Finance Documents

Tax Forms

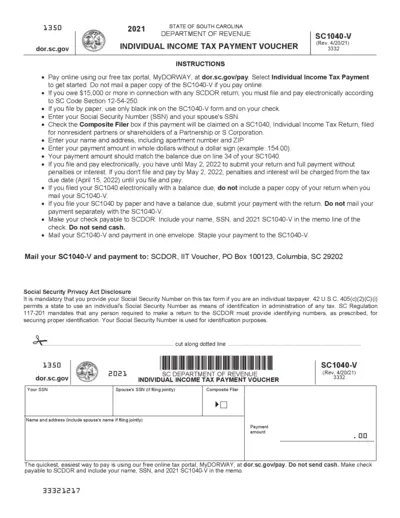

South Carolina Individual Income Tax Payment Voucher

This file provides the SC1040-V voucher for individual income tax payments. Users must fill out the form accurately to ensure proper processing. It includes essential instructions and deadlines for submission.

Tax Forms

FTB 5870A Instructions: Tax on Trust Distributions

The FTB 5870A instructions provide guidance on calculating tax on accumulation distributions from trusts. This document is essential for taxpayers dealing with foreign or domestic trusts. It ensures compliance with California tax laws and aligns with federal regulations.

Banking

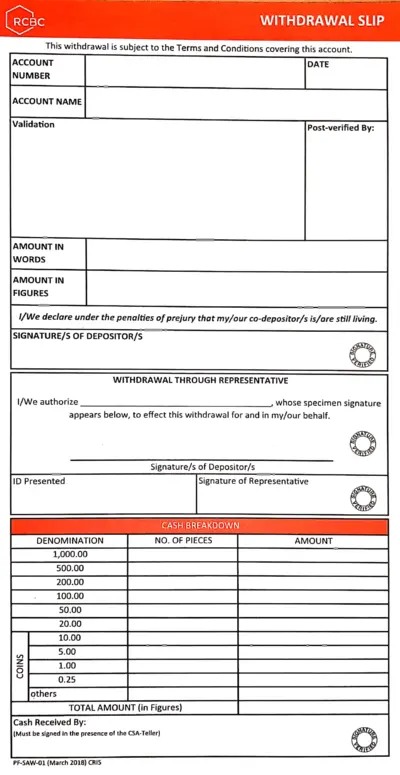

RCBC Withdrawal Slip Form Instructions and Details

This RCBC withdrawal slip is essential for withdrawing money from your account. It provides a clear format to submit your request while ensuring compliance with the bank's regulations. Properly filling out this form is crucial for a successful transaction.

Banking

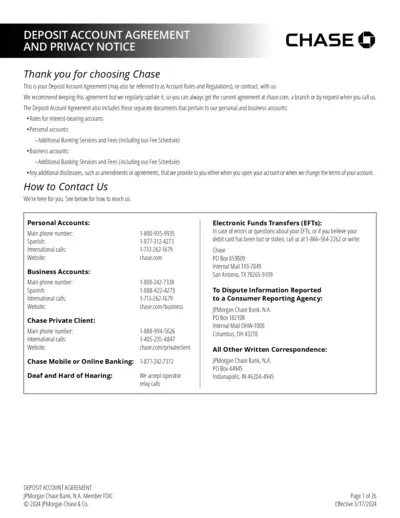

Chase Deposit Account Agreement and Privacy Notice

This document serves as your comprehensive Deposit Account Agreement with Chase. It outlines the rules, regulations, and services associated with personal and business accounts. Ensure to review the agreement for important details regarding your account.

Banking

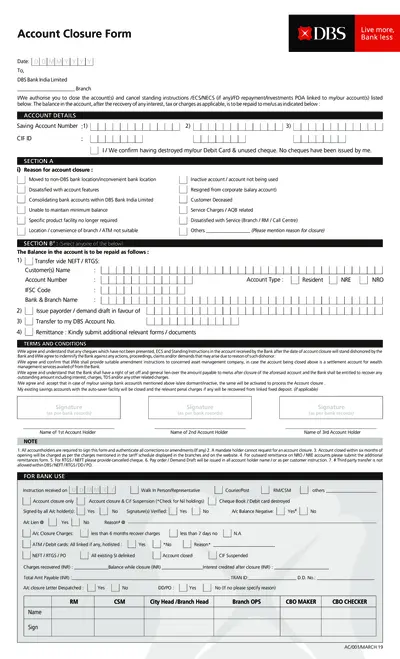

Account Closure Form for DBS Bank India

This document is essential for closing your DBS Bank India account securely. It includes instructions for account holders on how to properly fill out the form. Ensure you follow the guidelines to avoid any complications.

