California Withholding Certificate for Pensions

This file serves as a withholding certificate for California residents receiving pension or annuity payments. It provides options for how state income tax is withheld. Utilizing this form helps ensure correct withholding based on allowances and additional amounts.

Edit, Download, and Sign the California Withholding Certificate for Pensions

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, start by entering your personal details including your name and social security number. Next, select your withholding preferences based on the instructions provided. Finally, review the completed form for accuracy before submission.

How to fill out the California Withholding Certificate for Pensions?

1

Enter your full name and home address.

2

Fill in your social security number and pension identification number.

3

Choose your withholding preference by completing the relevant lines.

4

Signature and date must be provided at the end of the form.

5

Submit the top part of the form to your pension payer or keep for your records.

Who needs the California Withholding Certificate for Pensions?

1

California residents collecting pension payments.

2

Individuals needing to adjust their state tax withholding.

3

Retirees wanting to avoid excess withholding for taxes.

4

Those with multiple pensions seeking to specify withholding.

5

Financial advisors managing tax strategies for clients.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the California Withholding Certificate for Pensions along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your California Withholding Certificate for Pensions online.

Editing this PDF on PrintFriendly is effortless and user-friendly. Simply upload the document, and utilize our tools to alter text and fields as needed. Save your changes by downloading the revised PDF directly to your device.

Add your legally-binding signature.

Signing your PDF on PrintFriendly is a simple process. Use our intuitive signature tool to add your electronic signature to the document easily. Once signed, you can download the completed PDF for your records.

Share your form instantly.

Sharing your PDF on PrintFriendly is quick and efficient. After you edit your document, use our sharing options to send it directly to recipients via email or social media. Enhance collaboration by sharing your documents in real-time.

How do I edit the California Withholding Certificate for Pensions online?

Editing this PDF on PrintFriendly is effortless and user-friendly. Simply upload the document, and utilize our tools to alter text and fields as needed. Save your changes by downloading the revised PDF directly to your device.

1

Upload the PDF document to PrintFriendly.

2

Select the text or fields you wish to edit.

3

Make changes as necessary using the editing tools.

4

Preview your document to ensure everything is correct.

5

Download the edited PDF to your device.

What are the instructions for submitting this form?

To submit this form, provide the completed top part to your pension payer either through mail or in person. For electronic submissions, check if your pension provider allows online form submissions. Retain the lower part of the form for your records, noting that changes can be made at any time by resubmitting this certificate.

What are the important dates for this form in 2024 and 2025?

For 2024 and 2025, ensure you submit your withholding certificate before the start of the tax year to align your tax withholding preferences with your pension payments.

What is the purpose of this form?

The purpose of this form is to allow California residents to elect how their state income tax is withheld from their pension or annuity payments. It enables individuals to claim allowances or choose not to have taxes withheld based on their unique financial situations. By using this certificate, taxpayers can better manage their withholding to fit their financial needs, ensuring accuracy in their tax payments.

Tell me about this form and its components and fields line-by-line.

- 1. First Name: Your first name as it appears on legal documents.

- 2. Middle Name: Your middle name if applicable.

- 3. Last Name: Your last name as it appears on legal documents.

- 4. Social Security Number: Your unique social security identifier.

- 5. Home Address: Your residential address for correspondence.

- 6. Claim Number: Identification number related to your pension or annuity.

What happens if I fail to submit this form?

Failure to submit this form may result in higher withholding amounts from your pension or annuity payments. This could lead to receiving less income than anticipated, affecting financial plans.

- Increased Withholding: Without proper completion, your pension payments may have excessive state tax withheld.

- Financial Strain: Inaccurate withholding can lead to financial difficulties if not corrected.

- Tax Penalties: Missing the submission may lead to penalties for underpayment of taxes.

How do I know when to use this form?

- 1. New Pension Initiation: Submit this form when you start receiving pension payments.

- 2. Tax Adjustment: File to adjust your state tax withholding based on your financial situation.

- 3. Exemption Revocation: Use this form to revoke any previous exemptions from withholding.

