Finance Documents

Tax Forms

Form 8396 Mortgage Interest Credit Instructions

Form 8396 is used to calculate the mortgage interest credit for eligible taxpayers. It provides instructions on how to claim credits if you hold a qualified mortgage credit certificate. Use this form to enhance your tax savings during the filing process.

Tax Forms

Form 8453-PE for IRS e-file Return Submission

Form 8453-PE is a crucial document for partnerships to authenticate their electronic Form 1065. It enables general partners or LLC member managers to authorize electronic return originators (EROs) and ensure accurate filing. Use this form to ensure compliance with IRS guidelines and facilitate a smooth tax return process.

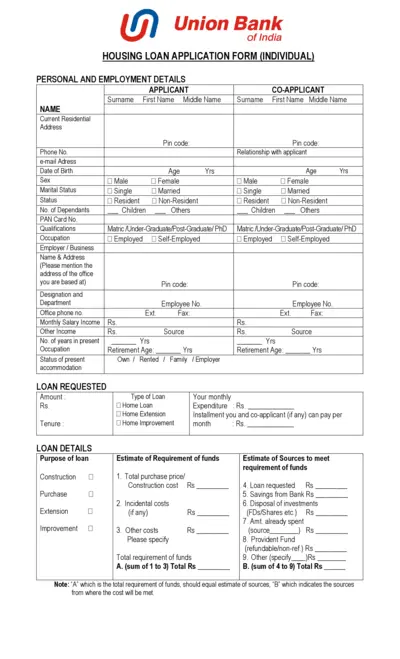

Loans

Union Bank Housing Loan Application Form

This is the Union Bank housing loan application form designed for individuals seeking a housing loan. It includes sections for personal, employment, and financial details necessary to process the loan request. Use this form to apply for a home loan, home extension, or improvement.

Tax Forms

Senior Citizens Property Tax Exemption in New York

This file provides detailed information on the Senior Citizens Property Tax Exemption program in New York State. It outlines eligibility requirements, application procedures, and important deadlines. Homeowners aged 65 and older may qualify for reduced property taxes.

Tax Forms

Download Instructions for Form 16 Part-A and Part-B

This file provides detailed instructions on downloading Form 16 Part-A and Part-B. Users can follow the step-by-step guide to successfully access the forms. It is essential for pensioners seeking to manage their income tax efficiently.

Tax Forms

Residency Certification Form for Local Earned Income Tax

This form is essential for employers and taxpayers to report information needed for Local Earned Income Tax collection and distribution. It's necessary for new employee hires or any changes in employee details such as name or address. Employers must fill this out accurately to comply with local tax regulations.

Tax Forms

IRS Form 8805 Instructions for Foreign Partners

This file contains important instructions and details for completing IRS Form 8805. It caters to foreign partners involved in partnerships in the U.S. Ensure compliance with tax regulations by following the guidelines provided.

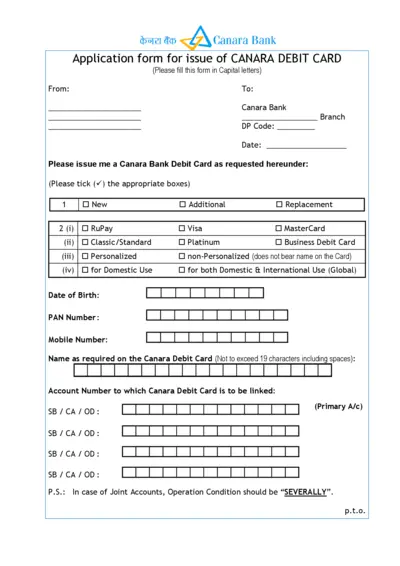

Banking

Canara Bank Debit Card Application Form

This file contains the application form for obtaining a Canara Bank Debit Card. It includes instructions for filling it out and details required for processing the application. Ideal for individuals seeking to apply for a new debit card from Canara Bank.

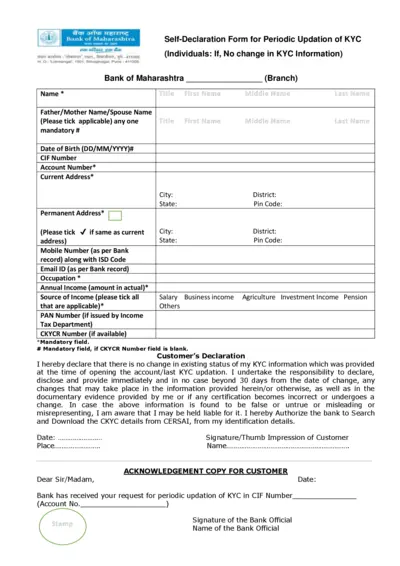

Banking

Self-Declaration Form for KYC Updation

This file is a Self-Declaration Form for periodic updating of KYC details. It is required for individuals to confirm there are no changes in their KYC information. Users must fill in personal information and submit it to the bank.

Banking

MUFG Bank Savings Account Opening Application Form

This application form is required to open a savings account at MUFG Bank. It includes important instructions and required documentation. Ensure to follow the guidelines strictly for a smooth application process.

Tax Forms

Illinois IL-1041 Instructions and Updates

This document provides detailed instructions for filing Form IL-1041, the Illinois Fiduciary Income and Replacement Tax Return. It includes updated credit information and guidelines for fiduciaries of trusts and estates. Ensure compliance with state tax regulations with this essential guide.

Tax Forms

Mortgage Deduction Limit Worksheet Instructions

This worksheet helps users calculate their mortgage deduction limits based on qualified loan balances. It provides step-by-step instructions to ensure accurate reporting on Form 1040. Ideal for taxpayers seeking to maximize their mortgage interest deductions.