Legal Documents

Property Taxes

Form 5227 - Split-Interest Trust Information Return

Form 5227 is the Split-Interest Trust Information Return. This form is required for reporting income, deductions, and other relevant details of split-interest trusts. It assists in the compliance of trust entities with IRS regulations.

Property Taxes

Instructions for Form 945-A and Tax Liability Reporting

This file provides comprehensive instructions for Form 945-A, including how to report federal tax liabilities and applicable credits. It outlines eligibility criteria, filing requirements, and step-by-step guidance. Users can efficiently navigate their tax responsibilities with these updated instructions.

Property Taxes

Arizona Joint Tax Application Overview and Instructions

The Arizona Joint Tax Application (JT-1) is essential for businesses filing taxes in Arizona. This form collects business and owner information necessary for tax registration. Ensure compliance by filling out the form accurately.

Property Taxes

2023 Massachusetts Resident Income Tax Return

This file contains the necessary forms and instructions for filing the 2023 Massachusetts Resident Income Tax Return. It is essential for residents to accurately report their income and claim applicable deductions and credits. Follow the detailed instructions provided to ensure a smooth filing process.

Business Formation

New Jersey DOR Short Form Standing Certificate

This document certifies the standing of a New Jersey Domestic For-Profit Corporation. It confirms the corporation was registered and is in good standing. Use this certificate for legal and business purposes, including verification of corporate status.

Business Formation

Certificate of Destruction for Equipment and Software

This file serves as a Certificate of Destruction for destroyed equipment and software. It ensures compliance with company policies while documenting the destruction process. Ideal for businesses participating in technology refresh or replacement programs.

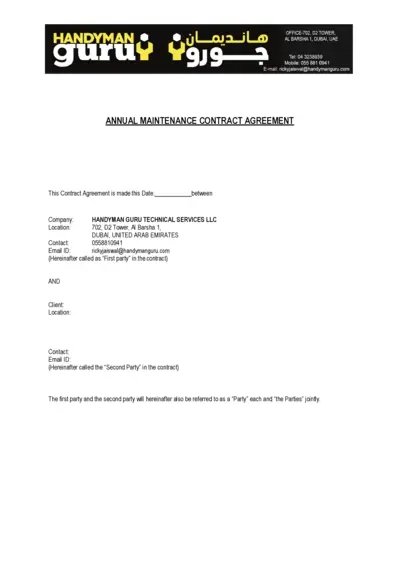

Contracts

Annual Maintenance Contract Agreement for Handyman Services

This file outlines the terms and conditions for an annual maintenance contract. It is essential for clients seeking handyman services to understand their responsibilities and the scope of work. The agreement provides clear definitions and procedures related to maintenance services.

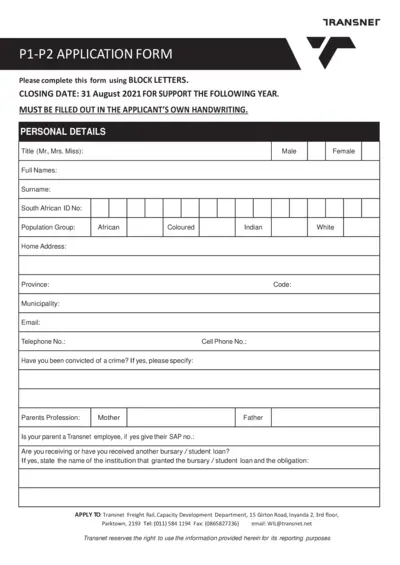

Spousal Support

Transnet Application Form Instructions and Details

This file contains the Transnet P1-P2 application form for students seeking support. It provides instructions on filling out the form and necessary requirements for submission. Ensure all details are completed accurately for consideration.

Property Taxes

IRS Form 1040-SR Instructions 2023

This document provides essential instructions for filing IRS Form 1040-SR for seniors. It includes step-by-step guidance on completing the form accurately. Utilize this resource to ensure compliant tax reporting for the 2023 tax year.

Business Formation

Amway Sales and Marketing Plan Overview

This document provides a comprehensive overview of the Amway Sales and Marketing Plan. It outlines the key strategies, income calculations, and rewards associated with the plan. Ideal for new and existing ABOs looking to maximize their opportunities.

Property Taxes

Virginia Estimated Tax Underpayment Form 760C

Form 760C is essential for individuals, estates, and trusts to report any underpayment of estimated taxes in Virginia. This document guides users on how to calculate and rectify their tax obligations accurately. Ensure timely submission to avoid penalties and interest.

Property Taxes

Arkansas Individual Income Tax Return Form AR1000F

The Arkansas Individual Income Tax Return Form AR1000F is essential for full-year residents filing their income tax. This form helps residents report their income, claim deductions, and calculate their tax liability. Make sure to complete it accurately to ensure compliance with state tax regulations.