Legal Documents

Property Taxes

Arizona Transaction Privilege Use and Severance Tax Return

The Transaction Privilege, Use, and Severance Tax Return (TPT-EZ) is a crucial document for Arizona businesses. This form allows taxpayers to report and remit their tax liabilities effectively. It simplifies the process of submitting tax information for those engaging in applicable transactions.

Business Formation

Payroll Setup Checklist for Efficient Management

This checklist assists you in setting up your payroll system efficiently. It covers all essential information required for correct payroll processing. Utilize this guide to ensure compliance and streamline your payroll operations.

Property Taxes

Form 8949 Instructions for Capital Asset Transactions

Form 8949 is used to report sales and dispositions of capital assets. It allows taxpayers to summarize their short-term and long-term transactions. This form is essential for accurately calculating gains and losses on your tax return.

Real Estate

Missouri General Warranty Deed Document

This document is a Missouri General Warranty Deed used for transferring real property ownership in Missouri. It outlines the rights, guarantees, and obligations of the grantor and grantee. Essential for property transactions, it ensures legal protection for the buyer.

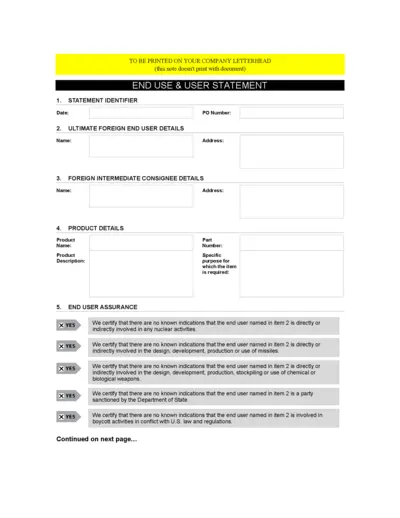

Compliance

End User and End Use Statement Form

This document serves as a declaration for end-user and end-use acknowledgments. It is essential for compliance with U.S. export regulations. Ensure to accurately fill it out for proper submission.

Property Taxes

IRS Form 1065 Instructions for Partnerships

This document provides detailed instructions for filing IRS Form 1065 for partnerships. Learn how to amend returns under the CARES Act and ensure compliance. It includes necessary schedules and required information for accurate submission.

Business Formation

Credit for Small Employer Pension Plan Costs Form 8881

Form 8881 is used by small employers to claim a credit for startup costs associated with pension plans. This form helps eligible employers reduce their tax burden while providing retirement benefits. Follow the instructions carefully to ensure proper completion and compliance.

Business Formation

Application for Louisiana Revenue Account Number

This application is required for businesses seeking to obtain a Louisiana revenue account number for tax purposes. It outlines various types of taxes and provides essential information needed for filing. Completing this form accurately is crucial to ensure compliance with Louisiana tax regulations.

Real Estate

Lease Agreement for Seasonal Housing in Spain

This file is a lease agreement for seasonal housing in Spain. It details the terms of rental, tenant and landlord responsibilities, and important legal provisions. Ideal for individuals looking to rent property in Spain for short-term stays.

Property Taxes

Instructions for New York Amended Resident Tax Return

The file provides comprehensive instructions for completing the amended Form IT-201-X for New York State. It outlines required steps, necessary forms, and filing requirements. Ideal for residents who need to amend their tax returns for errors or IRS changes.

Property Taxes

Arizona Resident Personal Income Tax Form 140

This file contains the Arizona Form 140 for the 2010 tax year. It provides instructions for filing personal income tax as a resident of Arizona. Use this form to ensure accurate reporting of your Arizona income.

Property Taxes

Missouri Property Tax Credit Claim Form MO-PTC 2023

This document provides instructions and eligibility criteria for the Missouri Property Tax Credit Claim Form MO-PTC. It includes a checklist for required documentation and guidance on eligibility for renters and homeowners. The form is essential for those seeking property tax credits in Missouri for 2023.