses are not available. It outlines the necessary expenses which can be claimed, and describes the process for certifying those expenses. Complete this form to ensure compliance with travel regulations.

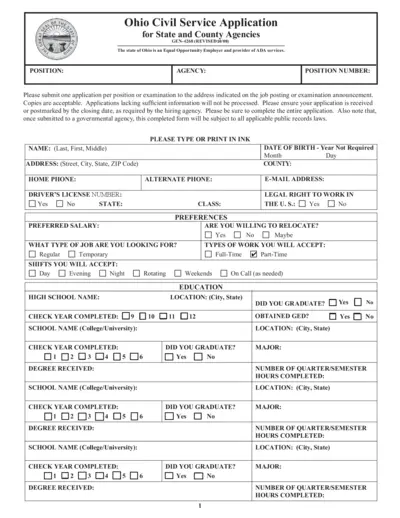

Ohio Civil Service Application Form for State Agencies

This is the Ohio Civil Service Application form for state and county agencies. It contains sections for personal information, education, employment history, and certifications. Ensure all information is filled out accurately to be considered for state employment.