Legal Documents

Property Taxes

Schedule D Form 1120-S for Reporting Capital Gains

This file contains Schedule D, Form 1120-S for the IRS, which is used to report capital gains and losses. It includes detailed instructions for completion and submission. Essential for corporations reporting investments and taxable transactions.

Business Formation

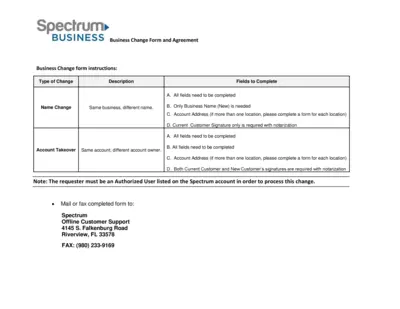

Spectrum Business Change Form and Agreement

This form is essential for businesses looking to request account changes with Spectrum. It provides structured instructions for name changes and account takeovers. Correctly filling out this form ensures a smooth and efficient transition of services.

Real Estate

Indiana Residential Purchase Agreement Template

The Indiana Residential Purchase Agreement serves as a binding contract between a buyer and seller for real estate transactions in Indiana. This comprehensive document outlines the terms of the agreement, including property details, purchase price, and financing options. Utilize this template to ensure a smooth transaction in accordance with Indiana real estate laws.

Real Estate

Standard Residential Tenancy Agreement Manitoba

This Standard Residential Tenancy Agreement is essential for landlords and tenants in Manitoba. It outlines rental terms, obligations, and rights under the Residential Tenancies Act. Ensure both parties understand the agreement for a successful tenancy.

Real Estate

Texas Association of Realtors Listing Termination Form

This document is essential for terminating a property listing between the owner and the broker. Make sure to read through the terms and fees outlined in this form before signing. It's designed to provide a clear and legal termination process.

Property Taxes

Massachusetts S Corporation Tax Instructions 2023

This file contains detailed instructions for filing the Massachusetts S Corporation Return Form 355S. It includes information on necessary schedules, deadlines, and contact details for assistance. This comprehensive guide is essential for taxpayers completing S corporation tax returns.

Property Taxes

2022 Colorado DR 0104AD Subtractions from Income

This file is the Subtractions from Income Schedule for Colorado residents. It provides instructions on reporting subtractions from Federal Taxable Income. Use this form to accurately adjust your Colorado Taxable Income based on available deductions.

Adoption

PetSmart Adoption Partner Application Guide

This guide provides essential instructions for organizations looking to become adoption partners with PetSmart Charities. It outlines the qualification criteria, step-by-step application process, and necessary documentation. Use this comprehensive resource to navigate the adoption partner application with ease.

Business Formation

User Manual for MIDC Online Plot Application

This user manual provides comprehensive guidelines on how to use the MIDC Online Plot Application. It covers everything from registration to application submission. Ideal for entrepreneurs seeking plot allotment in Maharashtra.

Property Taxes

DR-15EZ Florida Sales and Use Tax Returns Guide

This file provides detailed instructions on the eligibility, filing, and payment process for the DR-15EZ sales and use tax returns in Florida. It assists businesses in understanding how to fill out the return accurately and comply with state requirements. Whether you are a new business owner or managing an established enterprise, this guide is essential for tax compliance.

Business Formation

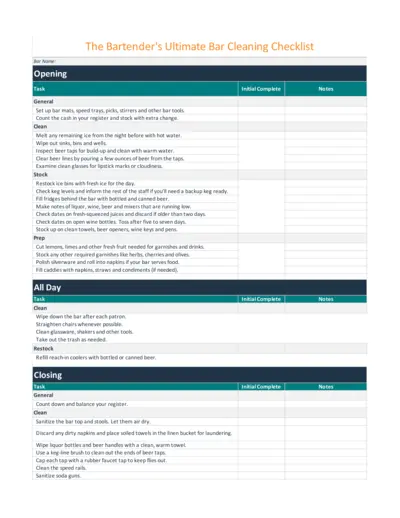

Bartender's Ultimate Bar Cleaning Checklist

This comprehensive checklist helps bartenders maintain cleanliness and organization in their bar. With detailed tasks for opening, operational, and closing procedures, it ensures high standards of hygiene. Perfect for both new and experienced bartenders aiming for operational excellence.

Property Taxes

Arizona Consolidated or Combined Return Form

This document contains the Arizona Form 51, which is used for filing consolidated and combined returns. It provides detailed instructions necessary for accurate completion. Utilize this form to ensure compliance with Arizona tax filing requirements.