Legal Documents

Property Taxes

Form 1120-H for Homeowners Associations 2023

This file contains Form 1120-H, the U.S. Income Tax Return specifically for Homeowners Associations. It's essential for homeowners associations to report their income and maintain tax-exempt status. Detailed instructions and guidelines are provided within the document for proper completion.

Property Taxes

New York State 2023 IT-196 Itemized Deductions

The New York IT-196 form allows residents and nonresidents to itemize their deductions for the 2023 tax year. This form is essential for accurately calculating taxable income and maximizing potential refunds. Complete it with Form IT-201 or IT-203 for proper submission.

Property Taxes

Partnership Instructions for Schedules K-2 and K-3

This file provides detailed instructions for partnerships filing Schedule K-2 and K-3 related to international tax matters. It outlines the purpose, who must file, and guidance on completing the forms. Understanding these instructions is essential for accurate reporting of partners' distributive share items.

Property Taxes

Virginia Individual Income Tax Form 760 Instructions

The Virginia Form 760 is essential for residents filing income taxes. It guides taxpayers through the necessary steps to complete their returns. Use this comprehensive booklet for smooth tax preparation.

Business Formation

Registration of Fictitious Name Application Form

This form is required for registering a fictitious name in Pennsylvania. It provides essential details about the entity and the fictitious name. Complete this form accurately to ensure compliance with state regulations.

Real Estate

Maine Real Estate Transfer Tax Declaration Form

The Maine Real Estate Transfer Tax Declaration Form is essential for documenting property transfers in Maine. It outlines necessary tax obligations and provides verification of the property's details. Ensure compliance with state regulations by accurately completing this form.

Business Formation

Los Angeles County Fictitious Business Name Statement

This file serves as the official documentation required for registering a fictitious business name in Los Angeles County. It provides essential guidelines and forms necessary for the filing process. Users must complete the affidavit of identity along with the business name statement.

Prenuptial Agreements

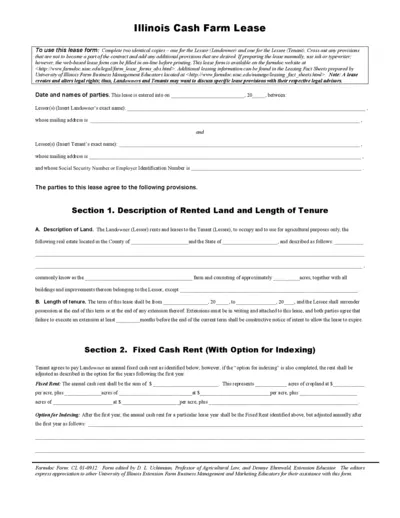

Illinois Cash Farm Lease Agreement Template

This file contains a cash farm lease agreement template for agricultural purposes. It provides detailed guidance for both lessors and lessees. Use it to understand your rights and responsibilities in leasing farmland.

Property Taxes

California Nonresident Tax Adjustment Form 540NR

This file contains the Schedule CA for California Nonresidents or Part-Year Residents for the tax year 2023. It provides essential information about residency and income adjustments necessary for nonresidents. Users will find detailed instructions for properly filling out the form.

Property Taxes

DC Personal Property Tax Instructions Form FP-31

The FP-31 form provides guidelines for filing and paying the District of Columbia Personal Property Tax. It includes necessary details regarding exemptions, deadlines, and filing processes. This resource is essential for individuals and businesses holding tangible personal property in DC.

Property Taxes

Instructions for Form 8995 Qualified Business Income

This document provides guidelines for completing Form 8995 related to the Qualified Business Income Deduction. Users will find essential information regarding eligibility and calculation for the deduction. It serves as a crucial resource for individual taxpayers, trusts, and estates seeking to understand their tax obligations.

Property Taxes

Instructions for Form 1120 U.S. Corporation Tax Return

This file provides detailed instructions for filing Form 1120, the U.S. Corporation Income Tax Return. It includes information on eligibility, deadlines, and filing requirements. Essential for corporations to correctly report their income and deductions.