Legal Documents

Property Taxes

Illinois ST-587 Exemption Certificate for Manufacturing

The Illinois ST-587 Exemption Certificate verifies that no tax is due on exempt sales for manufacturing and other specified uses. This form is crucial for businesses involved in production agriculture, mining, and manufacturing processes. Proper completion of this certificate ensures compliance with Illinois tax regulations.

Labor Law

UFCW5 Collective Bargaining Agreement Save Mart

This file contains the UFCW5 Collective Bargaining Agreement with The Save Mart Companies. It includes detailed sections on employee rights, benefits, and work protocols. Essential for union members and companies to understand employment terms.

Real Estate

WB-11 Residential Offer to Purchase Form

The WB-11 Residential Offer to Purchase is a legally binding document used in real estate transactions in Wisconsin. This form outlines the terms and conditions of the offer made by the buyer to purchase a residential property. It includes important details such as purchase price, earnest money, and property conditions.

Real Estate

California Disclosure Information Advisory for Sellers

This document provides essential disclosure requirements for sellers in California real estate transactions. It outlines the obligations to disclose material conditions and defects known to the seller. Failure to comply may result in legal consequences, making it crucial for sellers to understand and adhere to these guidelines.

Property Taxes

2023 Schedule OR-ASC Oregon Adjustments for Form OR-40

The 2023 Schedule OR-ASC provides essential instructions for reporting Oregon tax adjustments. This schedule allows Oregon taxpayers to report various credits and adjustments that are not included in Form OR-40. It is crucial for accurate tax reporting and compliance with the Oregon Department of Revenue.

Labor Law

Delaware Child Labor Work Permit Instructions

This document outlines the procedures required for applying for a child labor work permit in Delaware. It provides detailed instructions for minors, employers, and issuing officers. Ensure compliance with state laws when employing minors.

Property Taxes

Virginia Pass-Through Entity Income Tax Instructions

This file provides essential instructions for preparing the Virginia FORM 502 for pass-through entities. It details requirements for nonresident withholding tax and compliance. Ideal for entities needing to file taxes in Virginia.

Compliance

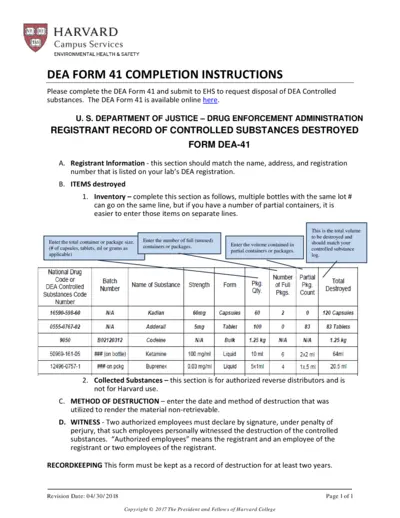

DEA Form 41 Completion Instructions for Disposal

The DEA Form 41 provides essential instructions for the disposal of DEA controlled substances. This form is crucial for compliance with regulatory requirements. Ensure accuracy to facilitate safe and legal disposal.

Property Taxes

Alabama Department of Revenue Form 41 Instructions

This document provides detailed instructions for completing the Alabama Form 41, Fiduciary Income Tax Return for the year 2023. It covers eligibility requirements, filing procedures, and payment options. Ideal for fiduciaries managing estates and trusts in Alabama.

Property Taxes

Illinois Department of Revenue Form IL-2210 Instructions

The IL-2210 form helps individuals assess penalties for underpayment of estimated taxes. It provides guidance on late penalties and the filing process. Use this form if you need to calculate tax liabilities and penalties accurately.

Real Estate

California REALTORS Modification of Agreement Form

This document outlines the modification of a listing or buyer representation agreement between a broker and a principal. It includes details regarding price adjustments and expiration dates. Ensure all modifications are documented and understood by all parties involved.

Property Taxes

PA Rent Certificate Submission Instructions

The PA Rent Certificate is a form required for claiming rental funds. It allows renters to provide proof of their rent payments. Proper completion and submission are necessary for receiving benefits.