Finance Documents

Tax Forms

2023 New Jersey Form NJ-1040NR Tax Return Instructions

This PDF provides detailed instructions for filing the 2023 New Jersey Form NJ-1040NR. It outlines filing requirements, deductions, and tax rates. This guide is essential for nonresidents who need to file New Jersey income taxes.

Banking

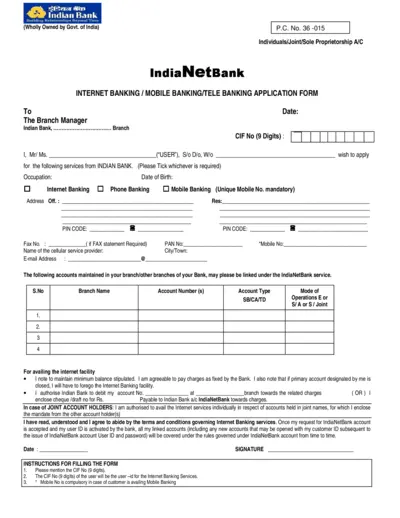

Indian Bank Internet Banking Application Form

This file is an application form for Internet Banking services from Indian Bank. It contains sections for personal details, account information, and service requests. Users must fill out the form accurately to access online banking features.

Tax Forms

Ohio Income Tax Return IT 10 Zero Liability

The 2022 Ohio IT 10 is an Individual Income Tax Return for taxpayers with zero liability. It must be filed by those who are not required to pay taxes in Ohio. This form helps taxpayers to report their income and fulfill state requirements.

Retirement Plans

IRS Form 5305-SEP Simplified Employee Pension Agreement

Form 5305-SEP allows employers to set up Simplified Employee Pension plans for their eligible employees. These plans provide a way to contribute towards employees’ retirement savings. This form should be kept for records and not submitted to the IRS.

Banking

Ally Individual Joint Account Application Form

This PDF contains the Ally Individual and Joint Account Application. It provides essential information and instructions for completing the application. Perfect for individuals and joint account seekers looking to open a new account with Ally Bank.

Banking

Enhanced Due Diligence Form - National Bank

This Enhanced Due Diligence Form is essential for customers of the National Bank of Pakistan. It ensures compliance and thorough vetting for account openings. Fill out this form carefully to meet all requirements.

Tax Forms

Idaho State Tax Commission Form 43 Instructions

This document provides essential instructions for completing Idaho's Form 43, applicable to part-year residents and nonresidents. It contains necessary fields and guidelines required for accurate tax returns. Ensure compliance with Idaho state tax regulations by carefully following the outlined instructions.

Disability Insurance

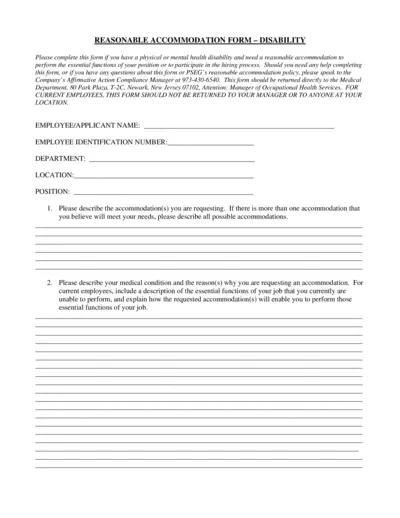

Reasonable Accommodation Form - Disability

This form is designed for individuals with physical or mental health disabilities who require accommodations to perform their job functions or participate in the hiring process. It outlines the necessary steps for requesting reasonable accommodations from PSEG. Ensure you provide accurate personal information and any supporting medical documentation.

Tax Forms

Maryland Form 500DM Decoupling Modification 2023

The Maryland Form 500DM is essential for taxpayers whose returns are affected by federal decoupling provisions. It helps in calculating necessary modifications to ensure compliance with Maryland tax regulations. For detailed instructions and form completion requirements, refer to the guidelines provided.

Loans

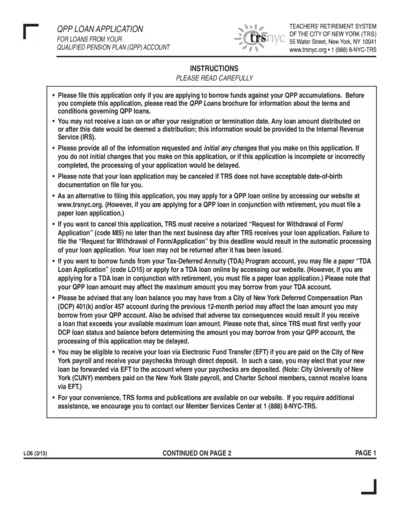

QPP Loan Application for Teachers' Retirement System

The QPP Loan Application form allows members of the Teachers' Retirement System to apply for loans against their qualified pension plan accumulations. This document includes important instructions and details for correctly completing the application. Ensure to follow the guidelines carefully to avoid delays in processing your loan request.

Tax Forms

Instructions for Form CT-400 Estimated Tax for Corporations

Form CT-400 provides essential instructions for corporations in New York State to declare estimated taxes. It outlines filing requirements, payment mandates, and crucial deadlines. This guidance ensures compliance with tax regulations and assists corporations in properly managing their tax obligations.

Tax Forms

Form 6781 Instructions on Gains and Losses Income Tax

Form 6781 is used to report gains and losses from section 1256 contracts and straddles. This form is essential for individuals and entities engaging in trading of section 1256 contracts. Accurate completion is crucial for the correct reporting on your tax return.