Finance Documents

Tax Forms

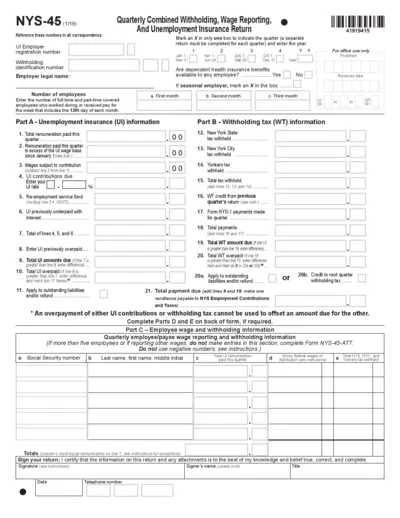

NYS-45 Quarterly Combined Withholding and Wage Return

The NYS-45 form is essential for New York employers to report combined withholding, wage information, and unemployment insurance return for employees. It provides detailed instructions on reporting remuneration, taxes due, and employee wages for a specific quarter. Completing this form accurately ensures compliance with state regulations and helps avoid potential penalties.

Tax Forms

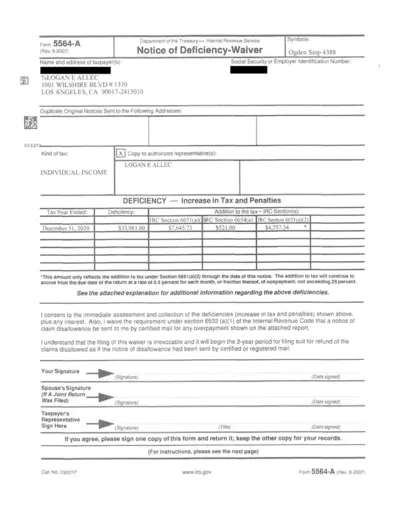

Form 5564-A Notice of Deficiency Waiver IRS

Form 5564-A is utilized to waive the notice of deficiency from the IRS. This form allows taxpayers to consent to the immediate assessment of deficiencies. Proper completion ensures a streamlined communication regarding tax discrepancies.

Estate Planning

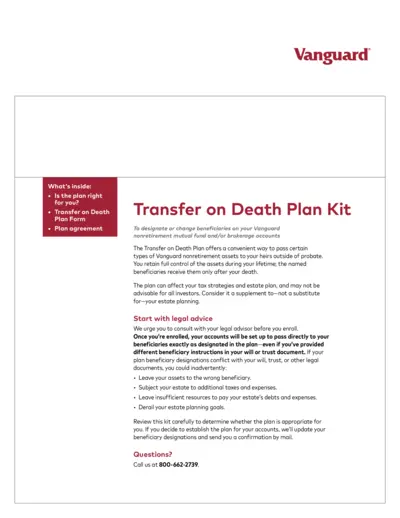

Vanguard Transfer on Death Plan Overview

This file provides detailed instructions for setting up and managing a Transfer on Death Plan with Vanguard. It is essential for individuals looking to ensure their nonretirement accounts are transferred to beneficiaries smoothly and efficiently. Users will find guidance on eligibility, filling out forms, and understanding the implications of the plan.

Banking

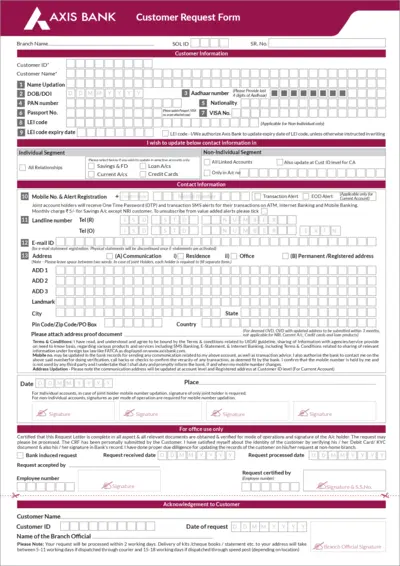

Axis Bank Customer Request Form Instructions

This document contains the instructions and details on how to fill out the Axis Bank Customer Request Form. It serves as a guide for both individual and non-individual customers to update their account information and retrieve bank services. Follow the steps carefully to ensure successful processing of your requests.

Tax Forms

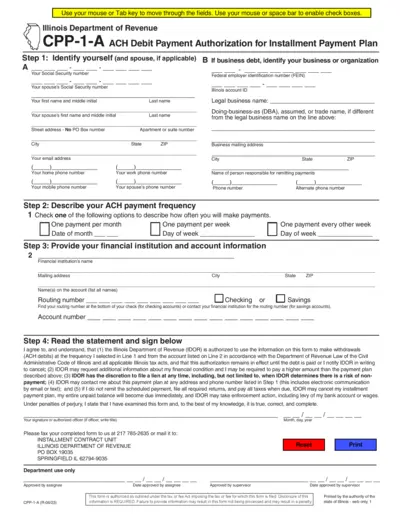

CPP-1-A ACH Debit Payment Authorization Form

This form is used to authorize ACH debit payments for installment payment plans to the Illinois Department of Revenue. It captures personal and financial information to facilitate automatic payments. Ensure to provide accurate details for a smoother processing experience.

