Legal Documents

Business Formation

Choice Home Warranty Vendor Application Instructions

This file contains the application and guidelines for becoming a vendor with Choice Home Warranty. It provides essential instructions and contact information for the application process. Vendors can expand their business by partnering with CHW.

Real Estate

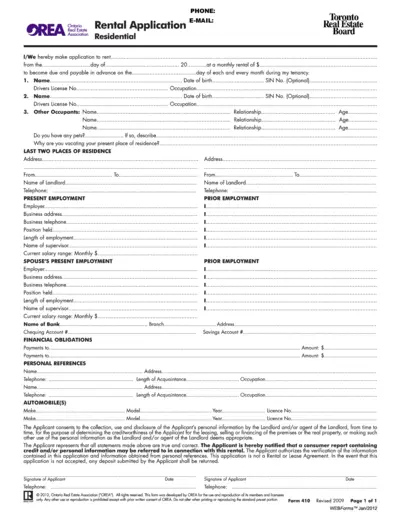

Residential Rental Application Form for Ontario

This Residential Rental Application is essential for tenants looking to rent a property in Ontario. It collects necessary personal and financial information to assess creditworthiness. Ensure to fill it out completely for a smooth application process.

Property Taxes

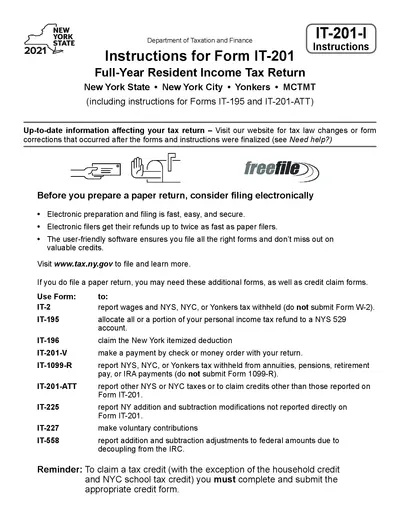

New York State IT-201 Instructions for 2021

This document provides detailed instructions for completing the New York State IT-201 Full-Year Resident Income Tax Return for 2021. It includes essential guidelines for filing taxes in New York State, New York City, and Yonkers, as well as important credit and payment information. Users will find valuable resources and links for e-filing and tax law updates.

Property Taxes

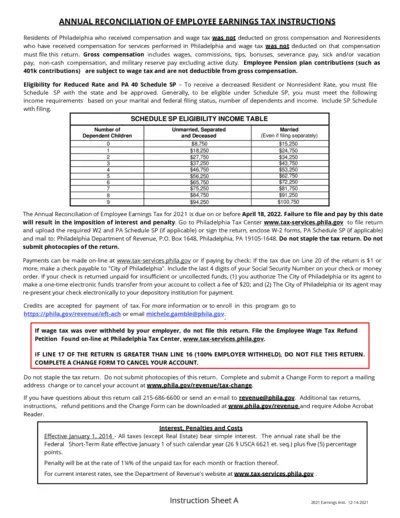

Annual Reconciliation Employee Earnings Tax Instructions

This file provides essential instructions for residents and non-residents of Philadelphia regarding the filing of the Annual Reconciliation of Employee Earnings Tax. It outlines eligibility criteria, submission guidelines, and important deadlines to ensure compliance with local tax regulations.

Tenant-Landlord

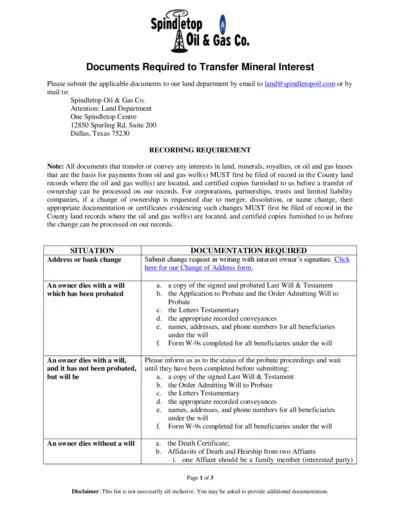

Transfer of Mineral Interest Documentation

This document outlines the requirements for transferring mineral interest ownership. It details necessary documentation and submission processes. Essential for both individuals and entities engaged in mineral interest transactions.

Franchise Agreements

KFC Franchise Disclosure Document - Essential Information

This document provides comprehensive details about KFC franchising opportunities, including financial requirements and operational guidelines. It is essential for anyone considering investing in a KFC franchise. Understanding this document is crucial for informed decision-making.

Business Formation

Florida Business Tax Application Instructions

This file provides essential details and instructions for the Florida Business Tax Application. It is designed to help business owners navigate the application process efficiently. Ensure to follow the guidelines for accurate submission.

