Legal Documents

Real Estate

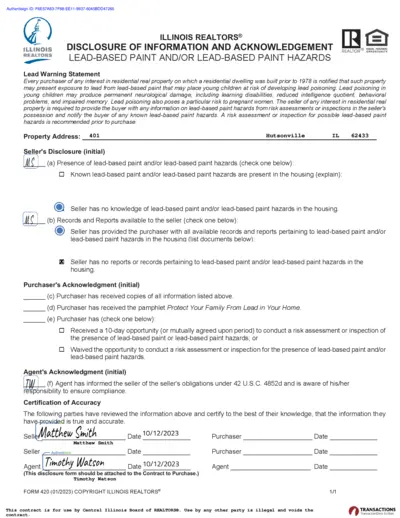

Illinois Realtors Lead-Based Paint Disclosure Form

This document is essential for home buyers to acknowledge lead-based paint hazards in properties built before 1978. It includes disclosures by the seller and the rights of the purchaser. Ensure you understand and complete this form during your property transaction.

Property Taxes

Texas Franchise Tax Extension Request Form

The Texas Franchise Tax Extension Request Form (05-164) allows businesses to request an extension for their franchise tax filing. This form is crucial for ensuring compliant tax submissions. Easily complete this form and submit it to the Texas Comptroller.

Zoning Regulations

Army Regulation 600-8-10 Leaves and Passes Policy

This document outlines the policies and procedures regarding leaves and passes for military personnel. It includes vital changes due to legislative updates, ensuring compliance with the latest regulations. Ideal for army personnel, administrative staff, and legal advisors involved in leave management.

Property Taxes

PA Declaration of Estimated Tax PA-40ESR Form

The PA-40ESR form is used for declaring estimated tax payments in Pennsylvania. This important tax document is necessary for individuals and businesses to report and pay their estimated taxes. Follow the instructions carefully to ensure timely and accurate submissions.

Property Taxes

IRS Form 1120-W Estimated Tax for Corporations

This file provides the form 1120-W for calculating estimated tax obligations for corporations. It includes detailed instructions and computation fields. Useful for businesses planning their tax strategies for the calendar year.

Property Taxes

2021 Estimated Tax Form 1040-ES Instructions

The 2021 Form 1040-ES provides individuals with guidelines to calculate and pay estimated taxes for their non-withholding income. Essential for U.S. citizens, resident aliens, and others, this form helps prevent underpayment penalties. Follow the detailed instructions to ensure compliance and accurate tax reporting.

Business Formation

Workplace Safety Insurance Board Reconciliation Form

This file is a reconciliation form from the Workplace Safety and Insurance Board that calculates total insurable earnings and employer premiums. It provides detailed instructions for reporting earnings, deductions, and premiums. Employers must fill out this form accurately to comply with WSIB regulations.

Real Estate

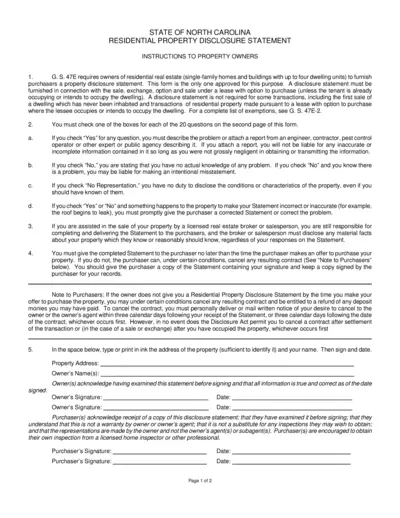

North Carolina Residential Property Disclosure

This Residential Property Disclosure Statement is essential for homeowners in North Carolina when selling residential real estate. This form helps ensure transparency between property owners and potential buyers regarding the condition of the property. It outlines important questions regarding the property's condition that must be disclosed to the buyer.

Real Estate

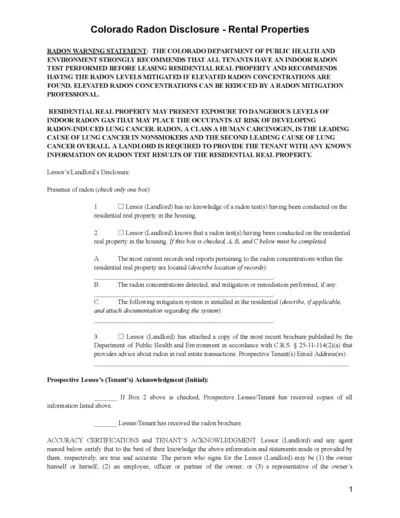

Colorado Radon Disclosure for Rental Properties

This file provides essential details about radon gas exposure for rental properties in Colorado. It includes necessary disclosures landlords must provide to tenants. The document is vital for ensuring tenant safety and awareness regarding radon levels.

Property Taxes

FATCA Report IRS Form 8966 Instructions 2023

This file contains important information and instructions for IRS Form 8966, which is used to report U.S. account holders. It is essential for compliance with FATCA regulations. Ensure you follow the guidelines accurately to avoid penalties.

Property Taxes

Form 8283 for Noncash Charitable Contributions

Form 8283 is used to report noncash charitable contributions. This form must be attached to your tax return if you claim a deduction over $500. Detailed instructions are available for completing this form.

Real Estate

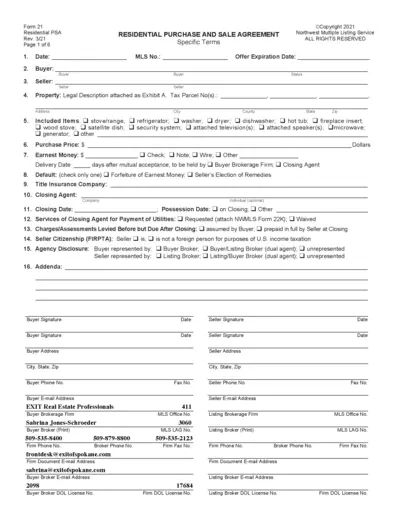

Residential Purchase and Sale Agreement Form 21

This file contains the Residential Purchase and Sale Agreement, outlining the terms and conditions of a property sale. It provides essential information for buyers and sellers, ensuring a clear understanding of the transaction. Completing this form accurately is crucial for a smooth and legally binding sale.