Finance Documents

Tax Forms

California Resident Income Tax Return Form 540

The California Resident Income Tax Return Form 540 is essential for filing your state taxes. This form helps determine your taxable income and calculates the taxes owed or refunds. Ensure you have all the necessary information to complete it correctly.

Loans

RCBC Loan Application Form

This file provides comprehensive information on various loan options offered by RCBC, including home, personal, business, and auto loans. It contains application instructions, required documents, and details about the credit application process. Discover how to apply and qualify for a loan today.

Tax Forms

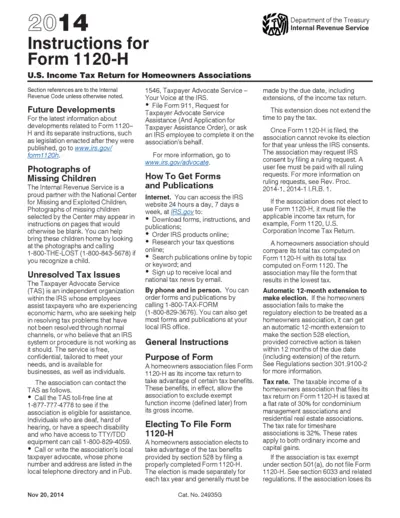

Instructions for Form 1120-H U.S. Income Tax Return

This document provides detailed instructions for completing Form 1120-H, specifically designed for homeowners associations. It outlines eligibility requirements, filing procedures, and essential tax information for associations. Proper understanding and completion of this form can lead to significant tax benefits.

Tax Forms

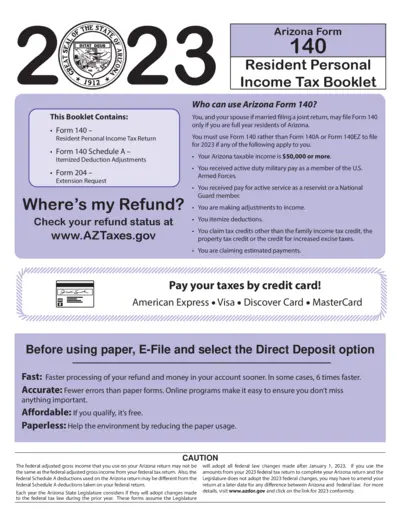

Arizona Form 140 Resident Personal Income Tax Instructions

This document provides the essential guidelines for completing Arizona Form 140, the Resident Personal Income Tax Return. It includes information on important dates, filing requirements, and deductions. Follow these instructions to ensure accurate and timely submission of your tax return.

Tax Forms

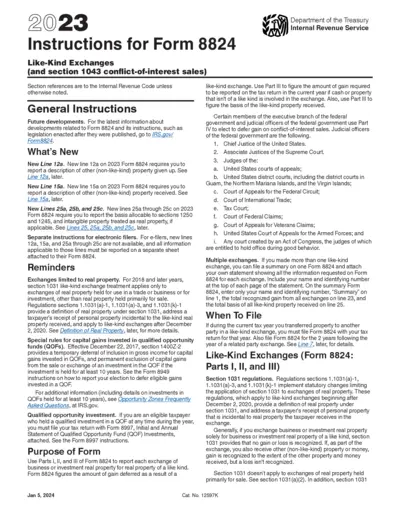

2023 Instructions for Form 8824 Like-Kind Exchanges

This document provides detailed instructions for filing Form 8824, which pertains to like-kind exchanges. It covers essential updates and regulations to facilitate accurate and compliant tax reporting. Users can find guidance on completing the form and understanding related requirements.

Banking

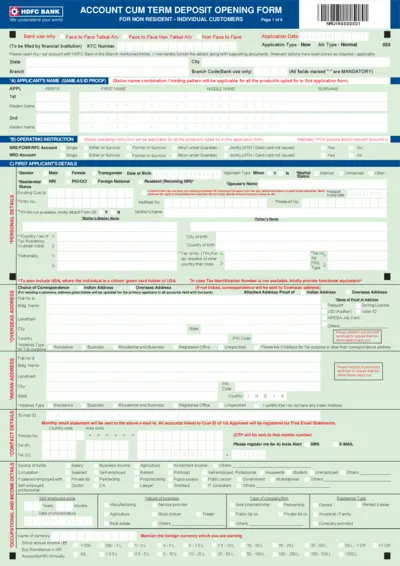

HDFC Bank Account Opening Form for NRIs

This file contains the HDFC Bank Account Cum Term Deposit Opening Form for Non-Resident Individual customers. It provides detailed instructions and requirements for opening bank accounts, including necessary documents and application procedures. Users can fill out the form and follow guidelines for successful submission.

Tax Forms

Louisiana Corporation Income Tax and Franchise Tax 2023

This file provides essential instructions for filing the Louisiana Corporation Income Tax and Corporation Franchise Tax. It includes guidelines for completing the CIFT-620 form, eligibility criteria, and important filing deadlines. It serves as a comprehensive resource for corporations operating in Louisiana.

Tax Forms

Noncash Charitable Contributions Form 8283

This document outlines the instructions and details for Form 8283, which is used for reporting noncash charitable contributions. It is essential for taxpayers claiming deductions over $500 for donated property. Ensure to follow the guidelines to complete the form accurately.

Banking

RTGS NEFT Application Form - Bank Transaction

This file contains the RTGS/NEFT application form for transferring funds. It includes specific instructions for filling out the form and details required for successful remittance. Ideal for individuals and businesses needing to execute banking transactions efficiently.

Tax Forms

Kansas Withholding Form K-4 Instructions and Info

The Kansas Withholding Form K-4 is essential for employees in Kansas to accurately report their withholding allowances. Ensure compliance with state tax laws by completing this form as soon as employment begins. This guide provides all necessary details for filling out the form and understanding its implications.

Annual Reports

Discord Transparency Report Q1 2023

This file contains the first quarter 2023 Transparency Report for Discord, detailing community guideline enforcement and safety measures. It provides insights into actions taken against abuse and highlights Discord’s ongoing commitment to safety. The report serves as a resource for users to understand Discord's measures for keeping the community safe.

Tax Forms

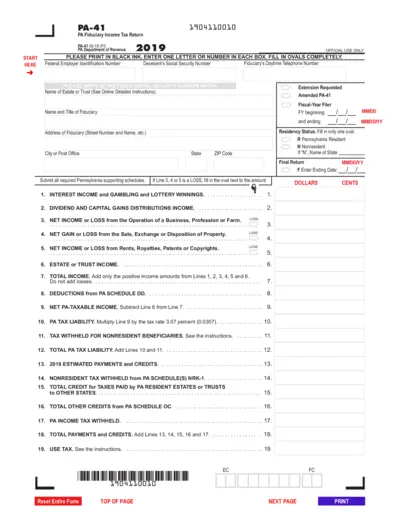

PA Fiduciary Income Tax Return Instructions 2019

The PA-41 Fiduciary Income Tax Return is used to report the income and expenses of an estate or trust in Pennsylvania. It helps in determining the tax liability based on the income earned by the estate or trust. Proper filling of this form ensures compliance with Pennsylvania tax laws.