Property Taxes

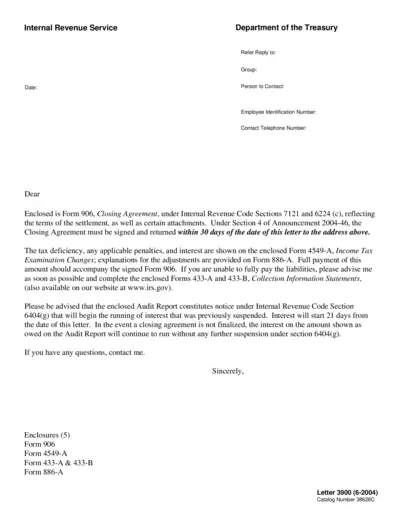

IRS Form 906 Closing Agreement Instructions

This document provides essential instructions for Form 906, a Closing Agreement under the Internal Revenue Code. It includes details about submission deadlines and related forms. Understanding this form is crucial for taxpayers facing a tax deficiency.

Property Taxes

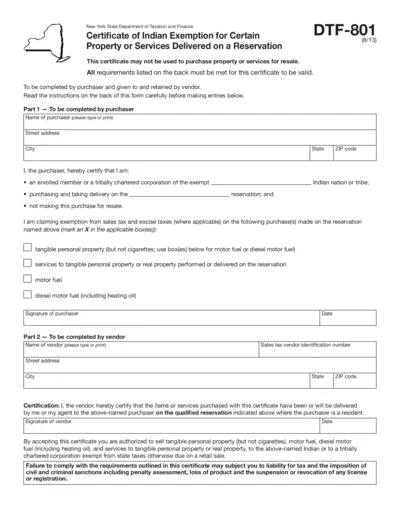

Certificate of Indian Exemption for Property Services

This form certifies Indian exemption from sales and excise taxes for property or services on a qualified reservation in New York. It must be completed by the purchaser and retained by the vendor. Ensure to follow the guidelines and instructions on the reverse side for valid use.

Property Taxes

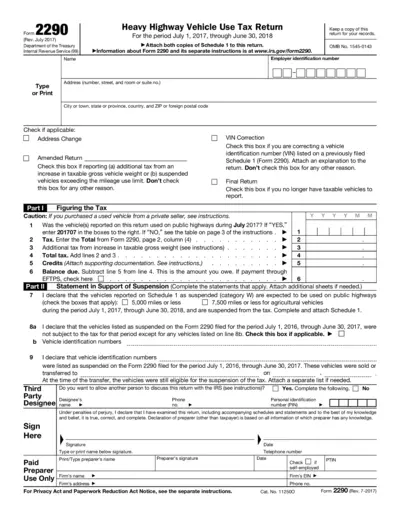

Form 2290 - Heavy Highway Vehicle Use Tax Return

Form 2290 is used for reporting the Heavy Highway Vehicle Use Tax to the IRS. It is essential for vehicle owners who operate heavy vehicles on public highways. This form helps facilitate tax compliance for the fiscal year ending June 30, 2018.

Real Estate

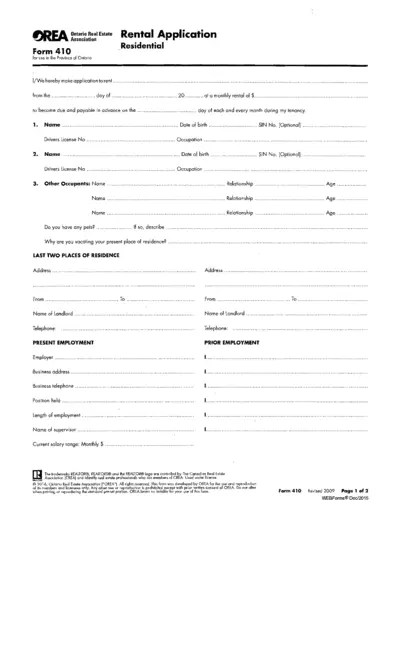

OREA Ontario Real Estate Rental Application Form 410

The OREA Form 410 is a standardized rental application used in Ontario for residential properties. This form collects important information from prospective tenants, including employment and financial details. It ensures a clear evaluation process for landlords.

Property Taxes

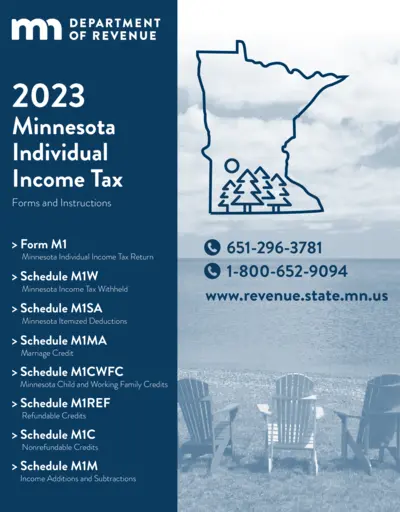

Minnesota Individual Income Tax Forms and Instructions

This file provides comprehensive instructions for the Minnesota Individual Income Tax Return and other related forms. It includes essential guidelines for filing, available credits, and important deadlines. Ideal for Minnesota taxpayers looking for guidance on their income tax return process.