Legal Documents

Business Formation

Assumed Name Records Application - Harris County

This file provides the necessary forms and instructions for filing an Assumed Name Certificate in Harris County, Texas. It is essential for individuals or businesses operating under a name other than their legal name. Ensure you follow the guidelines for a successful submission.

Business Formation

Sample Accountable Plan for Expense Reimbursement

This document serves as a guide for creating an accountable plan for business expense reimbursements. It outlines the necessary terms and conditions to ensure compliance with tax rules. Users should consult legal counsel before adaptation.

Business Formation

Vendor Verification Form Instructions and Details

This document serves as a Vendor Verification Form for Small and Local Business Development. Users can submit and verify subcontractor information essential for compliance. It outlines necessary details for small and certified business enterprises.

Property Taxes

Instructions for Form 1065X for Partnerships

This file contains important instructions for completing Form 1065X, including eligibility criteria and detailed guidelines for filing. It is essential for partnerships who need to amend their returns or make administrative adjustments. Use this comprehensive guide to ensure compliance with IRS regulations.

Property Taxes

IRS Form 2624 Consent for Third Party Contact

Form 2624 allows taxpayers to authorize the IRS to contact a third party on their behalf. It is essential for those needing assistance with tax-related inquiries. Use this form to manage consent to share sensitive tax information with authorized parties.

Compliance

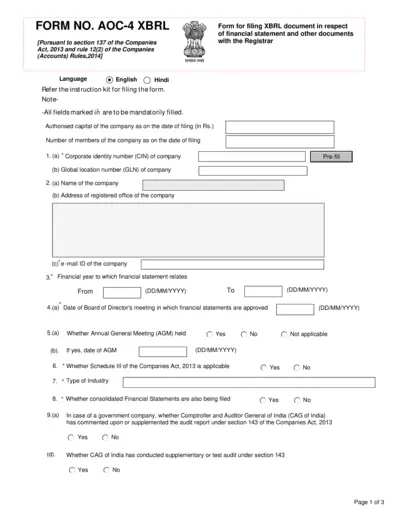

AOC-4 XBRL Filing Instructions and Details

This file provides detailed instructions on how to fill out the AOC-4 XBRL form for financial statements. Follow these guidelines to ensure compliance with the Companies Act, 2013. Essential for corporations submitting annual reports.

Business Formation

Exemption from Workers' Compensation in California

This file provides essential instructions and information for claiming exemption from workers' compensation in California. Users can complete and submit the form efficiently. This document is crucial for business owners who do not employ anyone subject to workers' compensation laws.

Property Taxes

Filing 1099 Forms Guide for Independent Contractors

This guide provides essential information regarding filing 1099 forms, including important forms and compliance details. It's perfect for businesses and independent contractors who need clarity on tax reporting. Use this resource to ensure accurate and timely filing of 1099 forms.

Property Taxes

Wisconsin Homestead Credit Claim Schedule H-EZ

This file provides the necessary instructions and forms for claiming the Wisconsin homestead credit. It is essential for residents who qualify to receive property tax relief. Ensure you follow the guidelines to accurately fill out and submit your claim.

Business Formation

Bank of the Philippine Islands Customer Information Sheet

This document is the Customer Information Sheet for Non-Individuals from Bank of the Philippine Islands. It captures essential details such as business name, address, and other pertinent information. Completing this form is crucial for establishing and managing your banking relationship.

Property Taxes

Indiana 2020 IT-20S S Corporation Income Tax Booklet

The Indiana 2020 IT-20S S Corporation Income Tax Booklet includes important guidelines and updates for tax filing. This booklet outlines the necessary procedures and online services available to taxpayers. It serves as a comprehensive guide for S corporations in Indiana for the tax year 2020.

Business Formation

Tulare County Clerk Fictitious Business Name Statement

This document provides instructions for filing a fictitious business name statement in Tulare County, California. It outlines important details about fees, filing processes, and compliance requirements. Business owners must register their fictitious business names to ensure legal operation.