Banking

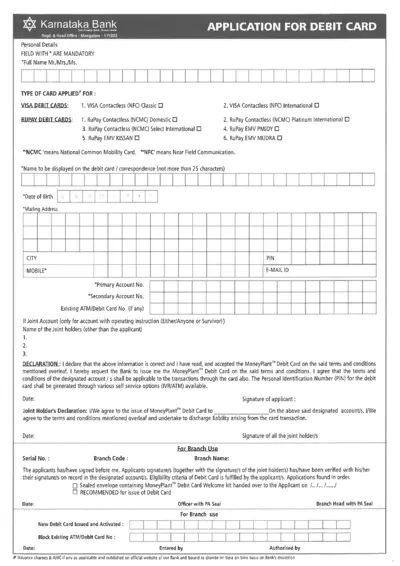

Karnataka Bank Debit Card Application Form

This PDF contains the application form for obtaining a Debit Card from Karnataka Bank. It includes detailed terms and conditions, usage instructions, and fields required for application. Ideal for individuals looking to manage their banking transactions efficiently.

Banking

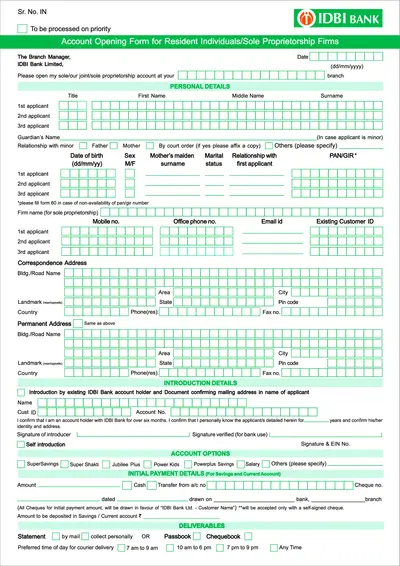

IDBI Bank Account Opening Form for Individuals

This file is the IDBI Bank Account Opening Form designed for resident individuals and sole proprietorship firms. It contains all necessary fields to fill in personal details, account options, and document requirements. Use this form to initiate your account opening process efficiently.

Tax Forms

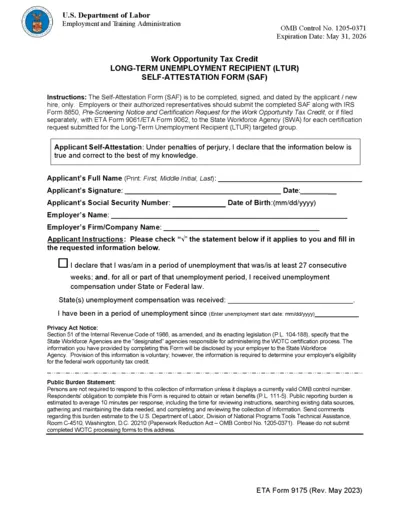

Work Opportunity Tax Credit Self-Attestation Form

The Self-Attestation Form (SAF) is required for applicants applying for the Work Opportunity Tax Credit. It collects essential information from long-term unemployment recipients to determine eligibility for the credit. Employers must submit this form along with IRS Form 8850.

Tax Forms

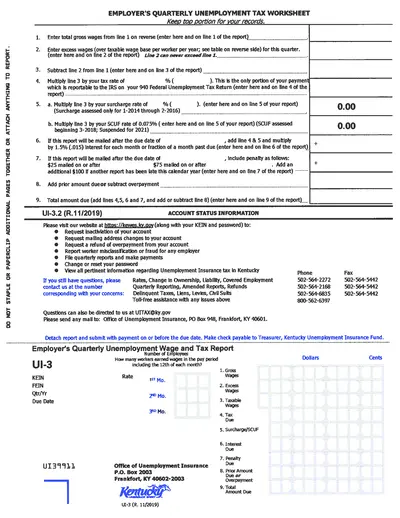

Employer Quarterly Unemployment Tax Worksheet

This form is essential for employers to report wages and calculate taxes for unemployment insurance. It provides clear instructions for completing each section accurately. Use this worksheet to ensure compliance with unemployment tax regulations in Kentucky.

Tax Forms

2021 Oregon Income Tax Form OR-40 Instructions

This document provides detailed instructions for filling out the 2021 Oregon Income Tax Form OR-40. It includes important deadlines, e-filing information, and resources for obtaining assistance. Essential for full-year residents of Oregon filing their income taxes.

Tax Forms

IRS Instructions for Form 2106 Employee Business Expenses

This file provides essential instructions for completing IRS Form 2106, which is related to employee business expenses. It is intended for individuals needing guidance on allowable deductions for business-related costs. Follow the instructions carefully to ensure proper filing.

Tax Forms

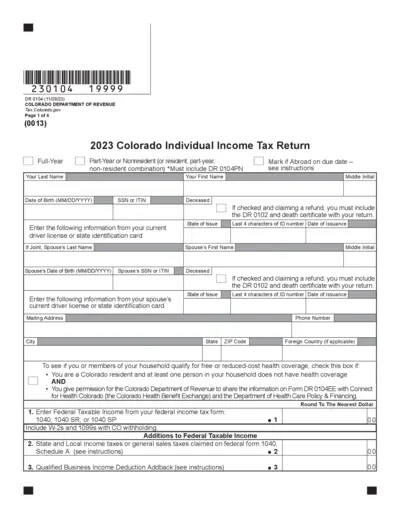

2023 Colorado Individual Income Tax Return Instructions

This document provides comprehensive instructions for filling out the 2023 Colorado Individual Income Tax Return. It includes essential information for both residents and non-residents. Users can navigate through various sections to ensure accurate and compliant submissions.