Legal Documents

Property Taxes

Uline Tax Exemption Certificate Instructions

This file provides essential instructions for filling out the Uline Tax Exemption Certificate. It includes guidelines for submission and eligibility requirements. Perfect for businesses seeking a sales tax exemption.

Property Taxes

Unified Tax Credit for the Elderly Indiana Form SC-40

This form is for married claimants in Indiana who qualify for the Unified Tax Credit for the Elderly. It is essential for taxpayers who are 65 or older and meet specified residence requirements. Complete this form by June 30, 2006, to claim your tax credit.

Property Taxes

IRS Noncash Charitable Contributions Form 8283 Instructions

This file provides essential instructions for completing Form 8283, which is necessary for reporting noncash charitable contributions. It includes guidelines for taxpayers and appraisers on the documentation required for tax deductions. Understanding this form is crucial for individuals donating significant property and claiming deductions.

Real Estate

Landlord Itemized List of Damages Template

This file is a comprehensive template for creating an itemized list of damages for landlords. It helps in documenting actual damages that exceed normal wear and tear, facilitating a transparent security deposit refund process. Essential for landlords aiming to maintain clear communication with tenants regarding deductions.

Property Taxes

Form 8849 Schedule 2 Instructions for Vendors

Form 8849 Schedule 2 is required for registered ultimate vendors to claim refunds on certain types of fuel sold at tax-excluded prices. This form ensures compliance with IRS regulations for fuel tax refunds. Users must follow the provided guidelines to complete it accurately.

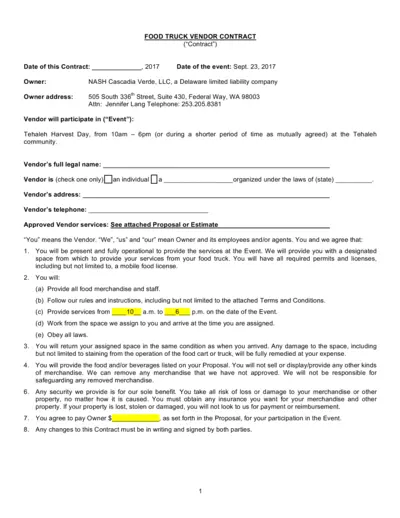

Contracts

Contract for Food Truck Vendor Participation in Event

This file is a Food Truck Vendor Contract outlining the terms and conditions for vendors wishing to participate in events. It includes details about the event, responsibilities of the vendor, and insurance requirements. This document is crucial for vendors seeking to ensure compliance with event regulations.

Business Formation

Effective Letters to Vendors and Suppliers

This file provides a variety of sample letters intended for communications with vendors and suppliers. It includes templates for various situations such as requests for proposals and sales presentations. It's designed to assist professionals in enhancing their correspondence skills.

Compliance

Privacy Act Data Cover Sheet

This file contains important privacy information and guidelines for managing personal data. It is essential for all personnel involved in handling sensitive information to understand this document. Ensure compliance with the Privacy Act of 1974.

Property Taxes

Work Opportunity Tax Credit Questionnaire Form

The Work Opportunity Tax Credit (WOTC) Questionnaire assists employers in determining eligibility for tax credits. This form includes various questions related to employment history, assistance programs, and veteran status. Your participation is crucial for the qualification process and is conducted voluntarily.

Property Taxes

2024 Estimated Tax Payment Record

This file serves as a record for your estimated tax payments for 2024. It includes details on payment installments and provides space to track your payments. Keep this record for your records and for filing your 2024 Form M1.

Business Formation

Whole Foods Market Code of Business Conduct

The Whole Foods Market Code of Business Conduct outlines the ethical and legal standards expected of all team members and board members. It serves as a guide to ensure compliance with laws, company policies, and best practices. Understanding this code is crucial for maintaining integrity in business interactions.

Real Estate

REALTOR Referral Contract Form Guide

This file contains the REALTOR® Referral Contract form, providing essential details for real estate transactions. It outlines the responsibilities and information needed for referring agents. Users can easily fill out and submit this form with provided guidelines.