Frequently Asked Questions

How can I edit the California withholding certificate?

You can edit the certificate by uploading it to PrintFriendly and using our editing tools to modify the text and fields.

Can I sign this PDF electronically?

Yes, PrintFriendly allows you to add your electronic signature to the PDF easily.

How do I download the edited document?

After making your edits, simply click the download button to save your updated PDF.

Is there a way to share my edited PDF?

Absolutely! Use the sharing options on PrintFriendly to send your edited document via email or social media.

What should I do if I make a mistake while editing?

You can easily undo changes or re-edit any part of the PDF before downloading it.

What formats can I edit the PDF in?

You can edit the PDF in our online editor without worrying about format issues.

Can I save my progress while editing?

You can edit and download your document, but currently, there’s no option to save your progress on our site.

How do I use this form for multiple pensions?

Fill out the sections related to each pension and specify your preferences accordingly.

Is there a help section for filling out the form?

Yes, PrintFriendly provides detailed instructions to facilitate the filling out of PDF forms.

What if I need to revoke my exemption from withholding?

You can complete the form to revoke your exemption and submit it to your pension payer.

Related Documents - CA Pension Withholding Certificate

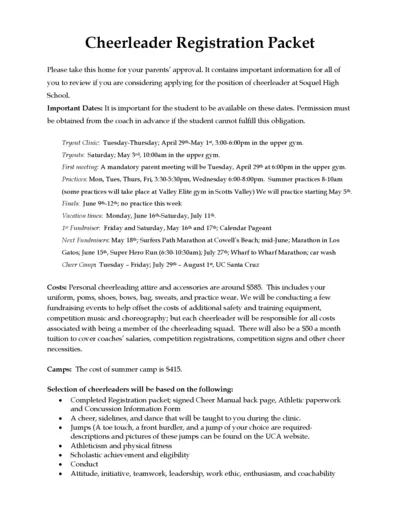

Soquel High School Cheerleader Registration Packet 2024-2025

This file contains important information for students considering applying for the cheerleader position at Soquel High School. It includes dates, costs, and instructions for tryouts and participation. Make sure to review and get parental approval before proceeding.

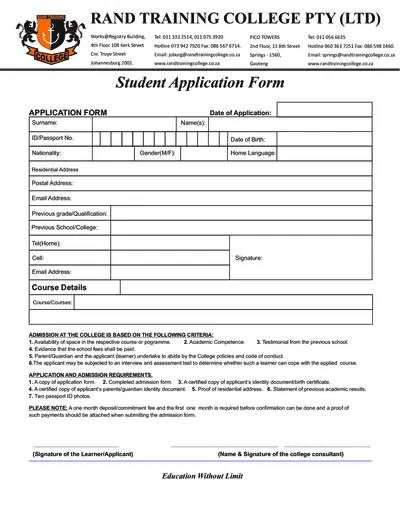

Student Application Form for Rand Training College

This file is a student application form for Rand Training College, including admission requirements and course details. It requires personal information, previous academic records, and other supporting documents. Complete the form to apply for courses offered by the college.

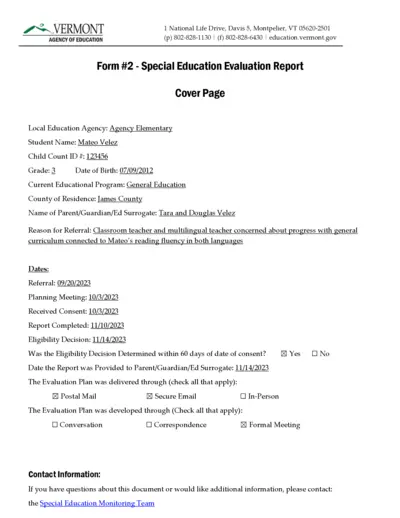

Special Education Evaluation Report - Vermont Agency

This file contains the Special Education Evaluation Report for a student named Mateo Velez. It includes details about the evaluation plan, team members involved, and assessment procedures used. The document is designed to determine the student's eligibility for special education services.

