Legal Documents

Business Formation

Order Acknowledgment and Invoice Form

This file serves as an order acknowledgment and invoice for your purchases. It helps in tracking your orders and ensuring accurate billing. Use this document to record customer and order details efficiently.

Business Formation

Initial Annual Report CL-1 LLCs Filing Instructions

This document provides essential instructions for submitting the Initial Annual Report CL-1 for LLCs. It outlines the filing requirements, fees, and penalties associated with the report. Ensure compliance to avoid late fees and penalties.

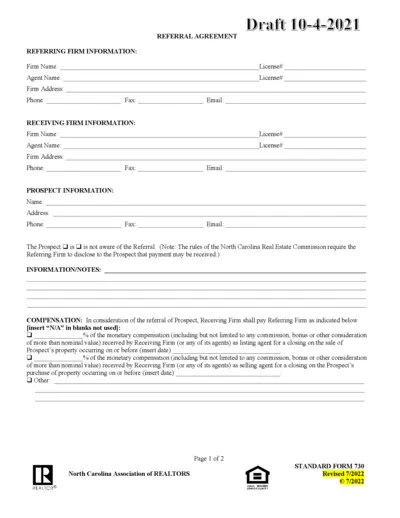

Real Estate

Referral Agreement Guidelines for North Carolina

This Referral Agreement outlines essential information for referring firms and receiving firms in North Carolina. It includes sections for compensation, time of payment, and assignment details. Use this form to ensure a clear and compliant referral process.

Property Taxes

IRS Publication 555 Community Property Tax Guidelines

IRS Publication 555 provides detailed guidelines on community property laws and federal tax implications for married couples and registered domestic partners. Understanding these guidelines helps in determining how to report income and deductions accurately. Essential for taxpayers residing in community property states.

Business Formation

Massachusetts Sales Tax Exemption Certificate

This file is a sales tax exemption certificate for the Town of Raynham. It provides detailed instructions for vendors on billing and invoicing procedures. Essential for local vendors to ensure compliance and proper processing of orders.

Property Taxes

Georgia Individual Income Tax Return Form 500

This is the official Georgia Form 500 for Individual Income Tax Return. It is essential for residents, part-year residents, and non-residents filing taxes in Georgia. Completing and submitting this form ensures compliance with state income tax regulations.

Property Taxes

PA Corporate Net Income Tax REV-1200 Instructions 2022

This file provides detailed instructions for the Pennsylvania Corporate Net Income Tax for the tax year 2022. It includes information on filing requirements, important tax rate changes, and relevant updates for tax forms. Corporations and business entities can ensure compliance by reviewing this comprehensive guidance.

Property Taxes

Instructions for Form 8697 Interest Computation

Form 8697 provides guidance on calculating interest using the look-back method for long-term contracts. This form assists individuals and corporations in determining what interest they owe or may be refunded. It's essential for accurate income tax filing related to completed long-term contracts.

Property Taxes

Wisconsin Form 3 Instruction Guide for 2022

The 2022 Wisconsin Form 3 instructions provide essential guidelines for partnerships and LLCs to file their tax returns accurately. This document outlines who must file, what information is needed, and the consequences of failing to file. It's a vital resource for Wisconsin business owners navigating their tax obligations.

Property Taxes

Schedule K-1 Form 1065 2022 Instructions

This document contains the Schedule K-1 (Form 1065) for the tax year 2022. It details the partner's share of income, deductions, and credits. This form is essential for partnerships to report income distribution among partners.

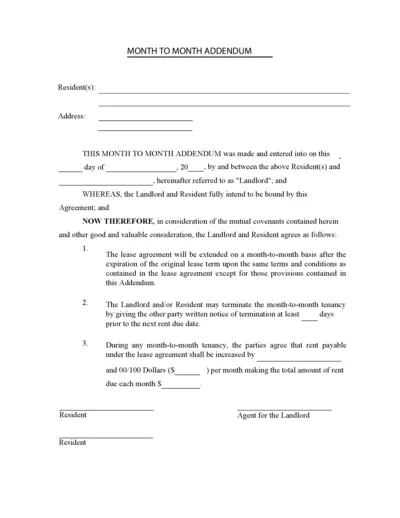

Real Estate

Month to Month Lease Addendum for Residents

This Month to Month Addendum is crucial for residents who wish to continue their tenancy beyond the original lease term. It outlines the agreement terms between the landlord and resident, including rent adjustments and termination procedures. Ensure you understand the extension details for a seamless transition in your rental arrangement.

Property Taxes

Claim for Sales and Use Tax Exemption in New York

This file contains the Claim for Sales and Use Tax Exemption form for motor vehicles, trailers, ATVs, vessels, and snowmobiles in New York. It provides detailed instructions on how to claim exemptions from sales and use tax for eligible purchases. Fill out the form accurately to avoid penalties and ensure a smooth processing of your exemption claim.