Finance Documents

Tax Forms

Sales and Use Tax Returns Instructions - Florida

This document provides detailed instructions for filing the Florida Sales and Use Tax Return (DR-15). It outlines lawful deductions, tax due calculations, and important filing deadlines. Useful for both individuals and businesses in compliance.

Tax Forms

Form 2555 Instructions for Foreign Earned Income

Form 2555 is used by U.S. Citizens and Resident Aliens to report foreign earned income. It allows individuals to claim the foreign earned income exclusion and housing exclusion or deduction. This form is essential for those working abroad to accurately report their income for tax purposes.

Banking

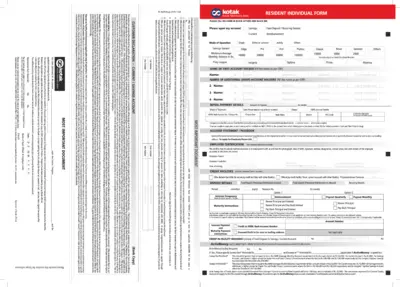

Kotak Mahindra Bank Account Opening Form Instructions

This document provides comprehensive instructions for opening a savings or current account with Kotak Mahindra Bank. It explains the necessary steps, required fields, and the importance of the information provided. Users will also find guidance on filling this form accurately and efficiently.

Loans

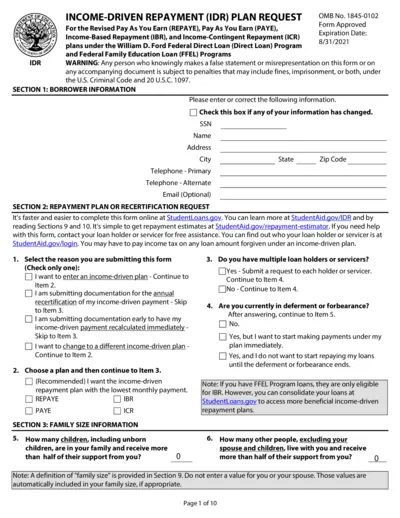

Income-Driven Repayment (IDR) Plan Request

This file is essential for borrowers who need to apply for an income-driven repayment plan. It outlines the necessary information and steps to complete your request. Use this guide to ensure you fill in all required fields correctly and efficiently.

Tax Forms

Arizona Form 321 - Credit for Charitable Contributions

Arizona Form 321 allows taxpayers to claim credits for contributions made to qualifying charitable organizations. This form is essential for those looking to receive tax advantages in the year 2022. Ensure to fill it out accurately to maximize your eligible credits.

Banking

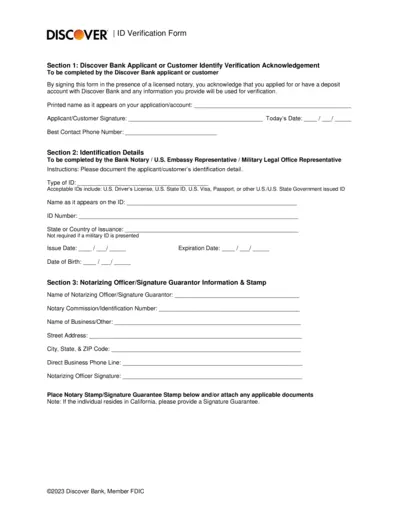

Discover Bank ID Verification Form

This ID Verification Form is designed for Discover Bank customers to confirm their identity for account verification. Fill out this form accurately to ensure smooth processing. Use this form in conjunction with a licensed notary or representative.

Tax Forms

Instructions for IRS Form 3520 Reporting Foreign Trusts

This file contains essential instructions for completing Form 3520, which is used to report transactions with foreign trusts and foreign gifts. It outlines who must file the form and details necessary procedures. Understanding these instructions is crucial for compliance with IRS regulations.

Tax Forms

IRS Form 8882 Instructions for Credit Claim

This file provides essential instructions for claiming the employer-provided childcare credit using IRS Form 8882. It details the steps, eligibility, and limits for this valuable tax credit. Users can benefit from this guide to maximize their childcare assistance claims.

Tax Forms

California Sales and Use Tax Return Short Form

The CDTFA-401-EZ form is a simplified sales and use tax return for California businesses. It allows users to report sales and tax liabilities efficiently. This form is essential for compliance with California tax laws.

Tax Forms

New York State Tax Modification Instructions IT-225

The IT-225 form provides detailed instructions for New York State tax modifications. It outlines necessary additions and subtractions for accurate filing. Ideal for individuals, partnerships, and tax professionals.

Tax Forms

New York State Application for Credit or Refund

The NYS Application for Credit or Refund is designed to help taxpayers apply for refunds or credits for sales or use tax. Complete this form accurately to ensure a smooth processing of your refund claim. Ensure you have all required documentation before submission.

Banking

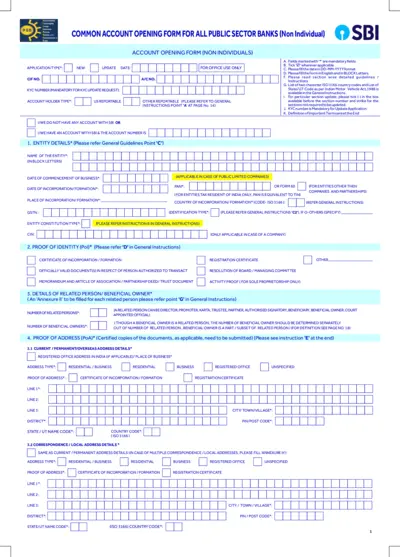

Common Account Opening Form for All Public Sector Banks

This form is required for opening accounts with public sector banks, specifically designed for non-individual entities. It includes guidelines for filling out the application accurately. Use this file to ensure a smooth application process.