Legal Documents

Business Formation

Incorporation Agreement Sample Document

This file contains a sample incorporation agreement that outlines the necessary articles and procedures for forming a company. It provides a template including details such as incorporator information and interpretations of related legal terms. Ideal for entrepreneurs and business professionals looking to establish a corporate entity.

Real Estate

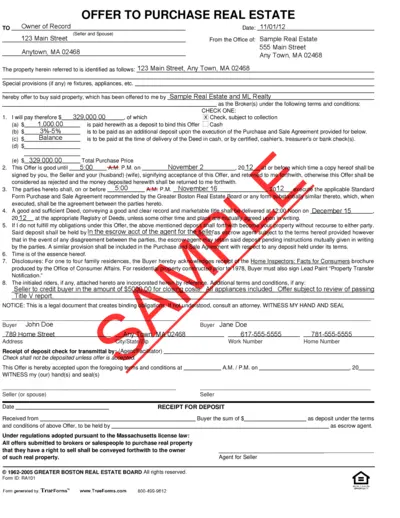

Offer to Purchase Real Estate Document

This file provides an official Offer to Purchase real estate. It includes instructions and necessary details for buyers and sellers. Make sure to fill it out correctly to comply with legal standards.

Real Estate

Real Estate Buyout Agreement Template Free

This file provides a free template for a Real Estate Buyout Agreement. It is essential for brokers and individuals looking to formalize a real estate transaction. With clear instructions and clauses, this document ensures a smooth buyout process.

Business Formation

Application For Dissolution Without Meeting Shareholders

This file provides the official application for dissolution of a domestic profit corporation in New Jersey. It outlines the necessary steps and requirements for shareholders to officially dissolve the corporation. Use this form to ensure compliance with New Jersey regulations during the dissolution process.

Real Estate

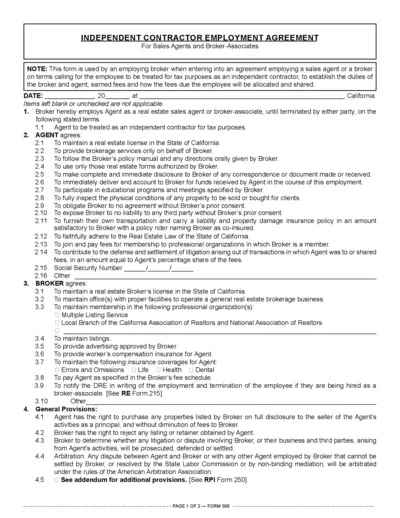

Independent Contractor Employment Agreement for Real Estate Agents

This Independent Contractor Employment Agreement is designed for sales agents and broker-associates in California. It outlines the terms of employment between the broker and the agent, ensuring compliance with state laws. Perfect for established real estate professionals and newcomers alike.

Property Taxes

Instructions for Form 8949 Sales and Dispositions

This file provides instructions for Form 8949, which is used to report sales and exchanges of capital assets. It includes details about how to fill out the form correctly, along with guidelines for various entities. Users will find helpful information about the purpose of the form and the process involved.

Real Estate

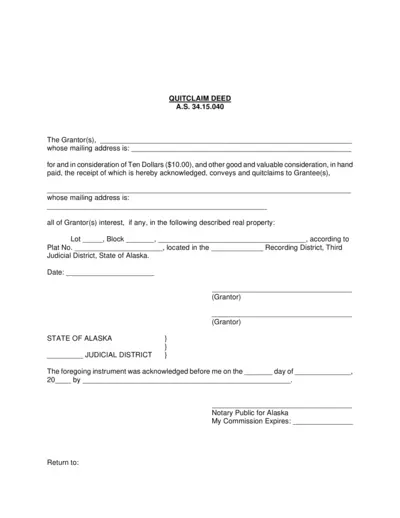

Quitclaim Deed Form for Alaska Real Property

The Quitclaim Deed is a legally binding document used to transfer property ownership. This file contains all necessary information and instructions for completing the deed in Alaska. Ideal for individuals looking to convey their interest in real estate.

Property Taxes

Nonresident or Part-Year Resident Tax Booklet 540NR 2022

The 2022 California 540NR Tax Booklet provides essential information and instructions for nonresidents and part-year residents filing their taxes. This document includes important dates, filing requirements, and tax credits. Use this booklet to guide your tax filing process for income earned in California.

Property Taxes

Instructions for Forms 1099-R and 5498

This document provides essential guidelines for completing Forms 1099-R and 5498 related to pension distributions, IRAs, and more. It includes updates about new laws and instructions for various situations. Users will find detailed instructions and necessary codes for accurate reporting.

Property Taxes

2022 Instructions for Form 8824 Like-Kind Exchanges

This file provides detailed guidelines on how to fill out Form 8824 for reporting like-kind exchanges. It includes important updates and specific instructions for different asset types. Understanding this form is essential for accurate tax reporting related to property exchanges.

Real Estate

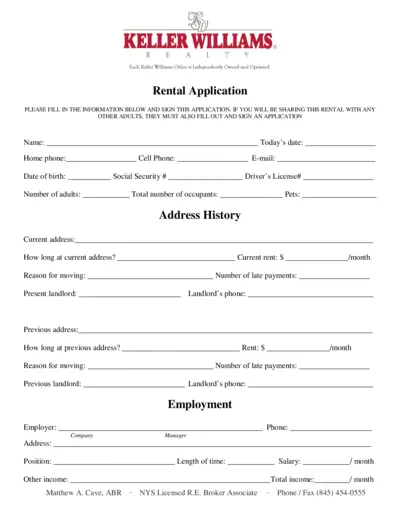

Keller Williams Rental Application Form

This rental application form is essential for those interested in renting a property through Keller Williams Realty. It outlines necessary information for prospective tenants, including personal details and past rental history. Completing this form accurately ensures a smooth application process.

Property Taxes

IRS Form 8879 e-file Signature Authorization

Form 8879 is used for IRS e-file signature authorization. This form allows taxpayers to authorize their electronic return originator (ERO) to file their tax returns electronically. Completing this form ensures your return is properly submitted to the IRS.