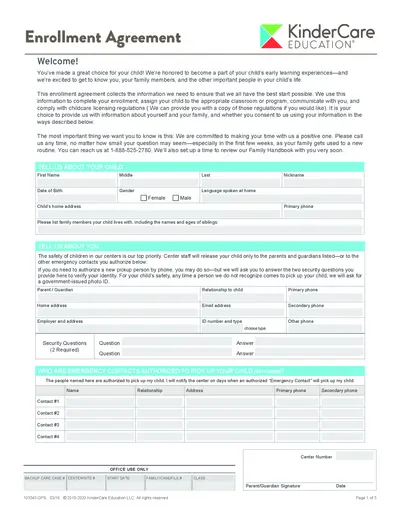

KinderCare Education Enrollment Agreement Form

This file is the enrollment agreement for KinderCare Education. It collects crucial information for your child's enrollment, classroom/program assignment, and compliance with childcare licensing regulations. Make sure to fill it out accurately to ensure a smooth enrollment process.

Bonafide Student Certificate & Scholarship Consent Forms

This file contains the Bonafide Student Certificate template, consent form for the use of Aadhaar/EID numbers in a state scholarship application, and an institution verification form for scholarship applications. It is intended for students applying for state scholarships and institutions verifying student information.

Undergraduate Bursary and Loan Opportunities for 2024 at University of Cape Town

This file provides information about the bursary and loan opportunities available for undergraduate students at the University of Cape Town for the academic year 2024. It includes details about financial aid, scholarships, and bursaries offered by the university and external organizations. Students can find instructions on how to apply and important contact information in this comprehensive guide.

KBCNMU Permanent Affiliation Proposal 2024-25 Guidelines

This file provides detailed guidelines for filling out the Permanent Affiliation Proposal for 2024-25 for Kavayitri Bahinabai Chaudhari North Maharashtra University. It includes instructions for processing fees, submission process, and necessary documents. The document is essential for institutions seeking permanent affiliation with the university.

Vectors in Component Form - TI-Nspire Student Activity

This file is a student activity guide for learning about vectors in component form using the TI-Nspire or TI-Nspire CAS. It includes a series of questions and visualizations to help students understand vectors. Perfect for teachers and students seeking interactive vector mathematics activities.

The Interlopers Quiz and Answers

This file contains a quiz based on the story 'The Interlopers,' including multiple-choice questions and answers. It is designed to test comprehension and recall of the story's details and themes. Teachers and students can use this quiz for educational purposes.

Applying to Campion College Sixth Form: Guidelines and Requirements

This document provides detailed information about applying to Campion College Sixth Form, including aims of sixth form studies, subject selections, and admission requirements. It is intended for both students and their parents/guardians. Additionally, it outlines the ethos and vision of Campion College.

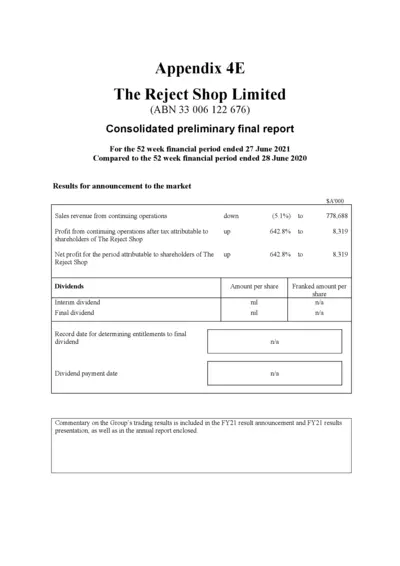

The Reject Shop Limited Annual Report 2020-2021

This file contains the consolidated preliminary final report for The Reject Shop Limited for the financial year ending on June 27, 2021. It includes sales revenue from continuing operations, net profit, and dividend information. Additional details and commentary on trading results are available in the FY21 result announcement and presentation.

KCSE Biology Essay Questions with Marking Schemes

This file contains a collection of biology essay questions along with marking schemes for KCSE. It is designed to help students understand how to structure their essays and what key points to include. It's an essential tool for exam preparation.