Tax Forms

Instructions for Form 8889 Health Savings Accounts

This file contains detailed instructions for filling out Form 8889 related to Health Savings Accounts (HSAs). It explains eligibility, contributions, distributions, and deductions. Follow the guidelines to ensure compliance with tax regulations.

Tax Forms

California Nonresident or Part-Year Resident Tax Return

This file contains the California 540NR income tax return form for 2022. It is essential for nonresidents or part-year residents filing their taxes. Use this form to report your income and calculate your California tax obligations.

Banking

Business Internet Banking Managing Service Guide

This file is the Service Guide for HSBC UK's Business Internet Banking. It provides detailed instructions for registering, activating, and using the Business Internet Banking services. Essential for both new and existing customers of HSBC UK.

Tax Forms

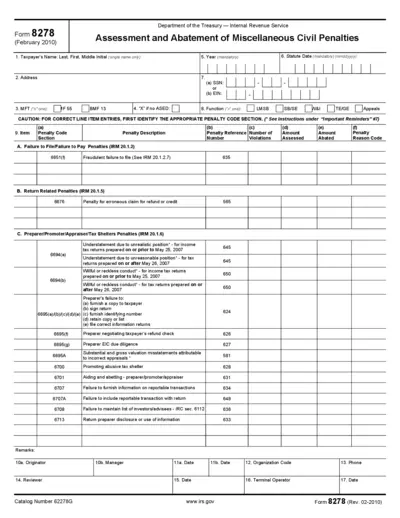

Form 8278 Assessment Abatement Civil Penalties

Form 8278 is used to assess and abate miscellaneous civil penalties by the IRS. It is essential for taxpayers seeking to resolve issues related to penalties. Understanding this form can help facilitate compliance with tax regulations.

Tax Forms

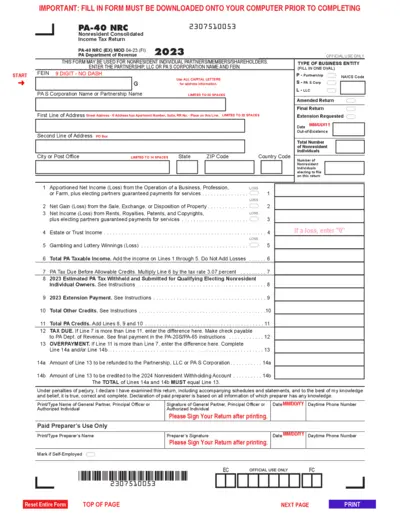

PA-40 NRC Nonresident Consolidated Income Tax Form

The PA-40 NRC form is for nonresident individuals to report their income. This form allows partnerships and LLCs to consolidate tax reporting. Ensure correct completion to avoid penalties.

Tax Forms

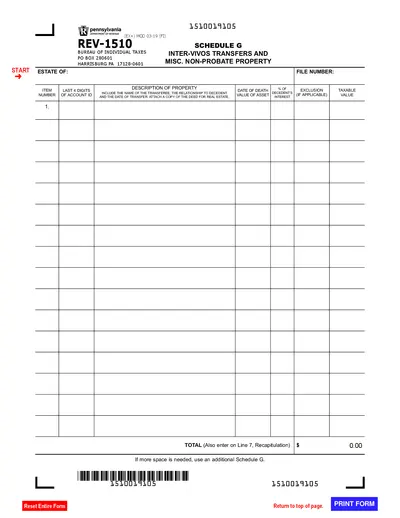

Pennsylvania REV-1510 Schedule G Tax Form Details

The Pennsylvania REV-1510 Schedule G form reports inter vivos transfers and miscellaneous non-probate property. The form provides essential information on property transfers made by a decedent before their passing. It also outlines instructions for reporting taxable values and exclusions pertinent to inheritance tax.

Tax Forms

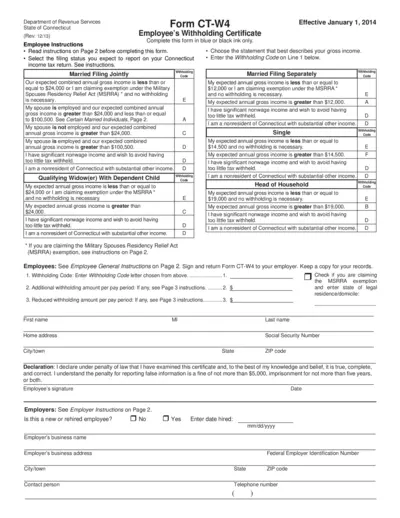

CT-W4 Employee Withholding Certificate Instructions

The CT-W4 form is essential for Connecticut employees to ensure correct state income tax withholding. This form helps determine your filing status and expected gross income for tax purposes. Complete the form accurately to facilitate proper withholding and avoid underpayment issues.